In brief

- Incoming SEC Chair Paul Atkins will have more than 70 crypto ETF hopefuls to review when he begins in the role.

- Funds pegged to Dogecoin, Pengu, Solana, XRP, and the Melania meme coin are all in the mix.

- After punting on XRP ETFs in March, the agency can delay its final decision until mid-October.

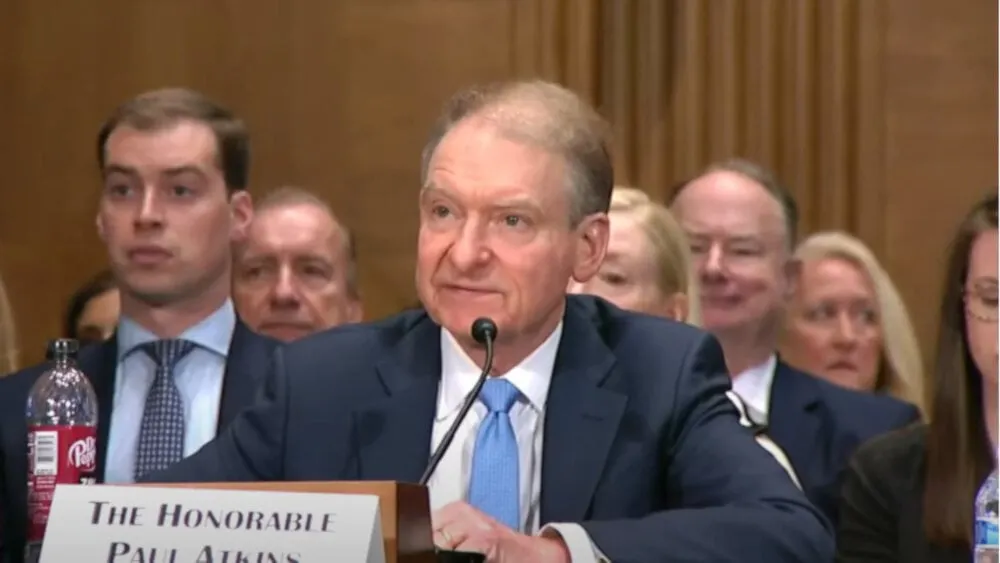

Incoming SEC Chair Paul Atkins will have an avalanche of crypto-related applications to sift through when he officially takes control of the regulator.

Hopeful issuers now await feedback on 72 crypto-linked exchange-traded funds in the U.S., including requests to list options, according to Bloomberg ETF analyst Eric Balchunas.

“Gonna be a wild year,” he said on X, formerly Twitter, on Monday, noting ETF hopefuls have positioned themselves to offer funds for assets ranging from Solana to the first lady’s meme coin.

Atkins was confirmed as U.S. President Donald Trump’s pick to lead the Securities and Exchange Commission by a full Senate vote around two weeks ago. His swearing-in ceremony is expected to take place soon, marking an official start to the SEC’s push to regulate crypto collaboratively under new leadership.

Although Atkins was a proponent of deregulation during his previous stint at the SEC, analysts say the crypto-friendly veteran may have to make a few first-time calls, specifically when it comes to which cryptocurrencies can be approved for listings as commodity-based trusts.

Balchunas did not immediately respond to a request for comment from Decrypt.

Last year, the SEC approved spot Bitcoin and Ethereum ETFs under former SEC Chair Gary Gensler. While the approvals represented a landmark moment for the crypto industry, it raised deeper questions about which cryptocurrencies should be regulated as commodities, and therefore be allowed to trade on Wall Street in a similar fashion to assets like gold.

In total, asset managers are looking for feedback on applications tied to 15 different cryptocurrencies beyond Bitcoin and Ethereum. Those include applications centered on digital assets with large valuations like Solana, Dogecoin, and XRP—alongside relatively nascent ones like the Solana-based tokens Bonk, Pengu, and Official Trump.

Under Acting SEC Chair Mark Uyeda, the agency has chipped away at some regulatory uncertainty. In February, the SEC said that it generally doesn’t consider meme coins to be securities, but it didn’t advise whether they were fitting for Wall Street wrappers.

For assets like XRP, the SEC won’t be forced to make a decision immediately after Atkins takes the reins at the agency. After punting on XRP ETFs in March, the agency can delay its final decision until mid-October.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.