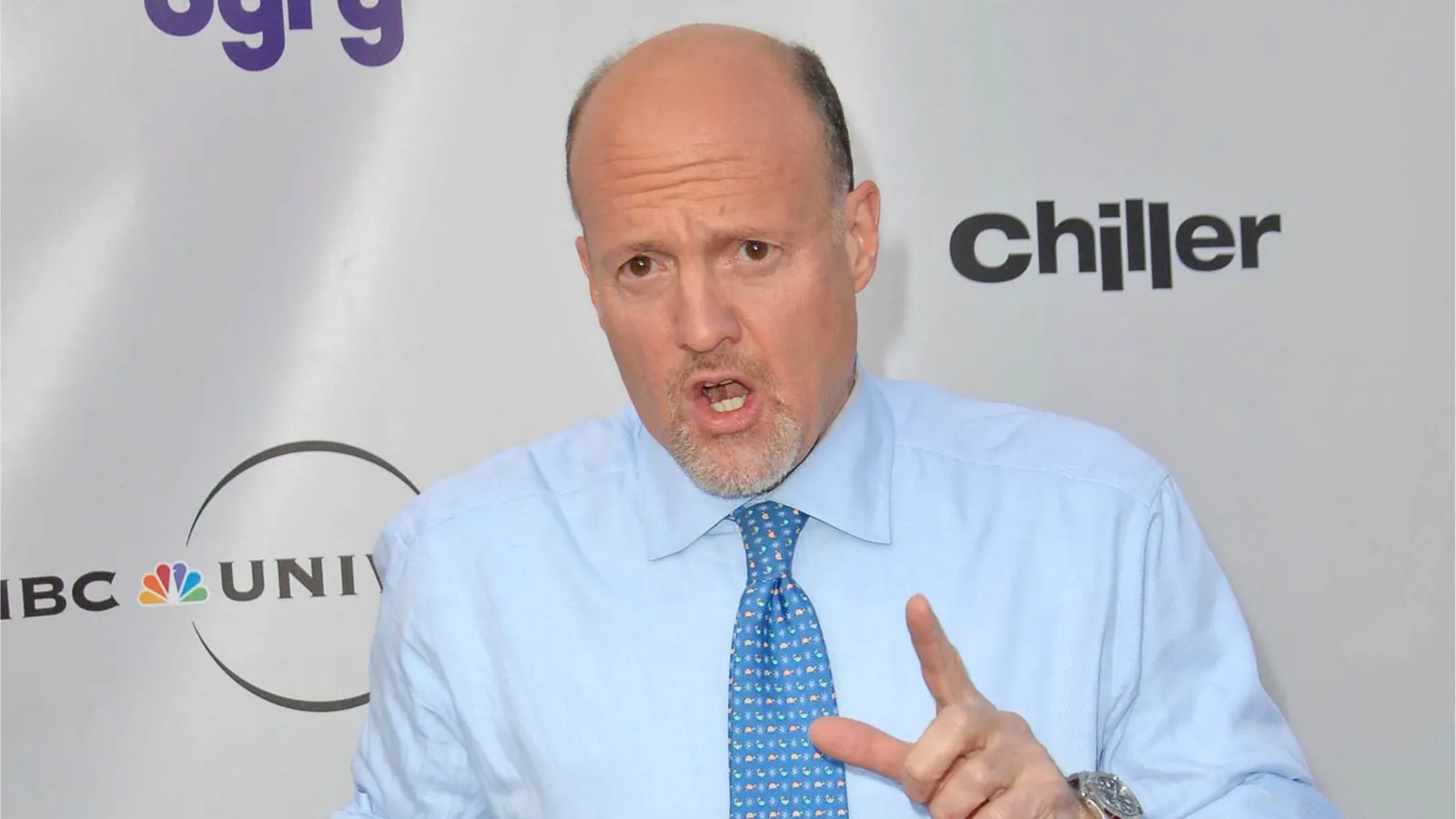

Jim Cramer, the animated host of CNBC's "Mad Money," has become something of an unintentional crypto market indicator—just not in the way he probably hoped.

The commentator defended his crypto stance Tuesday during another installment of his market entertainment show, citing government spending and deficit concerns.

On Friday, the firebrand stock enthusiast issued a bullish call on Bitcoin, sending Crypto Twitter into a frenzy and prompting onlookers to declare that the asset had peaked.

Two days later, Bitcoin’s price fell 5%, erasing nearly $5,000 from its value and pushing long liquidations to an 11-day high above $344 million.

"I got a bunch of yahoos saying I called the top on crypto by recommending it," Cramer said, adding there were people who wanted to "rake me over the coals for something I did wrong 10, 15, 20 years ago."

Cramer argued for crypto's inclusion in investment portfolios despite acknowledging no concrete evidence supporting it as a hedge against economic instability.

"While there's no proof crypto can protect you from anything, at least not yet, it's a plausible story," he said.

Cramer's notorious track record of making spectacularly wrong calls has made him a living meme within certain crypto circles, particularly among young traders.

His commentary has become so infamously contrarian that some traders developed an "Inverse Cramer" strategy, believing doing the opposite of whatever he recommends is a path to profits.

The former hedge fund manager has had quite the rollercoaster relationship with Bitcoin and other cryptos over the years: from boasting about buying a farm with Bitcoin profits to flip-flopping between calling them worthless and saying nobody can kill Bitcoin.

"I think Bitcoin, Ethereum, and maybe even some other cryptocurrencies deserve a spot in your portfolio, too," Cramer said during Tuesday’s show.

Despite maintaining that crypto deserves a spot for his audience's portfolio, Cramer's endorsement came with a notable caveat: he might "change his tune" if the deficit gets under control.

Edited by Sebastian Sinclair