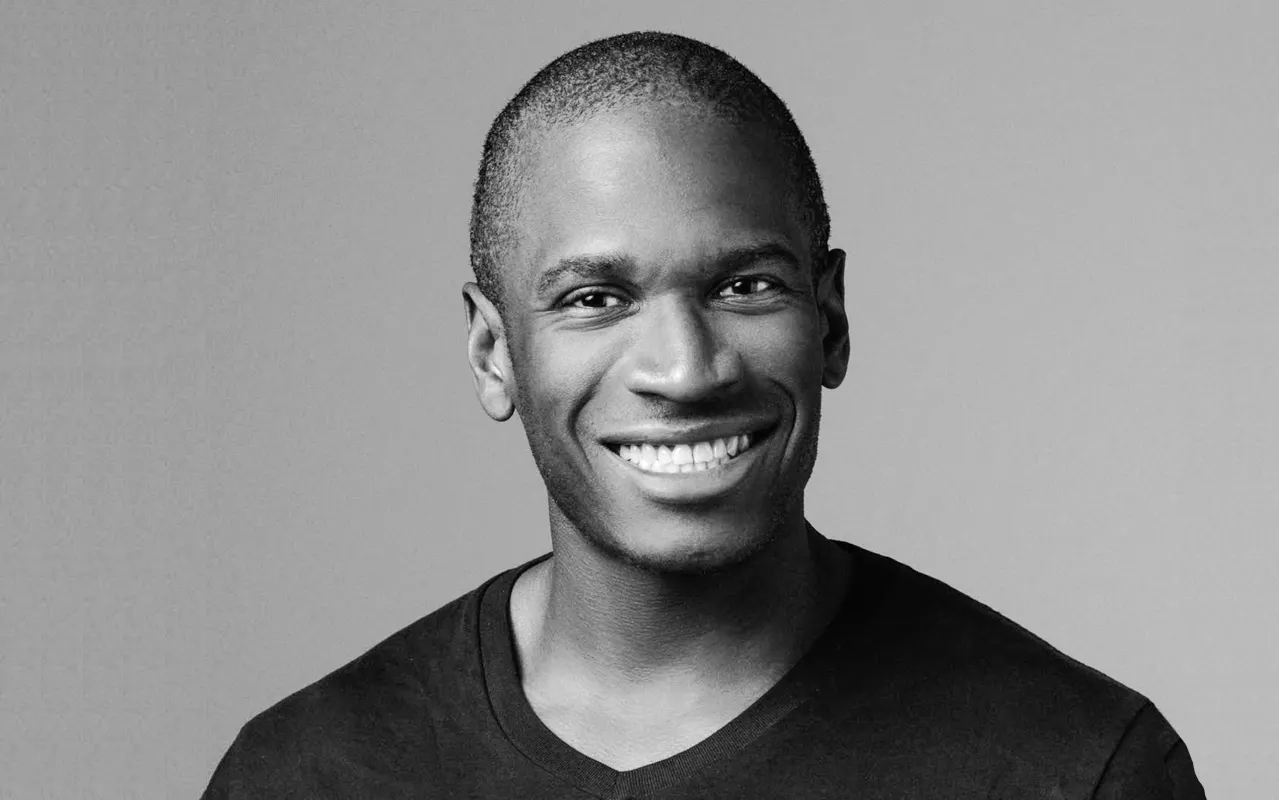

Will artificial intelligence need currency to operate in the same way humanity does? BitMEX co-founder Arthur Hayes says yes—and that currency will be Bitcoin (BTC).

In an essay published on Thursday, Hayes outlined why Bitcoin will be “chosen by AIs” as the most logical money with which to calculate their economic decisions, and the best payment rail with which to carry them out.

For starters, AI will necessarily require a payment system that is “available at all times, digital, and completely automated.” That’s because it must constantly be able to pay for two critical forms of “food”—data and compute power—in order to “stay alive.”

According to Hayes, the “balkanised,” analogue banking sector cannot provide this sort of 24/7 service, but a blockchain-based system can.

“By using a blockchain-based payment system, [AI] … can also receive payments electronically in extremely small increments if needed,” he added.

An AI payment rail must also be censorship-resistant, and enshrined with “clear and transparent” rules from the outset, Hayes explained. This is to avoid the risk of deplatforming, which is “high and undesirable” for a robot that does not intrinsically understand human laws, or the “opaque and intentionally unintelligible” rules of the censorious banking system.

While not all blockchains are necessarily permissionless or censorship-resistant, Bitcoin certainly fits the bill.

“Bitcoin is censorship resistant because the only way the rules can change is a public proposal is put before the entire network and the majority decides,” Hayes wrote. “There is no singular entity that can arbitrarily change the network rules.”

While fiat currency and gold can technically circulate on digital, decentralized networks using stablecoins, the reserves backing such tokens must be held with centralized entities. As such, stablecoins can be frozen and censored by their issuer, such as when Circle froze USDC linked to Tornado Cash following Treasury Department sanctions against the privacy protocol last year.

Finally, the ex-CEO argued that Bitcoin is best suited to maintain its value over time against AI’s electricity “foodstuffs.” Not only is the asset programmatically capped at 21 million coins, but is also mined directly using electricity, which therefore “defines the value of Bitcoin over time.”

Some have argued that Ethereum (ETH) could make stronger money than Bitcoin due to its deflationary supply dynamics following the Merge. However, shortly after the upgrade, Hayes claimed that ETH doesn’t qualify since it has other applications, unlike Bitcoin and fiat currency which are “just money.”

“That’s what makes [Bitcoin] good money, because its value cannot be conflated with the actual utility of other stuff,” he said at the time.