Imagine a world where the money supply is finite, and there’s no dollars left to print. Sounds bizarre, right? But in the realm of Bitcoin, this scenario is not only possible but inevitable.

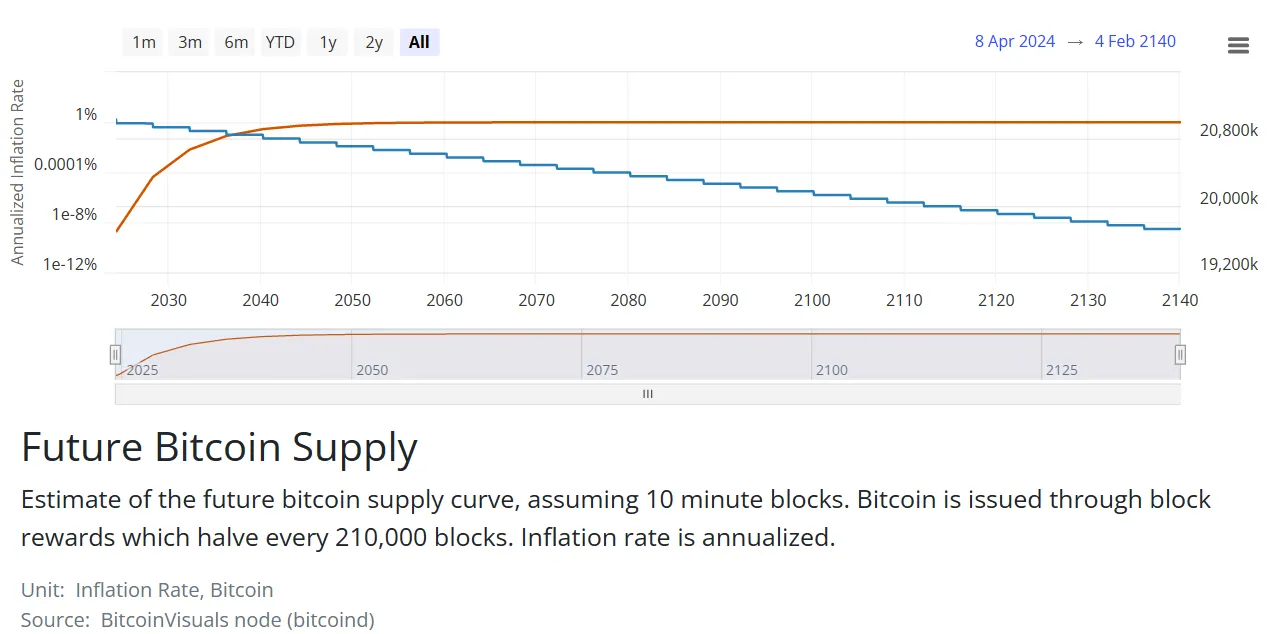

The Bitcoin network, designed with a finite supply of 21 million coins, just hit a significant milestone: the halving just chopped its inflation rate by 50% for the fourth time since its inception. As of now, 19,688,016 Bitcoin has been mined, leaving less than 2 million to be discovered over the next 120 years. This scarcity, coupled with the increasing demand for Bitcoin, is set to reshape the cryptocurrency's future.

The roadmap to the final Bitcoin being mined is a gradual process. By 2026, 95.24% of Bitcoins will have been mined, and by 2039, this figure will reach 99.52%. The mining of the penultimate Bitcoin is projected to occur around 2093.

Fast forward a little more to 2140, the year when the last Bitcoin (or realistically, the last satoshi—the smallest denomination of Bitcoin) is expected to be mined. By this time, Bitcoin's inflation rate would have flattened out.

