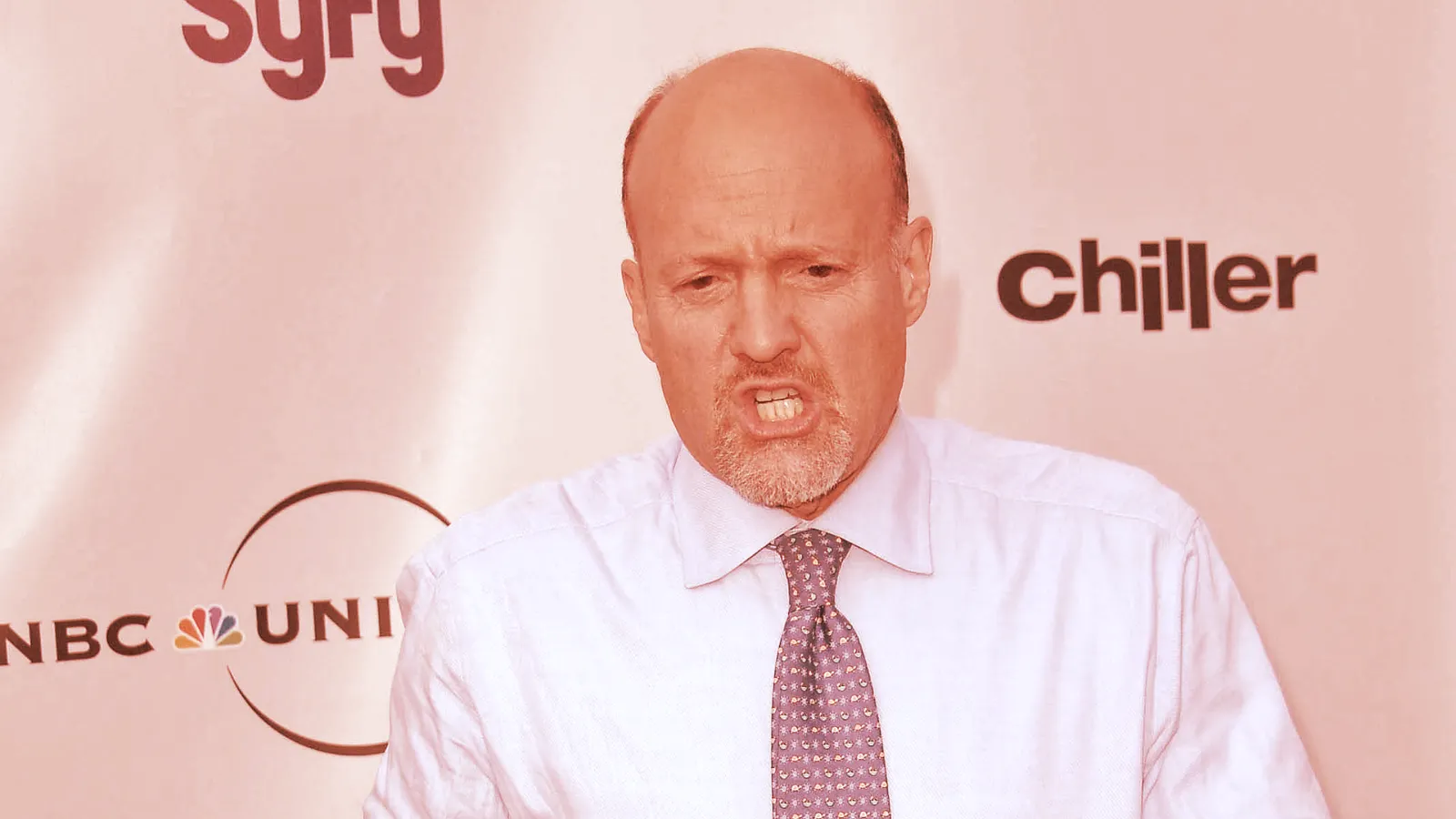

CNBC’s Jim Cramer prodded his myriad online non-believers on Friday with a challenge: bet against him. He dares you.

Cramer bragged to Crypto Twitter that he’s divested from Bitcoin and Ethereum and bought a farm and boat with the spoils. He then coaxed doubters of his crypto market analyses to go all in on their anti-Cramer positions.

Soon, those doubters may be able to do precisely that.

According to an SEC filing from earlier this week, Tuttle Capital Management has applied to launch two exchange-traded funds—the Inverse Cramer ETF (SJIM), and the Long Cramer ETF (LJIM)—that will put an investor’s funds towards the opposite of whatever the outspoken television personality advises on his CNBC program “Mad Money,” and via his Twitter account.

“The Fund is an actively managed exchange traded fund that seeks to achieve its investment objective by engaging in transactions designed to perform the opposite of the return of the investments recommended by television personality Jim Cramer (“Cramer”),” the SEC filing reads. “Under normal circumstances, at least 80% of the Fund’s investments is invested in the inverse of securities mentioned by Cramer.”

The history of the relationship between Cramer and Crypto Twitter is long and storied. Once an ardent crypto bull who stated it was “almost irresponsible” not to buy Bitcoin, Cramer had a 180-degree change of heart once crypto markets crashed earlier this year.

On Twitter, apparent patterns of Cramer’s financial advice backfiring perfectly led to the emergence of a parody account titled “Inverse Cramer ETF,” which would gloat whenever Cramer’s prognostications turned out to be precisely incorrect.

As Cramer developed increasing skepticism of crypto assets in the aftermath of May’s crypto crash, the television host began accumulating an ironic following on Crypto Twitter, with users jokingly—or maybe not—positing that so long as Cramer continued to bash crypto, there was hope for the market.

Cramer’s statement today may have been some form of acknowledgement of the lack of deference his financial advice is now generally granted online, and potentially, of his awareness of a prospective batch of publicly traded, anti-Cramer financial products.

As one Twitter user posited though, what "Inception"-level event would transpire if Cramer ever turned bullish on the Inverse Cramer?

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.