The controversial BRC-20 standard and Ordinals protocol that made it possible keeps growing its footprint in the Bitcoin ecosystem. The latest: Stably USD, which is being billed as the first BRC-20 stablecoin.

After all, two of the largest stablecoins—Tether (USDT) and USDCoin (USDC)—originated on the Ethereum network as ERC-20 tokens. Although now both tokens are available on a handful of other networks like Solana, Avalanche, and TRON.

Like ERC-20 tokens, BRC-20s are a lot like NFTs. They allow for arbitrary, non-financial information to be added to the Bitcoin blockchain without the need for a sidechain or additional token. BRC-20 tokens have been at the center of an intense debate within the Bitcoin community, with important figures taking favorable and unfavorable positions.

Now U.S.-based Stably, which calls itself a fiat onramp for crypto trading, has announced its BRC-20 U.S. dollar-backed stablecoin on Twitter. But there are a few red flags.

For starters, the total supply: $69.420 trillion, according to the company’s website. That’s more than double the U.S. national debt and likely a nod to meme culture. And things seem to be off to a slow start. Their documentation links to a reserve wallet with a $220 balance at the time of writing.

While Stably claims its subsidiary, Stably Trading LLC, is a registered money transmitter, the registration number and address on their website don’t match what’s listed on the FinCEN website under “Stably Trading, LLC.”

The company tweeted that “#USD is backed and redeemable 1-to-1 for USD collateral managed by our regulated custodian” adding that a third party firm will be conducting monthly attestations to ensure the collateral always matches what’s been issued.

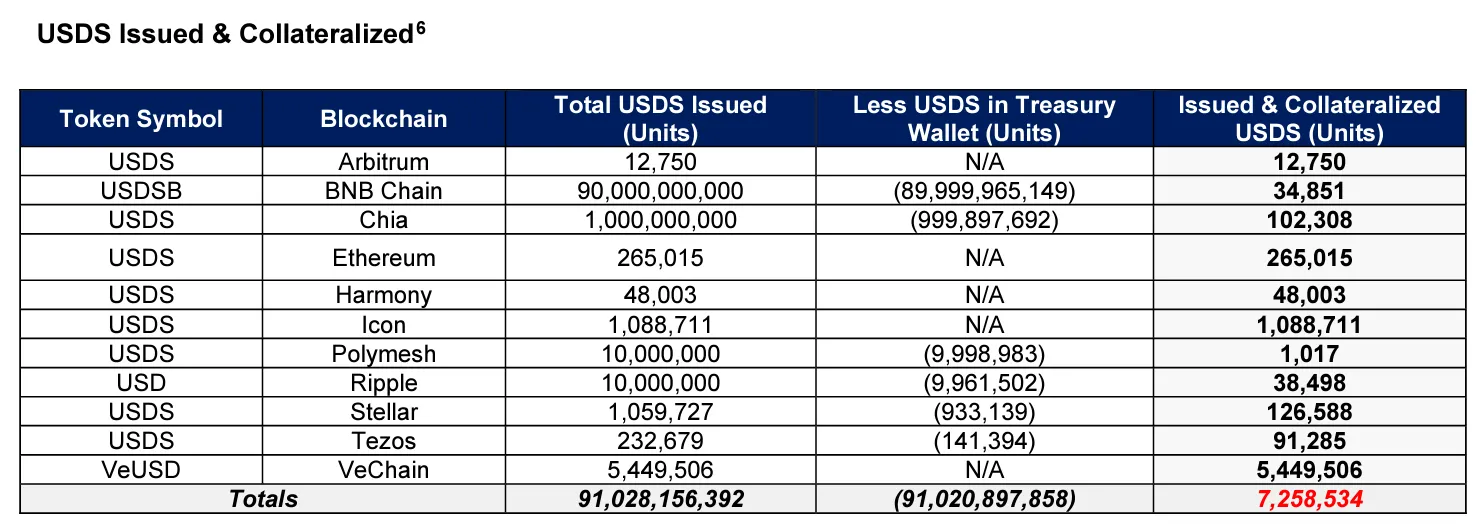

StablyUSD isn’t technically a new stablecoin. It’s been around since 2019 and only recently got converted into a BRC-20 token on Bitcoin. The latest attestation report shows it’s got a market capitalization of $7 million across 11 different blockchains, including Ethereum, BNB Chain, and Arbitrum.

The USDS listing on CoinGecko shows that its price hit an all-time high of $9.89 on November 30, then crashed days later to $0.05 on December 9, 2022. The token has about $5,000 worth of liquidity on decentralized exchange UniSwap split between two trading pairs.

According to Stably’s website, its regulated custodian–Prime Trust–holds the reserves for Stably USD. But it seems more likely that Prime Trust doesn’t hold the reserves directly, as it explains on its website that it isn’t FDIC-insured and uses accounts at a handful of banks that are.

That said, Stably said it will enforce a know your customer (KYC) and anti-money laundering process (AML) for users who want to redeem stablecoins for actual dollars.

Neither Stably nor Prime Trust immediately responded to a request for comment from Decrypt.

Although Stably has been quick to claim they were the first USD stablecoin on the Bitcoin network, USDT was initially launched on OMNI, a Bitcoin sidechain, in 2014. There are also several U.S. dollar-backed stablecoins, such as DoC on Rootstock, currently available on the network.

The new stablecoin, however, appears to be the first of its kind using the BRC-20 standard.

Whether this is another BRC-20 fad to quickly fade away, or a new era of stablecoins ushered in by the contentious Ordinals protocol remains to be seen. As always, do your own research.

Editor's Note: This article was updated to note that USDT and USDC originated on the Ethereum network, but don't both do the majority of their volume on the network.