If GameStop rallies to $65 later today, Keith Gill—better known as Roaring Kitty on Twitter or Youtube and DeepFuckingValue on Reddit—could see his GME position swell to $1 billion.

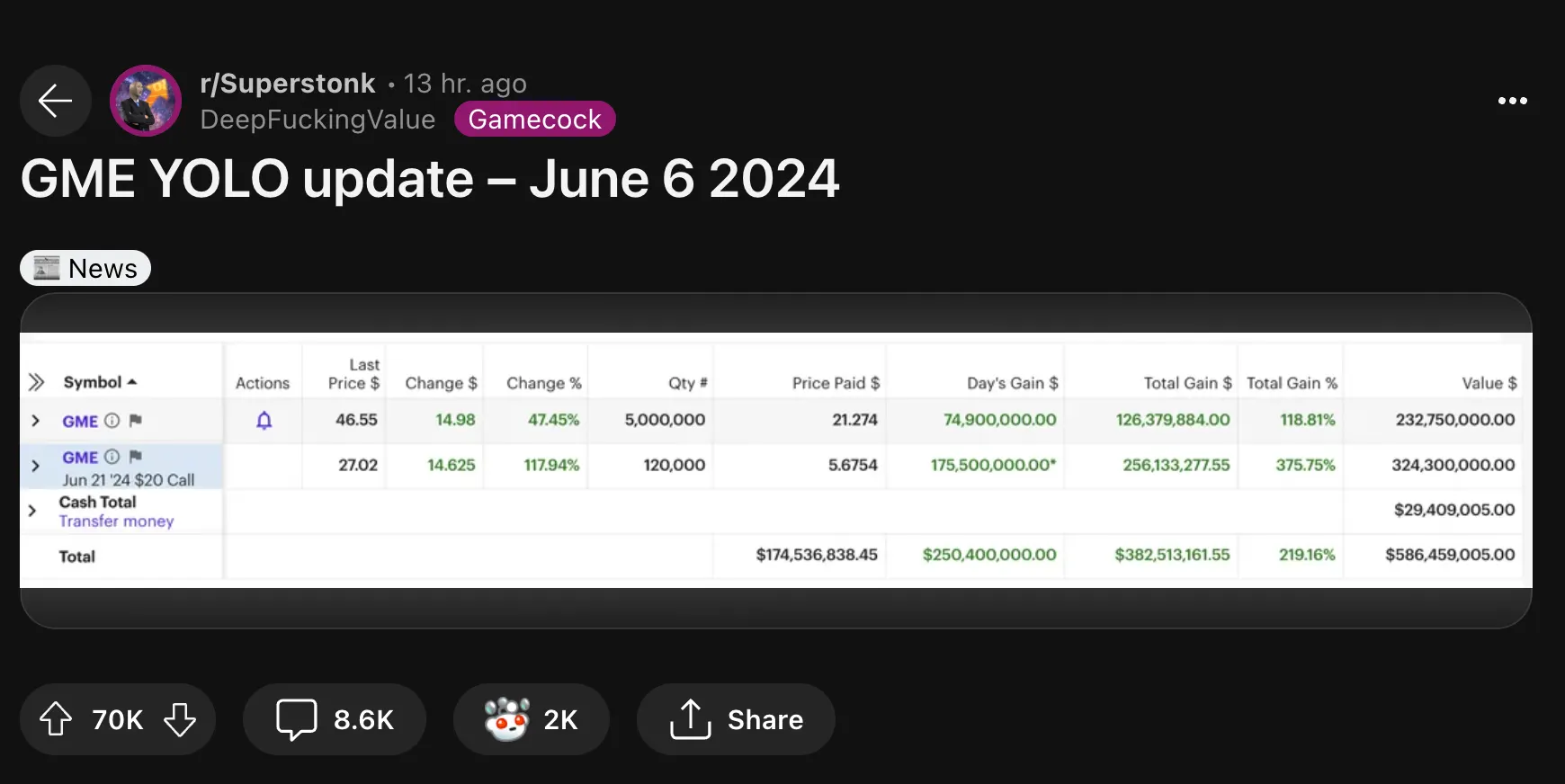

In a post on the Superstonk subreddit last night, Gill revealed that after the market closed his 5 million shares of GME had gained 119% and his 120,000 call options had surged by 376%.

All told, that means after a $174 million initial investment, his position now has a value of $586 million. And if GME can close the gap to $65, the position will have a total value of $1 billion.

It's not that big an if, considering the crazy ride that GME went on yesterday. At the time of writing, GME shares are priced at $61.61 in pre-market trading after having already gained 33% in after hours.

GameStop saw its shares open at $31.57 and then take a crazy ride after it Roaring Kitty scheduled a livestream for 12 p.m. Eastern Time on Friday.

Even though the livestream won't start for another 6 hours, the chat on YouTube has been full of bots, degens, meme coin fans, and opportunists trying to shill other meme coins. One early riser in the states wanted to know why their European counterparts hadn't done more to pump GME in after-hours trading.

"Europe why didn’t yall move the price up when us Americans were sleeping," the YouTube commentor asked.

Over on the r/Superstonk community, members are already celebrating Gill's status as an "Ethical Billionaire."

Gill became famous for the role he played in the GameStop short squeeze in 2021, spurred on by his bullish stance on GME. Since then, GameStop has

But this meteoric rise hasn't happened without a lot of headwinds. There have been reports that Gill is facing inquiries from the Securities and Exchange Commission and the Massachusetts securities regulator.

At the start of the week, an unnamed source told The Wall Street Journal that ETrade's financial crimes unit had started looking at Gill's trading account.