In brief

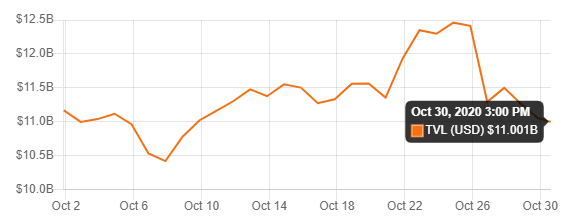

- Total value locked in DeFi has dropped by $1.5 billion in the last five days.

- That's partly to do with the price of Ethereum sinking by 4%.

- The amount of ETH locked in DeFi has remained stagnant since mid-September.

Is DeFi dead? Again?

The hype surrounding decentralized finance, shorthand for a collection of non-custodial financial products that exist mostly on Ethereum, was arguably the catalyst for the crypto market’s 2020 bull run (post-COVID-induced market crash in March, that is). But the last few weeks have given little reason for optimism for those who fixate on DeFi coin market caps and “total value locked” metrics.

In the past five days, in fact, total value locked—a metric that measures the amount of cryptocurrency put into DeFi contracts—has dropped by a whopping $1.5 billion, according to DeFi Pulse. On the surface, this would represent nearly 12% less economic value in the nascent industry.

In reality, however, this may have more to do with the sinking price of Ethereum, which has dropped by roughly 4% in the last week. In ETH terms, the amount locked in DeFi has remained virtually unchanged since September 16—though in the last five days, the amount of ETH locked in DeFi apps has dropped by 3.5%.

Ethereum is having a rough week overall. Since October 25, the price of ETH has been in decline after failing to break past the $400 mark. After falling as low as $374 today, ETH is currently trading for $383, down 1.56% over the last 24 hours.

DeFi tokens are having a bad time

At the moment, things aren’t looking much better for DeFi tokens—the Ethereum-based coins associated with various decentralized finance protocols. And if you jumped into DeFi sometime in September, chances are you know this all too well, with some of these tokens losing 50% of their value or more.

Uniswap’s UNI token, for example, went from $7.82 on September 18t to a current price of about $2.32. That's a 70% loss in just over a month. Link Marines are also licking their wounds with a 50% drop in the price of LINK, the native token of the Chainlink decentralize oracle network, since September. UMA (-74%), Compound (-61%), Sushiswap (-94%) and Yearn.Finance (-75%) are also showing significant losses from their September peaks.

But it’s not all bad for DeFi right now.

More and more Bitcoin investors are still seeking to get in on DeFi action, as represented by the amount of tokenized BTC on Ethereum breaking the $2 billion mark earlier this week. That exceeds Bitcoin's own Lightning Network capacity by nearly 10X.

What’s more, there’s roughly $7 billion more in Ethereum locked in DeFi now than in August, the last time DeFi died.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.