In Brief

- Framework Ventures led a $600,000 seed investment in DODO, a Chinese liquidity provider.

- Other notable investors include Robert Leshner, founder of Compound; Bobby Ong, founder of Coingecko; Jason Choi and Spencer Noon.

- The site launched to the public August 25.

The recently launched DODO, a Chinese, on-chain liquidity provider, closed a $600k seed round led by Framework Ventures, known for its investment in Chainlink and Synthetix. This is the fund’s first China deal. Other notable investors include crypto veterans and influencers such as Robert Leshner, founder of Compound; Bobby Ong, founder of Coingecko; Jason Choi and Spencer Noon.

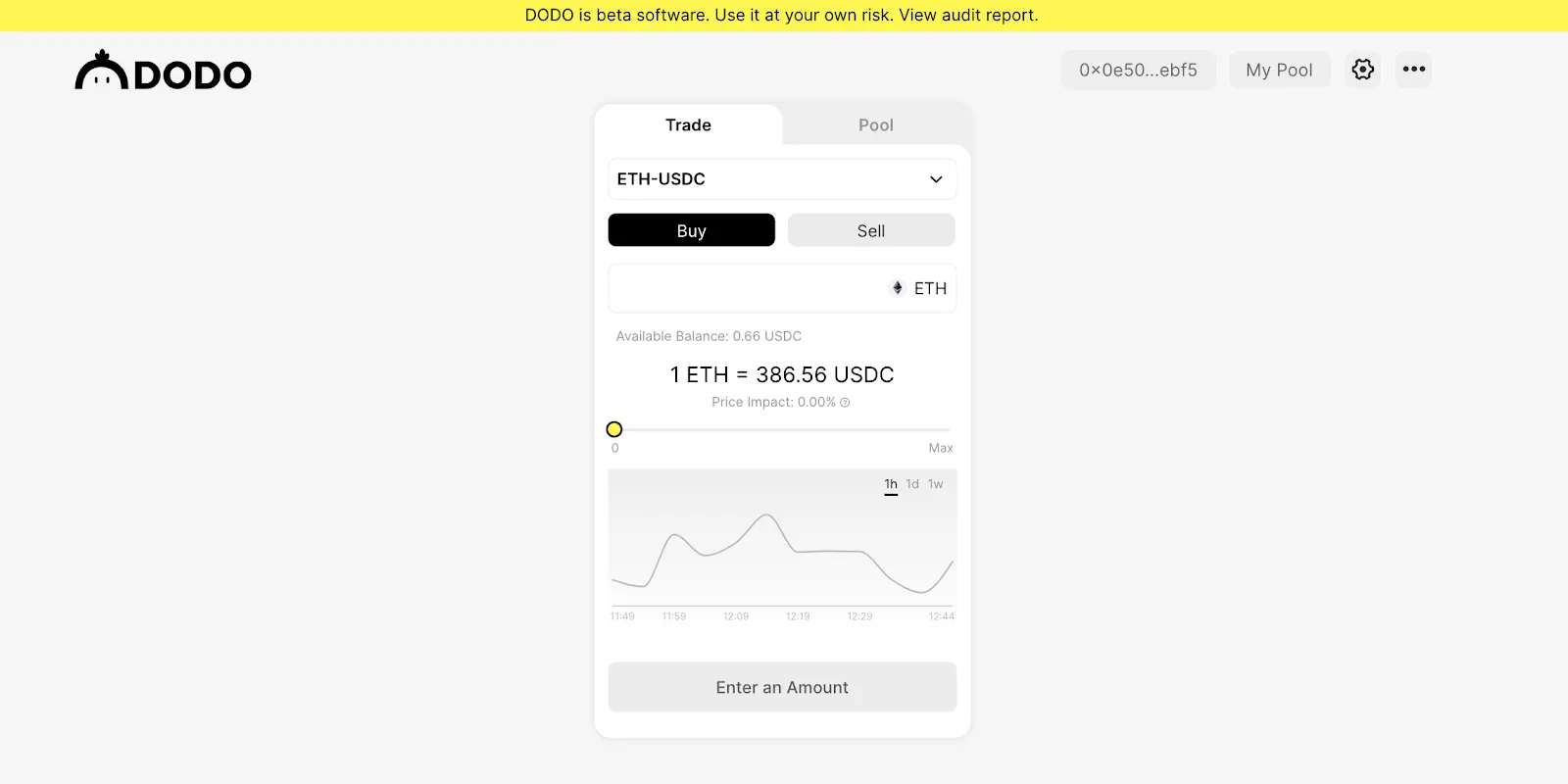

DODO, which launched a closed-beta pilot project on August 15, has been running a proof of concept campaign aiming to prove that it has lower slippage than competitors such as Uniswap. It opened to the public on August 25 and is developing new trading pairs.

DODO's secret sauce: Proactive Market Making

Unlike many liquidity providers that use 'Automated Market Making' (AMM), DODO’s special sauce is a new marketing-making algorithm, called ‘Proactive Market Making’ (PMM).

“Proactive market-making uses a formula that mimics the behaviors of human market makers, and efficiently allocates funds near the market price,” Diane Dai, co-founder of DODO told Decrypt. By comparison, AMM is inefficient since only funds allocated near the market price can be executed, she said.

In short, PMM combines the best of AMM and centralized exchange’s order book for better liquidity and lower slippage. She claimed that initial data from its August 15 proof-of-concept campaign showed that DODO can provide better trade execution than Uniswap, with only 1/10th the pooled capital, while sustaining a 40% APR return for LPs (without any liquidity mining rewards). All contracts are audited.

"We invest in teams that ship software rapidly, have cultural context, and aren’t afraid to try new things." Vance Spencer, founder of Framework Ventures, told Decrypt. "DODO’s team has built on their time at DDEX and from organizing the DeFi community in China, and has brought to market a PMM that provides traders with the best execution while increasing capital efficiency for liquidity providers."

DODO's team

Perhaps the biggest advantage of DODO is the influence its three co-founders have in China’s DeFi community. Diane Dai started the first DeFi community in China, running a WeChat subscription channel called DeFi Labs, and numerous WeChat groups such as “DeFi The World,” the oldest of China-focused DeFi WeChat groups.

Mingda Lei, the brain behind PMM, was a Physics PhD dropout at China’s prestigious Peking University. He was the core developer of DDEX, another China-based DeFi project. Dodo’s third co-founder, Qi Wang, is the founder of DOS network, China’s first oracle project.

Like all DeFi projects, risks exist. Other than the typical front running and back running, DODO’s biggest risks come from its price oracle. On its mainnet, DODO integrates with Chainlink, which provides price updates by aggregating responses from 21 independent price feeders (oracles). But oracle infrastructure is no guarantee during extreme market volatility. (Remember Chainlink’s stalled ETH price during Black Thursday on March 12.)

So what’s with the name? Dodo birds were large birds, unable to fly, that are now extinct—not a very auspicious symbol. Dai said that the company was named after “DODO Airlines,” in Animal Crossing, which allows players to visit all the islands in the virtual world. Similarly, DODO’s team believes it will sit at such an intersection, connecting all DeFi yield islands together.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.