In Brief

- Though Balancer blacklisted the YFI clone known as YFII, it's being celebrated in China as the real deal.

- The fork added features that YFI lacks.

- A Chinese nationalist, Maoist group known as Little Pink is embracing it as "Chinese Defi."

China is known for its knockoff economy. From LV bags to high-tech products, its global trading partners have accused the county of misconduct for years. Yet in the world of crypto, producing “knockoff products” can be easily achieved through forking, especially when communities disagree. And that’s what happened this week when China’s crypto community forked YFI, a star DeFi yield aggregator that gives depositors the best rates in the market.

The new project, confusingly called “YFII,” could have been just another forked project. But a series of events that’s been unfolding is turning it into the DeFi story of the week—and YFII into the hottest thing in China's nascent DeFi space. It’s angering DeFi proponents in the west, who say it's potentially a scam and have tried to ban it, while in China, it’s becoming popular as both an investment vehicle and a cause celebre for a Maoist, nationalist group of savvy, young crypto people.

Despite all the opera, and charges of being a cheap knockoff, YFII’s story is actually a pretty good case study of how to launch a successful DeFi protocol in China.

Who launched YFII and why

YFII was announced via a Medium post, written by a pseudonymous person named “White Noise,” a scant four days ago. It was indeed a fork of the YFI code—and there’s nothing illegal or even explicitly wrong in that. After all, YFI’s creator, Andre Cronje, relinquished his community governance rights so YFI could be a truly autonomous community. He has even personally stated many times that YFI’s governance token should have no value other than, well, governance.

Of course, “governance” of itself is not the reason why most people farm DeFi yields. Cronje’s could be a long-term vision, but so far, most DeFi players are eyeing a quick return on their investment, which makes DeFi smell a little like 2017’s ICO crazy-money bouquet. YFII might be an extreme representation of such a motive, but it is not an untrue one.

In any event, the YFI clone took off even faster in China than YFI did in the west.

“Initially, only a few Chinese non-DeFi players participated in YFII’s liquidity mining,” Tina Zhen, a DeFi developer who happens to know the guy who forked the code, told me. She said it didn’t take long for YFII to take off. “Suddenly, crypto whales who are new to DeFi, players in CeFi, exchanges, mining pools, and even crypto hedge funds have joined the game.”

The WeChat Rebellion

Conversations quickly erupted onto WeChat, where the crypto circle gathers. And influencers also joined the discussion, spearheaded by Robert Leshner, the founder of Compound. Embarrassingly, when he tried to join YFII’s WeChat group he discovered that either he was not known in the community and that he had to be verified. He was finally allowed in and submitted to questions from the community.

It turns out that YFII runs a vibrant community on WeChat, where they turn all anti-YFII rhetoric into anti-China sentiment. This technique is particularly effective given the gloomy, if not disastrous, diplomatic relationship between China and the US. Anger, fueled by nationalistic sentiment, prompted many to join the movement.

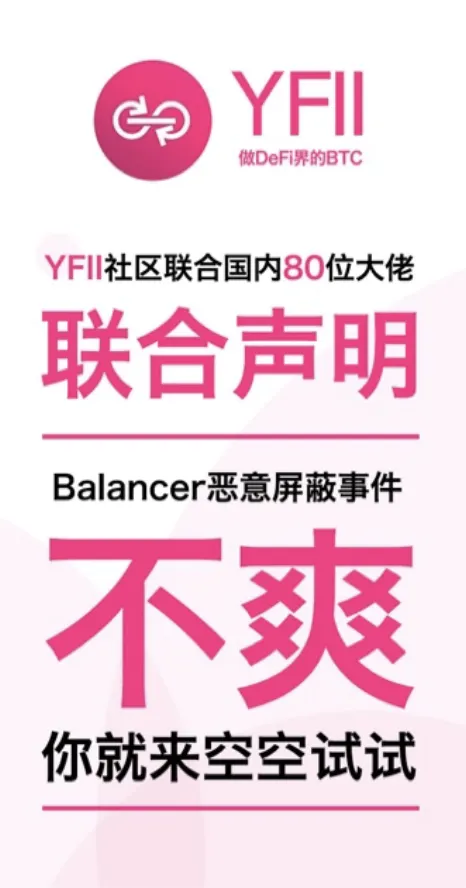

Even the project’s poster is a classic pink color, representing a generation of young, angry and extremely nationalistic, Maoist Chinese known as “Little Pink.” The poster, by the way, says, “We are pissed at Balancer's hostile blacklist."

Why YFII is the real deal

YFII managed to get liquidity from local Whales who have been curious about DeFi but never got their hands dirty. Most of the YFII tokens are being held by a handful of big accounts. These are DeFi newbies who have resources but probably just don’t understand most English-languish dominating DeFi products.

YFII, you see, provides an essential tutorial and home-like comfort for newbies to test the DeFi waters. That’s why there is now real money flowing into YFII.

It’s worth stopping and considering why the Chinese community forked YFI. At its inception, YFI only had 30,000 tokens, which could only be received through liquidity mining. A bunch of Chinese yield farmers counter proposed issuing more tokens, in a proposal called “YIP8,” which sought the issuance of 30,000 more new tokens, limited by a bitcoin-like halving mechanism.

YIP8 was however rejected, which is why the fork was created.

By issuing more tokens and halving, the YFII creators want to attract even more new capital, or as we call it in China “fresh leeks.” New capital is new liquidity. New liquidity can pump up token prices, which rewards early farmers.

The challenges facing YFII

Looking ahead, YFII faces many challenges. To start with, the “administrative key” to the protocol was apparently burned. Without that key, the protocol can’t be updated or otherwise modified. It’s literally stuck.

“Since the admin key has been destroyed, it’d be hard for the YFII community to make necessary changes on the YFII token economy model,” Johnson Xu, Head of Research & Analytics at TokenInsight, told me. “The community needs to thoroughly think about how to further govern and decentralize the protocol in order to build a vibrant ecosystem in China. Otherwise, it’d be a complete copycat for the sake of chasing the yield.”

This is hardly the end of the story. Remember how DeFi is money lego? YFI just deployed a new strategy to farm YFII—a fork Lego block. Fork or being forked, there’s always a new way to play the DeFi game.