In brief

- There's more than $2 billion worth of Bitcoin on Ethereum.

- Synthetic Bitcoin, such as WBTC, is being used on DeFi protocols that offer high yields.

- The rising price of Bitcoin is a factor.

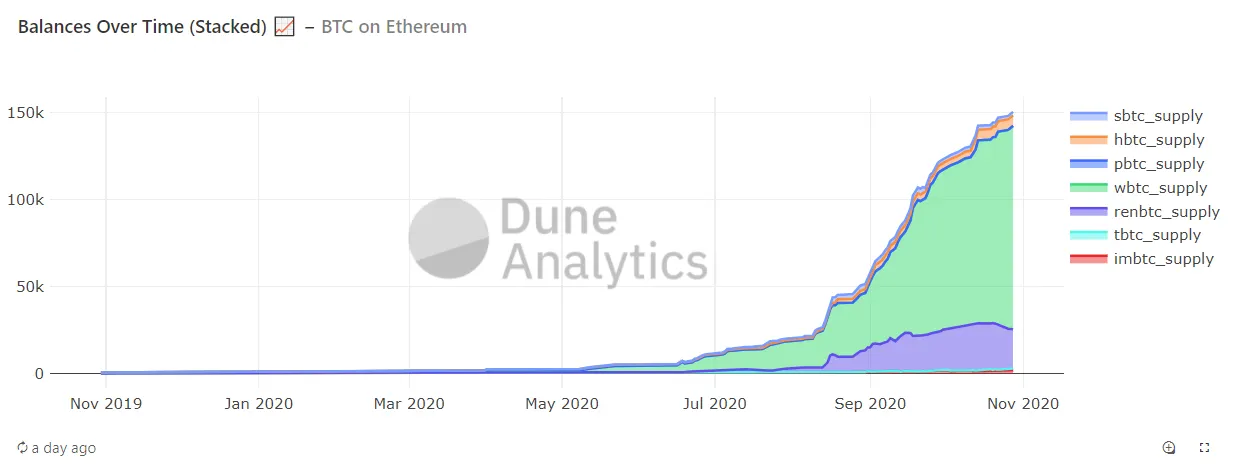

There’s now more than $2 billion worth of Bitcoin on the Ethereum network, according to the latest data compiled on metrics site Dune Analytics.

The data shows that there’s 150,049 Bitcoin on Ethereum, equivalent to 4.32% of Ethereum’s market cap, or $2.021 billion. In mid-September, that figure stood at just 80,000 Bitcoin, valued at just under $1 billion at the time. The price of Bitcoin has gone up by $3000 since then.

But isn’t Bitcoin...Bitcoin, and Ethereum, well, Ethereum? Nice spot—all of the Bitcoin on Ethereum is, in fact, synthetic representations of Bitcoin. For Bitcoin to become usable on Ethereum-based protocols, it has to be first exchanged for synthetic, Ethereum-based versions of Bitcoin.

The most popular is called Wrapped Bitcoin—it holds almost 80% of the market share and has a market cap of $1.5 billion all on its own (that’s enough for second place among DeFi coins, according to CoinGecko). The way it works is you send some actual Bitcoin to its smart contracts and you’ll receive Ethereum-based WBTC in return.

Bitcoiners may move their Bitcoin to Ethereum to get involved in decentralized finance protocols, many of which offer high yields. For long-term HODLers, it’s an attractive option for those wishing to earn money on any Bitcoin they own.

Decentralized finance, also known as DeFi, refers to non-custodial financial products, such as decentralized lending protocols or exchanges. Exchanges such as Uniswap offer fees to people who provide liquidity (crypto) to the exchange, and lending protocols offer high yields to lenders.

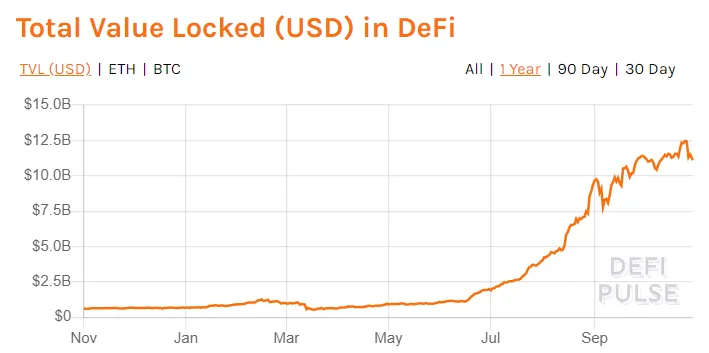

Investors have plugged about $11 billion worth of crypto into DeFi smart contracts, according to metrics site DeFi Pulse.

Synthetic Bitcoin took off along with the DeFi industry, which really only got started toward the end of June—when the first DeFi protocols began to offer extra incentives to users of the platforms, sometimes with yields of over 1,000% per year. (Granted, these rates were highly volatile and many protocols blew up in flames).

The synthetic Bitcoin market progressed at a faster clip toward the end of August, and has grown significantly since then. The reason? Perhaps it’s down to the huge increases to Bitcoin’s price. The coin, the largest by market cap, grew from about $10,000 in late August to just under $14,000 this month.

That’s brought a lot of investors into Bitcoin—and while they wait for the price to rise, they’re putting it to work on Ethereum DeFi protocols.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.