If you want to buy or sell crypto, you either go to a centralized exchange (CEX) run by private companies like Binance or a decentralized exchange (DEX) like Uniswap that runs on code and is non-custodial.

If you’ve used both, you’ll know they feel really different.

CEXs are typically based on an orderbook model, where you see a list of sell and buy orders by other traders against whom you trade.

Meanwhile, DEXs run on a technology called automated market makers that rebalance liquidity pools–pieces of code that contain funds–as you trade through them. DEXs are more secure because they’re non-custodial, but they’re also more expensive to use and typically require more–significantly more!–technical knowledge on the part of the user..

Against that established conception of CEXs and DEXs, a decentralized exchange in the Polkadot ecosystem offers a radical alternative

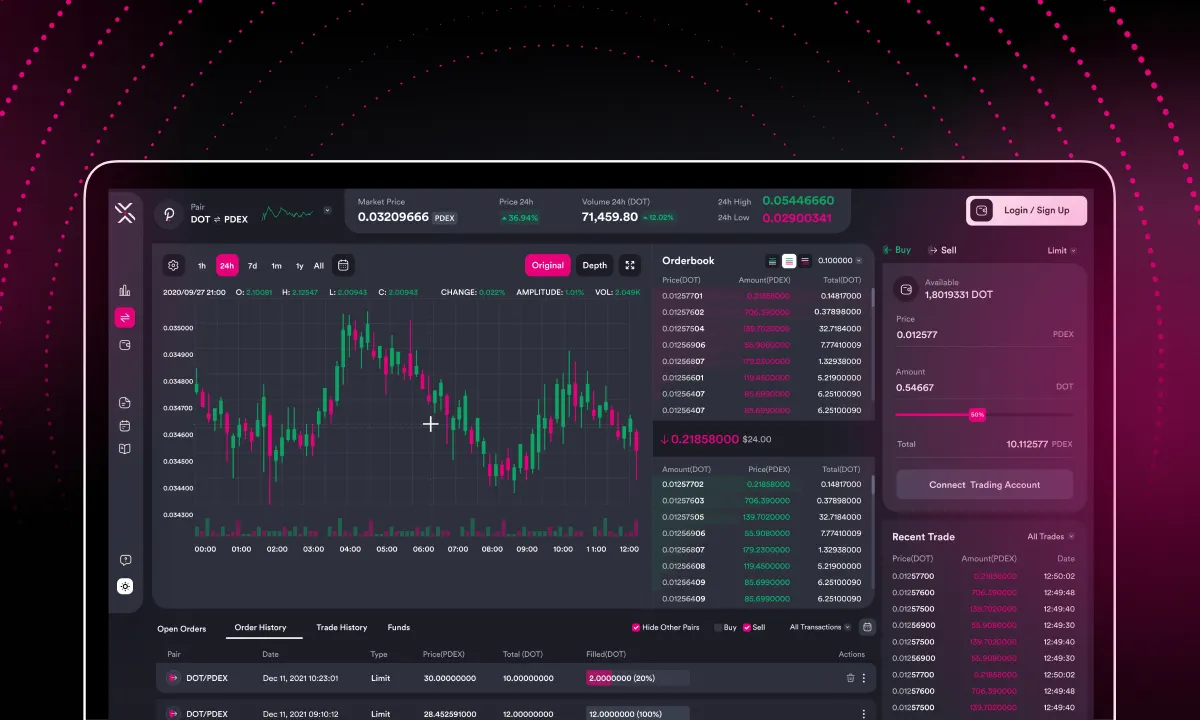

Polkadex, which launched its mainnet a year ago, now boasts a fully-functioning Polkadex Orderbook. (Yes, it’s an orderbook. And no, it’s not a CEX).

🎉 POLKADEX ORDERBOOK IS LIVE 🎉

The CEXier DEX is finally here 😏

Combining the advantages of CEXs and DEXs while tackling the issues of both, #PolkadexOrderbook is set to revolutionize #DeFi & become the trading engine for #Web3.

Get all the details👇https://t.co/e8JjZqsH3t

— Polkadex (@polkadex) October 31, 2022

The result, says Polkadex founder and CEO Gautham J, is a DEX that “looks exactly like a centralized exchange.” Show it to a new user, he told Decrypt, and even someone who has no idea about what Polkadex is will say, “This is a centralized exchange?”

The best of both worlds

By design, Polkadex Orderbook offers the best of both worlds, combining the best features of centralized and decentralized exchanges.

With DEXs, there are usually a lot of technicalities to wrap one’s head around. These user experience issues are the “main bottleneck with DEXs,” Gautham said. “You cannot assume everyone is technically inclined to understand the cryptography behind them, or has the time to manage all these things for themselves.”

CEXs, meanwhile, are prone to the vulnerabilities associated with having a single point of failure—like their founders gambling with customer funds or dying with sole access of the private keys to customer funds.

But, said Gautham, despite the risks, both neophyte retail traders and crypto pros tend to prefer CEXs, thanks to their high levels of functionality and the advanced trading features that make them cheaper to use.

One distinguishing feature of CEXs is that they’re also mobile-friendly. Since much of the internet activity takes place on mobile, it makes sense to have a mobile app through which you can trade. But DEXs are typically terrible at serving mobile users. That’s another area where Polkadex aims to stand apart; it’s optimized its product to be fully accessible via mobile, tablet, and desktop.

Gautham points out that another significant breakthrough for Polkadex is the ability to delegate asset-trading to a third party, ideally suited to individuals or institutions with plenty of funds but limited time or expertise. Most importantly, delegation doesn’t involve handing over the custody of your funds. You still retain access to your assets, while someone else trades them on your behalf.

Underlying all of this is Polkadex’s use of trusted execution environment (TEE) technology. TEEs are an isolated hardware enclave that processes data in one area, while storing it securely in another area. They’re used in your smartphone to secure sensitive data like your fingerprint. “There is a cryptographic guarantee that nobody can tamper with it—even a virus or low-level attacks cannot enter it because it's in the hardware, it’s isolated from the rest of the system,” Gautham said.

Getting started with Polkadex

Polkadex has also ensured that its user onboarding process is as simple and straightforward as possible.

You can register an account (main and trading accounts, separately – just like in CEXs), and deposit some PDEX and/or USDT. It’s also possible to bridge USDT over from Ethereum via ChainBridge on Token Manager. There are no KYC requirements. And to start trading on Polkadex, just follow the tips here.

Decentralization doesn’t have to come at the expense of poor user experience. Letting someone trade on your behalf doesn’t have to mean a handover of asset custody. These are technically solvable problems—indeed, Gautham and his team worked for over a year to bring about a product that addresses user needs from all angles: security, convenience, and technical complexity.

Polkadex is proof that another model in crypto is possible.

Brought to you by Polkadex

Learn More about partnering with Decrypt.