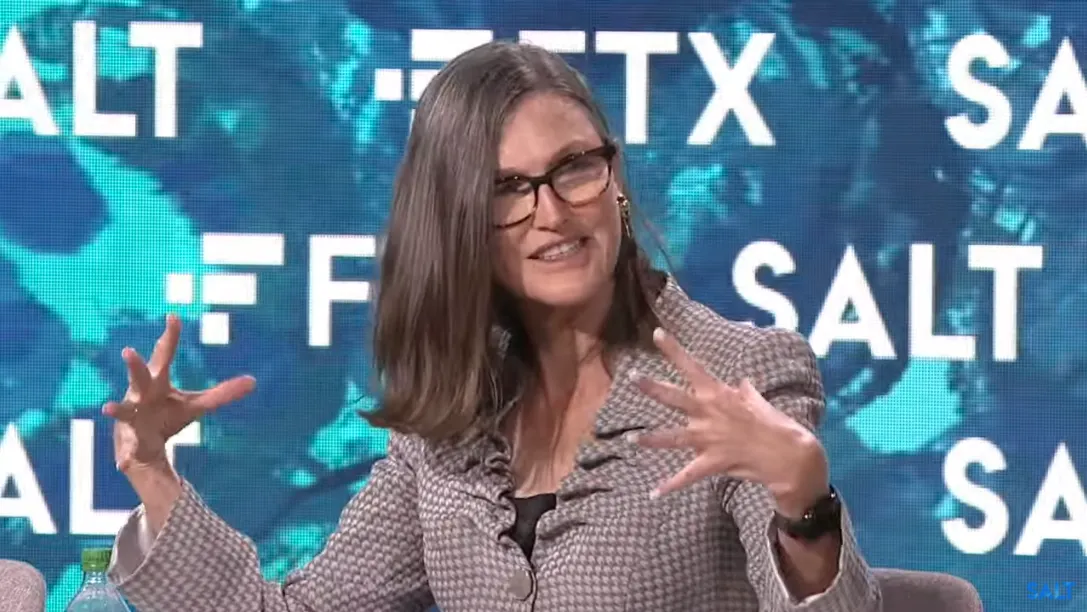

Cathie Wood, CEO of ARK Invest, has recently been vocal about Solana, which has been recently experiencing a huge price rally.

In her comments earlier this week, Wood praised the blockchain protocol for its efficiency and cost-effectiveness, especially when compared to Ethereum.

"Solana is doing a really good job. If you look at Ethereum it was faster and cheaper than Bitcoin in the day. Solana is faster and more cost-effective than Ethereum", she said during an interview with CNBC’s "Squawk Box" on Tuesday.

Solana saw a 15% increase on the day following her comments, with the price of Solana's SOL token extending its monthly rise to nearly 200% and eyes on the $100 target. Since she made her comments on Tuesday, SOL has gained another $10 and was trading at $62 as of this writing, according to CoinGecko.

Wood's sentiments this week echo her past comments because it's not the first time she's praised Solana.

On November 1, in another CNBC interview, Wood highlighted Solana's efficiency and indicated its potential to outpace Ethereum in terms of both speed and cost-effectiveness.

Cathie Wood has long been a fan of Bitcoin and the broader cryptocurrency market—but has often voiced her frustration at the U.S. regulatory environment.

She has critiqued the SEC for its delay in approving a Bitcoin ETF, suggesting that the political ambitions of SEC Chairman Gary Gensler could influence the hesitation. She's also defended Bitcoin's decentralized and transparent nature against concerns over market manipulation.

Despite regulatory hurdles, she remains optimistic about the future of cryptocurrencies, projecting that the market could grow to $25 trillion by 2030, with institutional adoption driving this growth.

Editor’s note: This article was written with the assistance of AI. Edited and fact-checked by Stacy Elliott.