Hedera helix is a type of poisonous ivy. So why would a startup name its latest initiative after a plant that’s felled many an innocent, nibbling creature? Could it be that, like its namesake, the technology underlying the concept, the DAG--or Directed Acyclic Graph--is fast growing, resilient and imminently scalable? Let’s take a correspondingly cautious view.

Certainly, the proponents of DAGs would have us believe that they are bigger, better, faster and infinitely preferable to anything invented by Satoshi or Vitalik. Hedera Hashgraph’s recent raise of over $100 million would give some credence to the boast. Today, the team announced it’s using a substantial chunk of that cash to spawn an accelerator in Asia to capitalize on the continent’s thirst for the decentralized--as long as you don’t count China--and capture some of the more disillusioned disciples of distributed-ledger technology in the process.

But before we get onto that, a moment to explore the DAG, the born-again blockchain. Is it the second coming, or just new money for old rope?

Mining no more

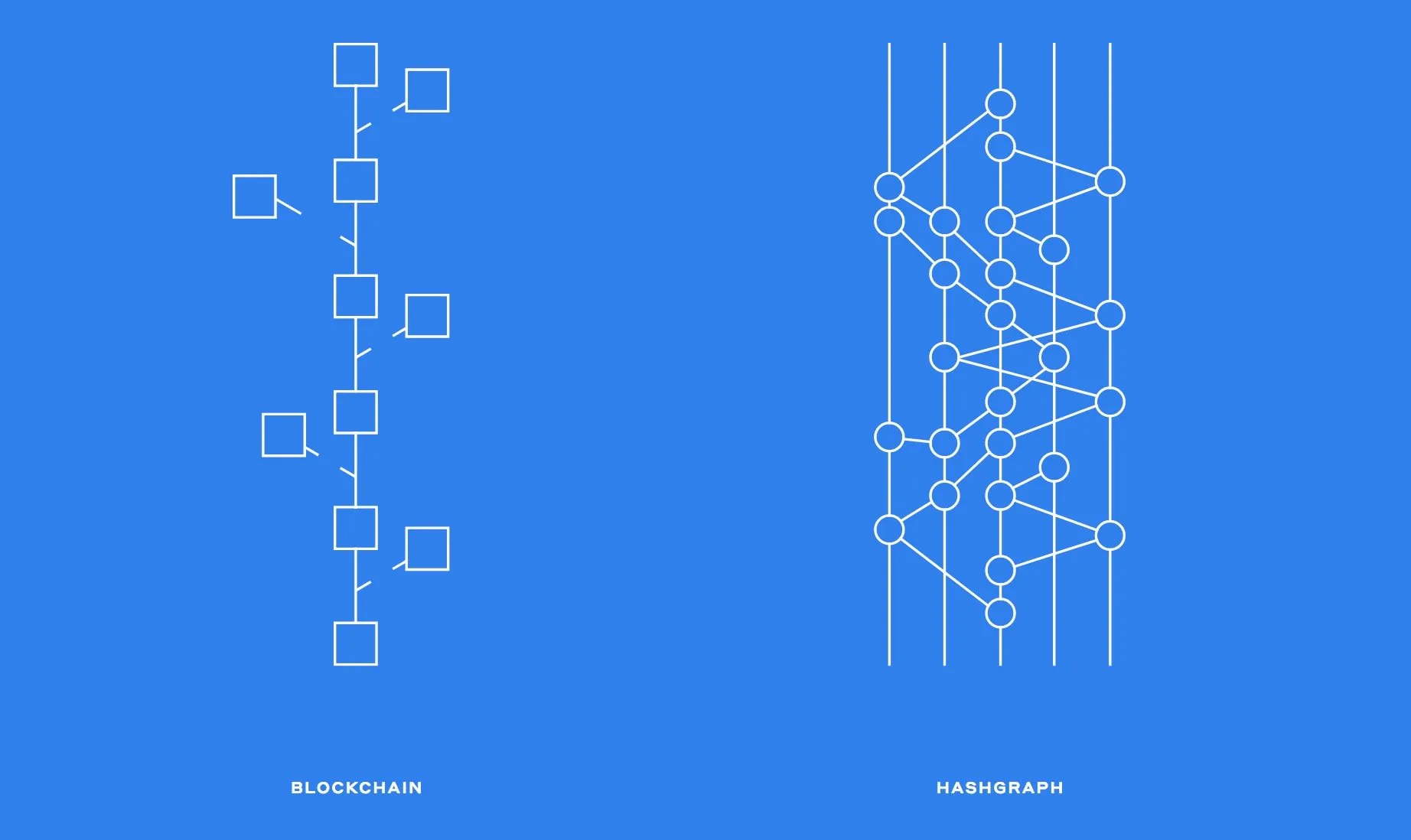

In most blockchain-based projects, the verification process relies on mining, an energy-intensive process requiring computers to work through fiendishly difficult computations in order to verify transactions. According to Hedera Hashgraph’s blurb, the DAG sidesteps that problem by removing mining entirely. In its place is something called “Swirlds Hashgraph.” In this new system, there are three distinct phases--which HH claims is much faster at verifying transactions than what blockchains can currently handle.