The economics of the final coins

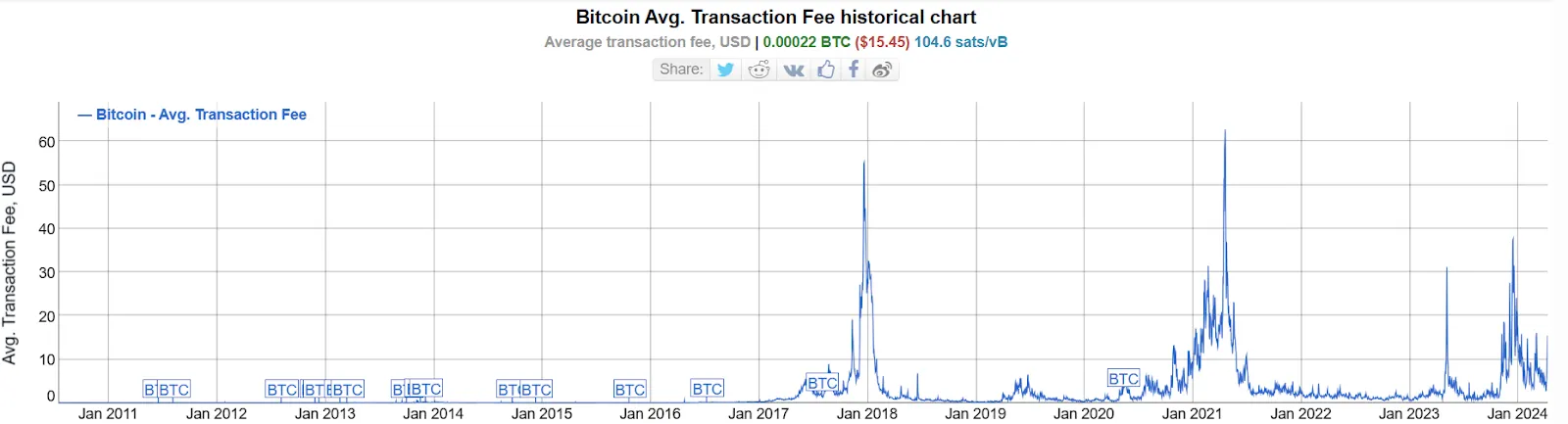

The impact of this milestone will be particularly significant for Bitcoin miners. Once all Bitcoin is mined, miners will no longer receive new Bitcoin as block rewards. Instead, they will rely solely on transaction fees as their source of income. As block rewards decrease over time, transaction fees are expected to become the primary revenue source for miners, potentially leading to higher fees—in U.S. dollar terms, that is.

Just for reference, back in 2011, users paid 0.01 BTC per transaction, with many of them being confirmed for free. This amount was then reduced to 0.0005 BTC in version 0.3.23, and kept going down as the reality of Bitcoin evolved—and its price started to go up.

Today the average fee per transaction is 0.00022 BTC (104.6 sats/vB), according to Bitinfocharts. In dollars, this means up to $15 per today’s prices. In 2017, the average fee was around $1, and in 2012 fees were around $0.01.

The cost of mining a Bitcoin block today varies significantly and depends on factors such as energy costs, mining hardware efficiency, and the network's hash rate.

According to estimates by data site Visual Capitalist, back in 2022, each American miner spent over $20,000 per mined block; UK miners spent almost $50,000, and the highly profitable Kazakhstan mining farms paid over $8,000 per block. These costs are anticipated to rise further after the latest halving event, with block rewards cut in half from 6.25 BTC to 3.125 BTC.

However, miners can afford a 50% drop in BTC rewards because there is a price appreciation that makes it more profitable to mine in terms of fiat: Between January 2020 and April 2024, the price of Bitcoin has increased by 943% in USD terms.

Despite these challenges, the Bitcoin network is designed to maintain its security through the difficulty adjustment algorithm, which ensures a consistent rate of block generation even as miner participation fluctuates due to economic incentives or changes in the mining landscape.

As the supply of new Bitcoins dwindles, the cryptocurrency is expected to become increasingly scarce and even deflationary due to external factors like lost wallet addresses and burned coins (i.e. coins sent to irrecoverable addresses). This means that not all Bitcoin in circulation will be available for use. Estimates from crypto forensics firm Chainalysis suggest that up to 20% of the Bitcoin already issued may be permanently lost due to factors such as lost private keys or the passing of Bitcoin holders without sharing their wallet details.

This shift could potentially affect Bitcoin's value and its role as a digital store of wealth, because Bitcoin’s appeal as peer-to-peer electronic cash, its intended utility, gives way to the “decentralized store of value” thesis every time its price goes up.

While the supply of Bitcoins will remain relatively stable, with a maximum increase of around 12% over the next century, demand for Bitcoin may continue to grow. Basic economic principles suggest that a fixed supply coupled with increasing demand could drive up prices as more people seek to gain a share of Bitcoin’s total supply.

Scaling solutions and the future

As noted, it is anticipated that users will pay fewer satoshis per transaction in the future. However, Bitcoin may still not be ideal for small payments—after all, it won’t be good for transactions that are equal or less than the fee required to process them. This is at the heart of the scalability debate that has been a contentious issue among developers, even leading to the most significant chain split in the Bitcoin network’s history and the emergence of Bitcoin Cash.

Bitcoin Cash proponents argue that Bitcoin should have larger blocks—essentially, larger data records measured in megabytes that contain the transaction details stored on the network. Larger blocks would allow miners to receive more money per mined block, thereby reducing the strain passed onto users. The bigger the block, the larger amount of transactions can fit into it, meaning there will be more fees to claim.

Bitcoin devs, however, believe that layer-2 solutions and sidechains could tackle this problem without having to alter the core BTC configuration. The Lightning Network, in particular, has been touted as a potential solution for facilitating daily Bitcoin transactions while keeping the main blockchain reserved for high-value or batch transactions.

What happens in the Lightning Network stays in the Lightning Network, and transactions are only confirmed on-chain when users cash out their Lightning Network satoshis. It's akin to a bank versus a street cash system. A bank maintains a record of every single digital transaction (the BTC chain). A person can cash out one digital dollar to receive one physical dollar, and all the money exchanges made with that dollar in the streets (the Lightning Network) are immediate and not registered by the bank until someone decides to deposit that dollar into their account, which is then recorded by the bank that stores the bill.

This could allow miners to charge higher fees for processing these larger transactions, leaving small change for off-chain developments while maintaining the traditional small blocks relevant.

However, a lot can happen in one century of Bitcoin history. A new fork that changes the chain’s configuration, the mass adoption of layer-2 solutions, a new development that increases network efficiency, sidechains, a “better bitcoin”—we don’t know.

What we do know, however, is that as long as there’s an internet, Bitcoin will function the way Satoshi intended: a strong, decentralized network—with a lot of weird people hyping it on Twitter.