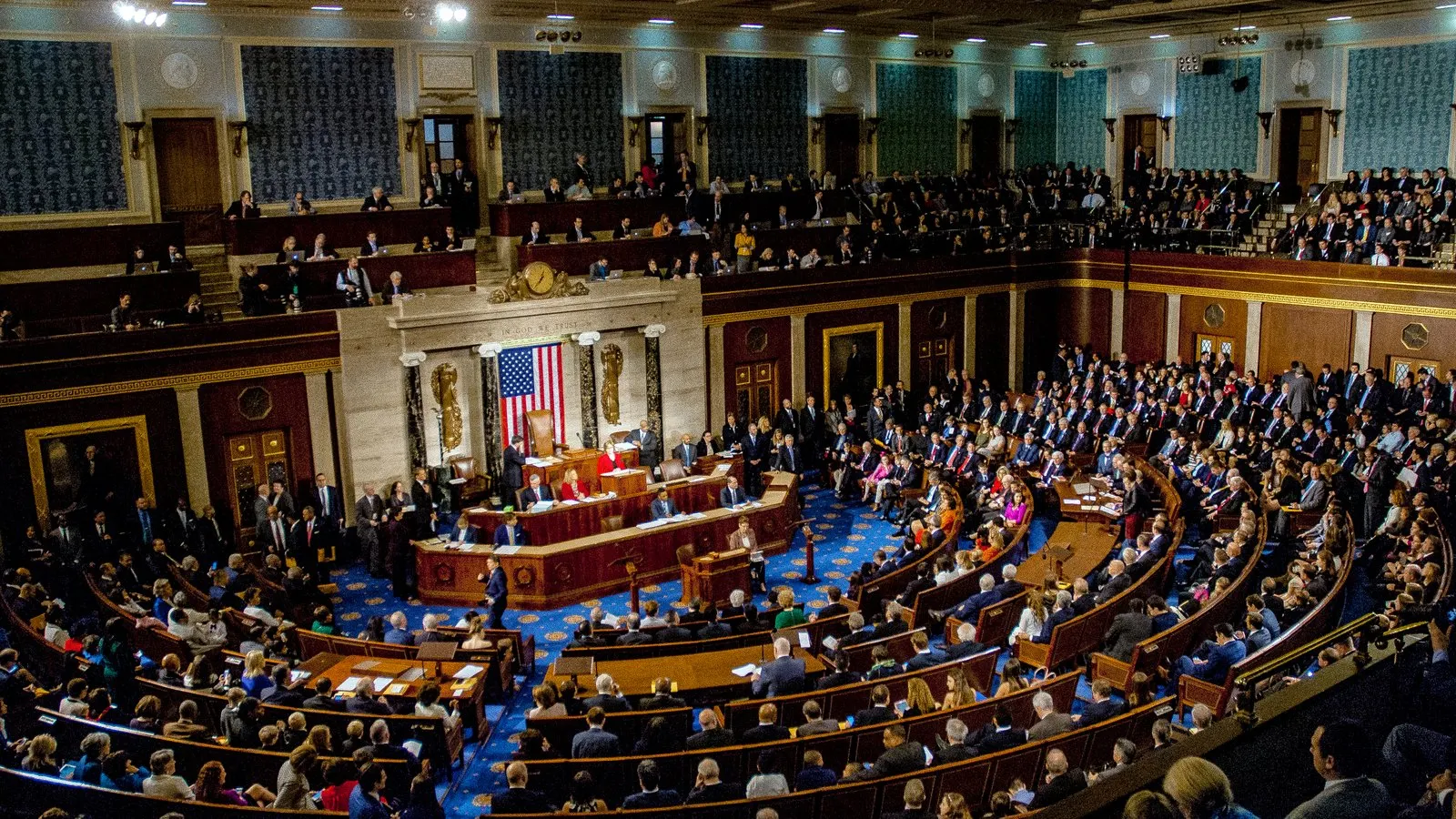

A bipartisan group of Senators introduced a bill on Wednesday that would require decentralized finance (DeFi) services to abide by the same compliance rules as financial firms like banks and centralized crypto exchanges.

The legislation, sponsored by Jack Reed (D-RI), aims to reign in “criminals, drug traffickers, and hostile state actors such as North Korea,” who’ve used decentralized finance for nefarious purposes, according to a description of the bill reviewed by Decrypt.

Named the Crypto-Asset National Security Enhancement and Enforcement (CANSEE) Act, the new rules would require decentralized finance services to abide by anti-money laundering (AML) rules and U.S. economic sanctions.

Decentralized finance, often cited as DeFi, refers to services built using smart contracts that don’t rely on financial intermediaries and exist on-chain, such as the exchange UniSwap and lending protocol Aave.

Anyone who controls a DeFi project would face penalties if a sanctioned person evades U.S. sanctions using their service. The description notes people who’ve invested more than $25 million in a project would be liable if no single entity is in control.

Overall, the legislation extends the U.S. Treasury Department’s “authority to crack down on illicit financial activity that may occur outside the banking sector,” the briefing states. The bill’s full text has not yet been added to Congress’ website.

The bill’s description highlights so-called crypto ATMs, where people can purchase crypto using cash or debit cards at kiosks, as an area that would be impacted. It would require operators to verify the identity of those involved in transactions.

The DeFi legislation is co-sponsored by Mike Rounds (R-SD), Mitt Romney (R-UT), and Mark Warner (D-VA), who said the bill is needed to protect the U.S.’s national security.

“I remain deeply concerned that criminals and rogue states continue to use crypto to launder money, evade sanctions, and conceal illicit activity,” he said, adding “participants who play by the rules” can continue to take advantage of crypto’s potential.

The description of the bill makes reference to cross-border fentanyl trafficking, arguing bad actors have used DeFi extensively to fuel the illicit trade. The sentiment mirrors concerns raised by Elizabeth Warren (D-MA).

The U.S. Treasury Department has gone after decentralized protocols in the past. The agency sanctioned the coin-mixing privacy tool Tornado Cash last year, which whistleblower Edward Snowden described as “profoundly authoritarian.”

The crypto advocacy group Coin Center is currently suing the U.S. Treasury Department over the move, which it said unfairly penalizes a DeFi project, and argues the decision could set a dangerous precedent if left unchallenged.