Bitcoin (BTC) continued its bearish price action over the weekend, with the leading cryptocurrency dropping to a new 3-month low of $18,390, according to data from CoinMarketCap.

Bitcoin now changes hands at around $18,440, down 8% over the past 24 hours, despite a 64% jump in daily trading volume.

BTC has lost over 17% of its value over the past week, and is down over 73% from its all-time high of $68,789.63 in November 2021.

The market capitalization of Bitcoin has more than halved, plummeting from $1.27 trillion last November to under $354 billion today.

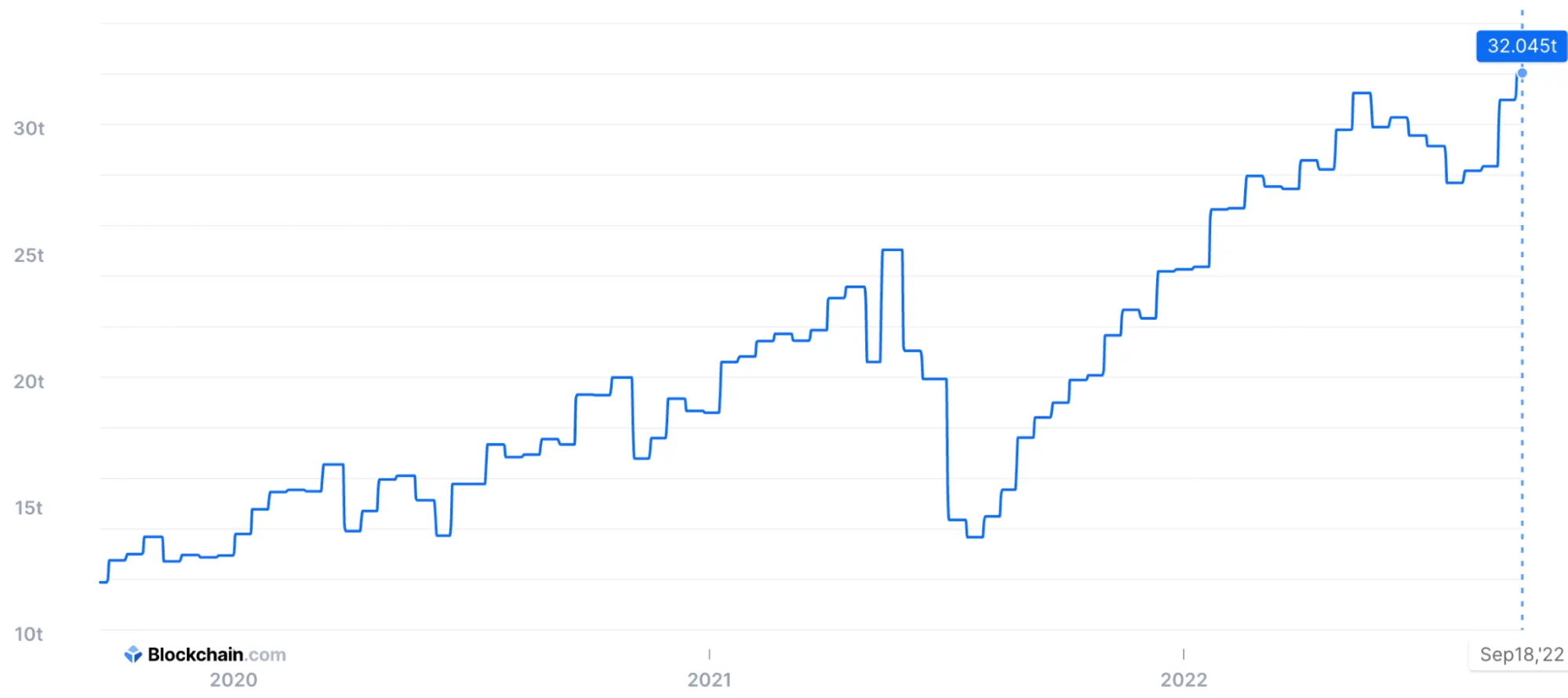

Yesterday, Bitcoin’s network difficulty reached an all-time high of 32.045t, according to data from Blockchain.com.

Network difficulty marks the computational challenge associated with mining a block. Greater difficulty requires high computational power and significantly affects miners' profitability, driving the price of the coin lower.

Ethereum Follows Bitcoin

Ethereum, the second largest cryptocurrency by market cap, has slipped to under $1,300, a whopping 11% decline over the past 24 hours.

Following its merge on 15th September, Ethereum has lost more than 20% of its value, with its market cap now standing at around $159 billion. ETH is down 73.30% from its all-time high of $4,891.70 recorded in November 2021, per data from CoinMarketCap.

NFT trading volumes on Ethereum dropped over 18% over the past 24 hours, according to data from Cryptoslam. On a monthly note, Ethereum-based NFT trading volumes have dropped by nearly 30%.

As per data from Defi Llama, the total value locked (TVL) across all decentralized applications on Ethereum is down 12.73% in the past 24 hours, indicating reduced user interest in DeFi.

Long traders rattled

Amid today’s bearish price action, over $433 million from over 131,000 traders has been liquidated in the crypto market over the past 24 hours, per data from Coinglass.

Of the $433 million liquidated, over $379 million, or 87%, were long positions, indicating the market’s bearish trend.

Ethereum leads liquidations with $173 million, followed by Bitcoin with $121 million over the same period.

The market’s bearish price action is likely linked to the Fed’s expected rate hike later this week.

As reported by Reuters, a 100-basis point hike is not off the table following August’s raging inflation figures, with most expecting a 50 to 75-basis point hike.

Other top cryptocurrencies, including Polkadot (down 12%), Avalanche ( down 10%), Shiba Inu (down 10%), Polygon (down 12%), and Cardano (down 10%), have also posted severe losses over the past 24 hours, according to CoinMarketCap.