In brief

- Two months after its first seed round. China-based DEX DODO raised $5 million.

- The round was led by Pantera Capital, Three Arrows Capital, and Binance Labs, and followed by Galaxy Digital and Coinbase Ventures.

- The liquidity provider is developing a new market-making algorithm called “Proactive Market Making.”

Following a seed round in August, DODO, a 6-month-old China-based DeFi project, completed another round of $5 million funding in private sales. The round was led by Pantera Capital, Three Arrows Capital, and Binance Labs, and followed by Galaxy Digital and Coinbase Ventures and represents 10% of its equity.

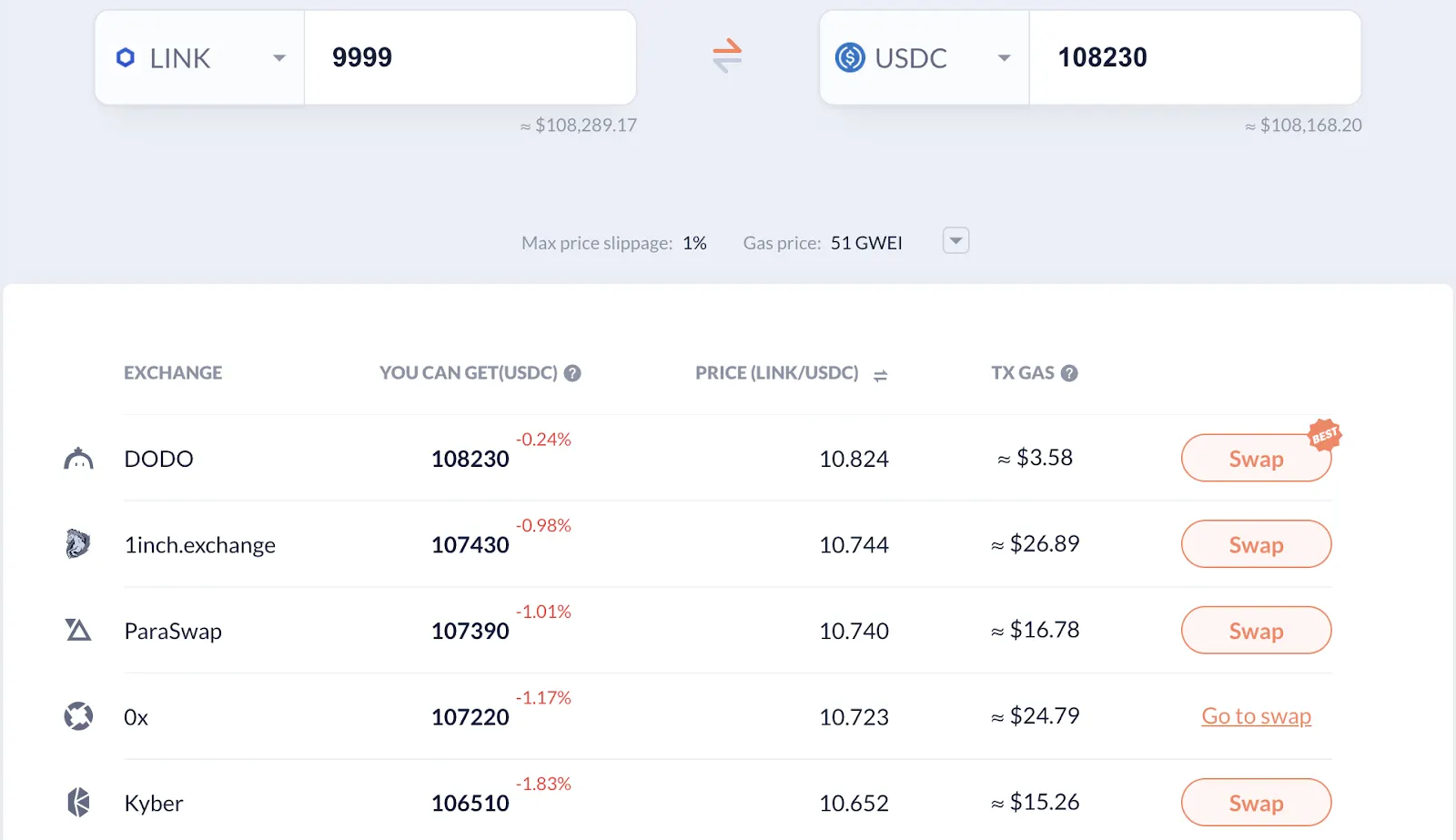

DODO, a decentralized exchange, is developing a new market-making algorithm called “Proactive Market Making” (PMM). It incorporates elements from both Automated Market Making (AMM) and the centralized exchange’s order book, and aims to provide lower slippage and cheaper gas fees.

“With the PMM algorithm, DODO not only can leverage public oracles for pricing but also adopt institutional market making strategies,” Diana Dai, co-founder of DODO told Decrypt.

DODO claims that is has locked in over $110 million and transacts $20 million in 24-hour trading volume.

“The 5 million raise will be used to recruit, and develop products in the next 3 years,” Dai said. “From our last seed round until now, we’ve finished smart contract development. DODOEx went live and hit its highest trading volume within 24 hours and remains as one of the best DEXes in terms of liquidity and transaction costs.”

Like many DEX, DODO also launched its native exchange governance token DODO, an ERC-20 token, on Sep 29th. The DODO tokens are also put on the DODO Exchange via an Initial DODO Offering ( IDO). To provide initial liquidity, DODO locked in 1% of the total DODO supply and promised not to further deposit or withdraw DODO or USDT from the liquidity pools.

Moving forward, the team’s top priority includes price oracle precision and optimization development, a partnership with Chainlink, on-chain institutional market making strategies, trading experience and efficiency, and self-serve and permissionless products for IDO projects.

Dai said that the recent fundraising round was over-subscribed but the team kept the original funding size of $5 million. She added that now that funding is in place, she and her team are ready to tackle their biggest challenge: educating the market on PMM and focusing on the long term value-add of DEX.