Nodes on this type of network gossip with each other, comparing notes on the transaction history of the network. As the nodes gossip, famous witnesses--a tier of elected super nodes--collate the gossip in the nodes and compare them with other famous witnesses. The aim is to reach a point known as “strongly seeing” whereby two famous witnesses could predict with confidence the outcome of a third witness.

“Hashgraph is different as it’s not a chain, but a graph,” says Edgar Seah, Head of APAC at Hedera Hashgraph. In other words, transactions can be entered in parallel, not serially. “Each member of the community doesn’t have to wait to put [their transaction] in blocks. Individuals just submit these transactions to the network whenever they want, without anything slowing them down. Furthermore, hashgraph has fast latency—it takes only a few seconds for a transaction to be sent out and confirmed (with 100 percent certainty) by the network.”

HH is not the only one backing DAGs. IOTA is built on the same idea, though it prefers to call its protocol a “tangle,” instead of a DAG. According to IOTA, this new type of verification makes transaction processing lightweight enough to be performed on smartphones, drones and by the internet of things (IoT), enabling these smart objects to talk to each other in ever more complex ways.

So far, so wonderful, but not all data is cut from the same cloth. According to some analysts, where a DAG or tangle might be a speedy tamper proof way of collecting data on things like climate change, it may not be as useful if you’re looking to put a large deposit on a beach side property in Malibu. The security—and slowness—of a blockchain is preferable, meaning it might be wiser to wait for the cogs on the good ol’ fashioned blockchain to turn instead of asking your neighbor’s smart fridge to approve the sale.

That’s not to say DAGs and tangles can’t be secure. HH says it achieves the highest possible level of security, the blockchain holy grail--aBFT or asynchronous byzantine fault tolerance to you and me. This system can still find consensus even when malicious actors are present on the network, thanks to the wonders of incredibly technical maths. (For masochists, the Hedera Hashgraph whitepaper attempts to explain it all.) By being so locked down, the company claims, makes it best in class for applications such as micropayments, distributed stock markets and auctions.

Over to you, judges

Another distinction the Hashgraph offers is in its governance. “We are putting together a council of 39 of the largest, most trusted, multinational corporations from around the world to govern the platform and the software that will run on millions of nodes globally,” says Seah. “This governance structure is unique among the public ledgers that currently exist.”

A slew of companies have hitched their wagons to HH, including: gaming company alto.io; virtual trading platform, TrakInvest; CULedger, a consortium of North American credit unions; and Open VMS, the OS that powers critical infrastructure such as nuclear power plants and stock markets. So that’s reassuring.

The next stage of HH’s journey to trounce the blockchain, announced today, is an accelerator. For this it’s partnered with Mind Fund, a Hong Kong-based VC, to launch Helix and incubate distributed-ledger technologies (DLT) startups on the Hedera Hashgraph platform. In keeping with Mind Fund’s strategic location, the initial focus is on Asia. The APAC region saw spending on DLT-related solutions double to almost $281.69 million in 2018.

The first cohort of recruits will incubate for 10 weeks in Hong Kong, receiving $100,000 each upon graduation. But HH and Mind Fund are casting the net wide and sourcing their proteges from a series of hackathons, across nine cities on four continents, beginning in October with Dallas, Texas.

It’s an auspicious time to be launching an accelerator, believes Mark Cheng, Mind Fund partner and Helix CEO. “I think the era of projects raising massive sums of money based only on a whitepaper is over because regulators are cracking down, and the market has become smarter because a lot of investors have been burned in this bear market. Crypto startups are going to need a product before they raise, and accelerators that provide value can help startups achieve this.”

But should developers and investors be shunning blockchains? Lamont Black, Assistant Professor of Finance at Driehaus College of Business, patt of DePaul University in Chicago, says not so fast, as the miners, who are instrumental in building the blockchain magic, perform a valuable role:

“In DAG, there is less specialization in the verification process. Economies tend to benefit from specialization (the baker vs. the candlestick maker). If network users play multiple roles in DAG [famous witnesses play more than one role on DAGS], does this limit the benefits of specialization?”

And, with its 39 governors, does HH really offer a decentralized solution that blockchain purists clamor for? Probably not. But it's a growing trend. IOTA, Byteball, and Tron all use similar systems of governance that many believe is a sneaky attempt at centralizing power. But Bitcoin, and it's incredibly powerful mining pools pose a similar problem: centralization catches up with networks eventually. At some point, some entity or group will assume control, so why not just lay that out in the beginning?

And while DAG’s may present a quicker, more scalable solution than blockchain, there’s no one size fits all. For the mobile, IoT market, DAGs have obvious advantages, but more than a 1,000 cryptocurrencies now use blockchain; it has the strength of numbers behind it and the growing popularity of smart contracts. The DAG, currently looks like it’s playing catch up.

However, the blockchain camp would be wise to arm itself against poison ivy.

Read Next: Mistaken Identity: September 25, 2018