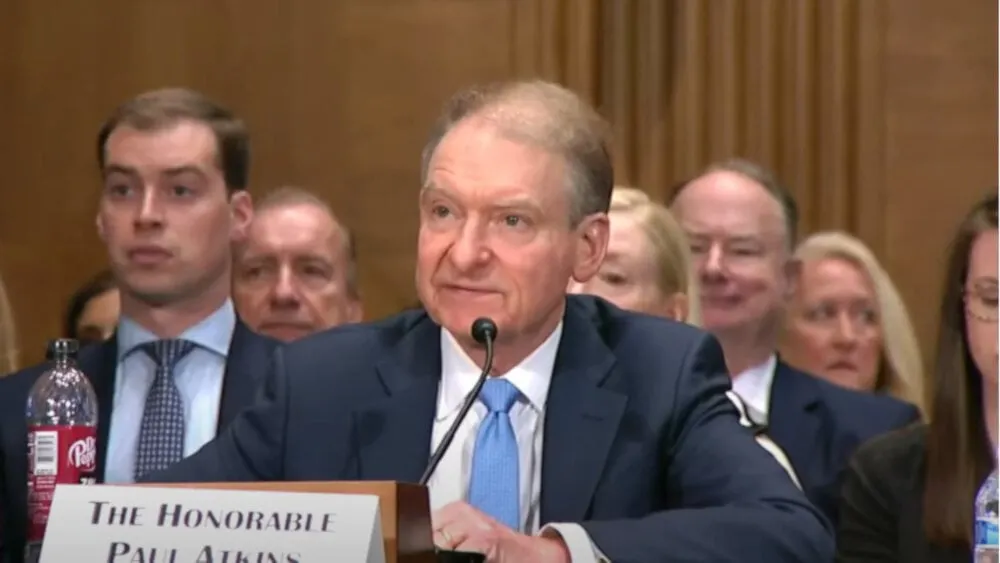

Paul Atkins, President Trump’s pick to lead the SEC, was officially confirmed by a full Senate vote Wednesday evening, with lawmakers mostly voting along party lines.

52 Republicans voted to confirm Atkins, a pro-crypto SEC veteran who has made reforming the agency’s digital assets policy a top priority. 44 Democrats opposed the nomination.

Atkins will succeed former SEC Chair Gary Gensler, who, under the Biden administration, attracted the ire of crypto leaders by suing or investigating almost every major company in the industry for alleged violations of securities laws.

The incoming SEC chair is all but certain to have a far different approach to crypto.

Atkins, who previously served as an SEC commissioner under President George W. Bush, recently told senators that a top concern of his chairmanship will be providing “a firm regulatory foundation for digital assets through a rational, coherent, and principled approach.”

Atkins himself holds up to a $5 million stake in a crypto investment firm where he serves as a limited partner.

Until February, he held between $250,000 and $500,000 in equity in the crypto custodian Anchorage Digital, and the same amount in call options in Securitize, a BlackRock-backed blockchain firm where he also held a board seat, according to ethics disclosures.

SEC pushes forward on crypto

In Atkins’ absence, the SEC has barrelled ahead with pro-crypto policies. The agency’s two Republican commissioners—Acting Chair Mark Uyeda and Commissioner Hester Peirce—have moved to dismiss almost every major lawsuit against a crypto company.

They’ve also issued statements effectively exempting meme coins, crypto mining, and stablecoins from securities regulation.

The SEC is currently operating with just three commissioners—Uyeda, Peirce, and Democratic commissioner Caroline Crenshaw—as opposed to the full five.

Crenshaw supported former chair Gensler’s crypto lawsuits during the Biden administration, and her nomination to the SEC was so intensely protested by the industry in December that Senate Democrats abandoned a push to renominate her.

The SEC’s rules state that no more than three commissioners from the same political party can serve at the same time to “ensure that the Commission remains non-partisan.”

Thus, Trump would ordinarily appoint two Democrats to fill empty seats at the agency.

But the president has recently shown an unorthodox resistance to such long-held Washington norms.

Last month, he fired two Democrats serving on the Federal Trade Commission and a Democrat on the National Labor Relations Board.

Until now, a key 1930s Supreme Court ruling has protected commissioners on such independent agencies—the SEC included—from being fired without cause.

Experts believe Trump could be angling to have that long-standing precedent overturned by the Supreme Court’s current conservative majority. Lawsuits on the subject have already been filed.

Edited by Sebastian Sinclair