In brief

- BlockFI has just released its mobile app on iOS and Android.

- The app is limited for now, but will expand to the entire BlockFi retail investor suite in June.

- CEO Zac Prince says it's all designed to make crypto more approachable to the masses.

BlockFi clients looking to invest in or loan out Bitcoin can now do it from the comfort of their phones.

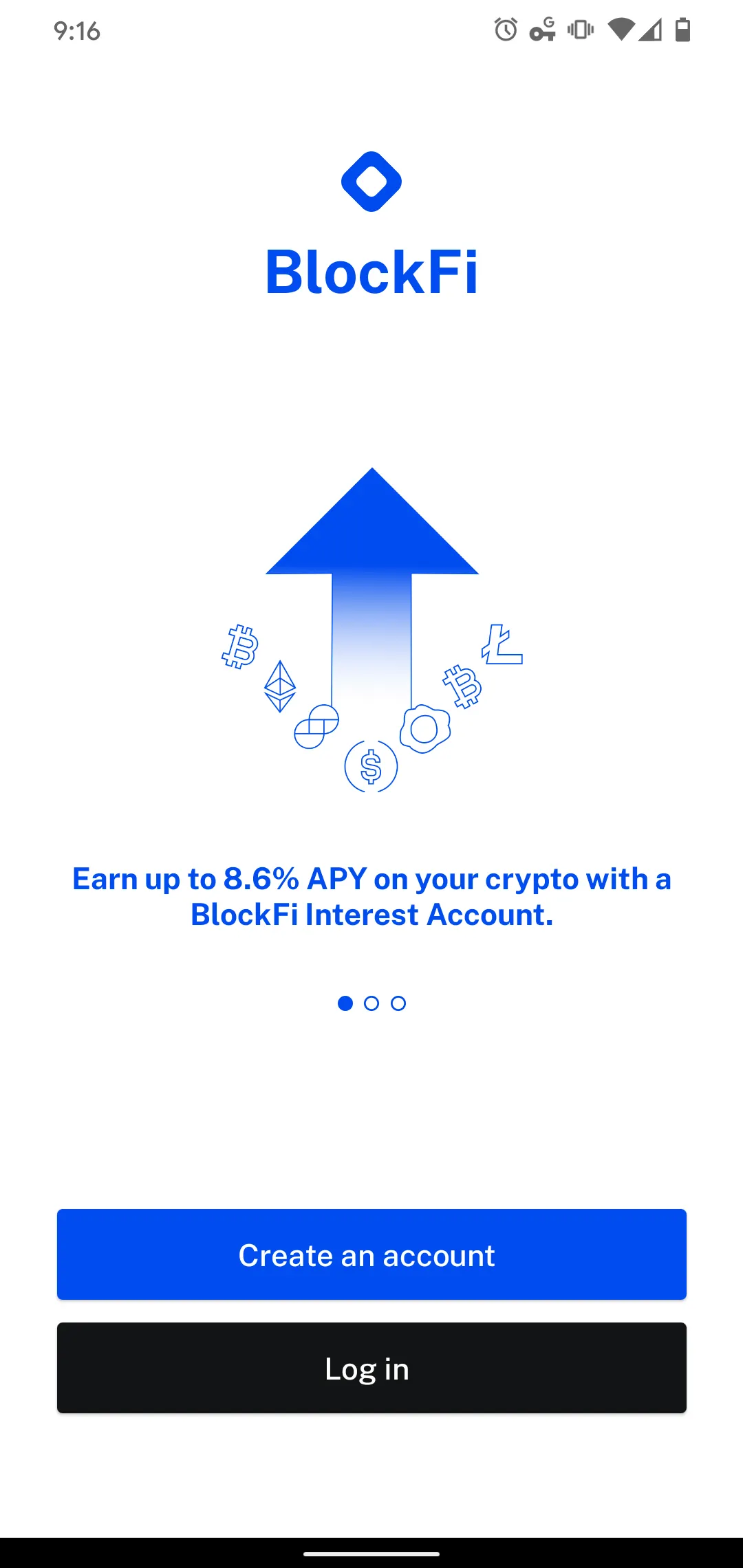

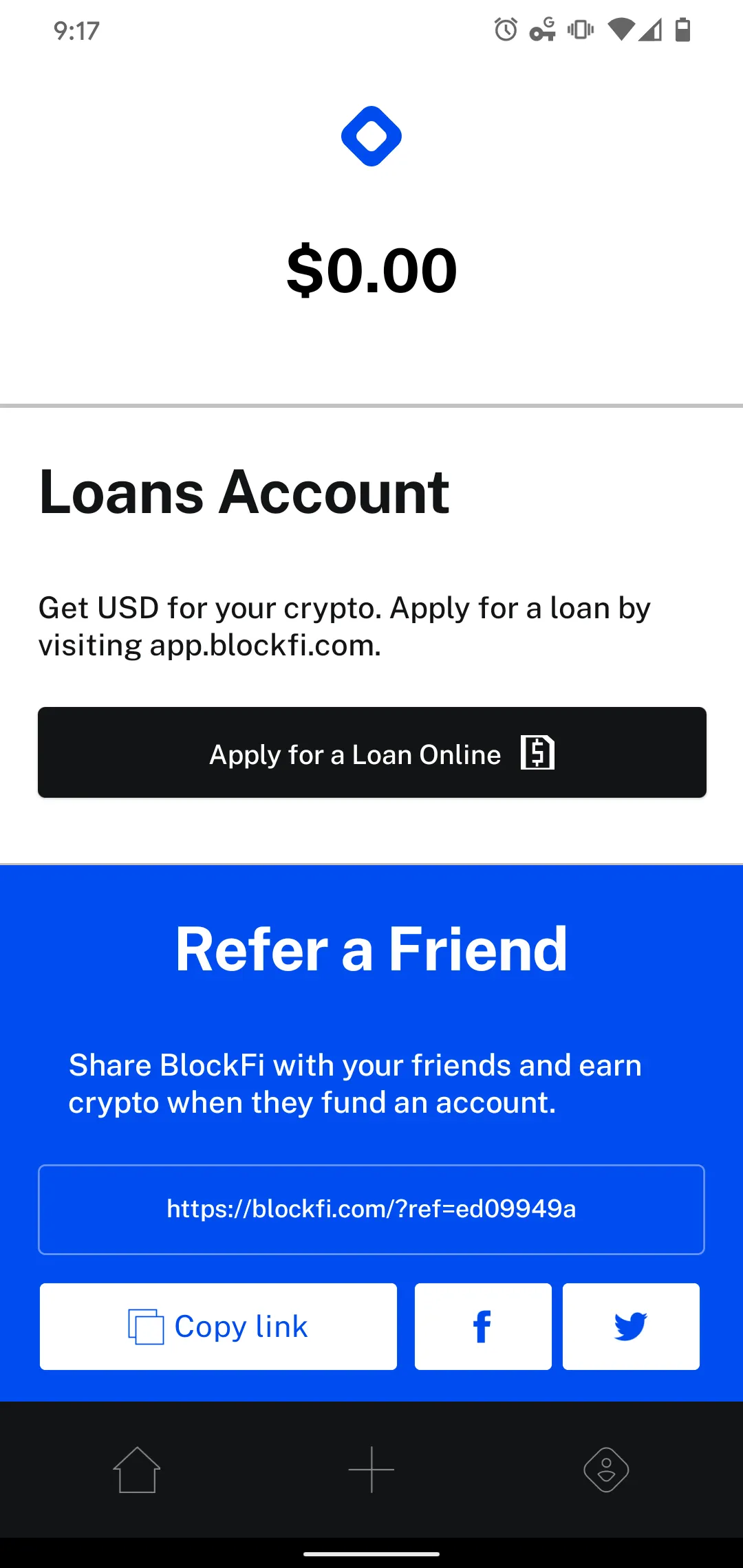

BlockFi today announced it released a mobile app for retail investors. The app is currently in public beta. Users can try limited features like account signups, deposits and management of interest accounts, and monitoring transactions, loans, and profile settings.

The final public release, slated for June, will expand its functionality to cryptocurrency and stablecoin trades, applications and funding of loans, wire transfers, and changes to profile settings. The beta app is now available to download on iOS and Android.

BlockFi CEO Zac Prince told Decrypt the app was created “to make cryptocurrencies more palatable and approachable for mainstream consumers,” meaning the ecosystem feels “familiar to offset what isn’t."

“People use mobile apps to control their investments and their bank accounts—and that’s exactly what Bitcoin and other cryptocurrencies are,” Prince said. “Managing your digital assets can’t be relegated to sitting [at] a computer desk—it needs to be convenient and accessible with a friendly user experience.”

Prince said the new app is “crucial” to BlockFi’s overall business strategy, and his team made it a point to keep it light. The app is “is conservative on memory and consistent with memory loads of other mobile apps from financial institutions and crypto companies,” he said.

The release of the app marks a major milestone for the company, according to its CEO. The idea is that it’ll go a long way to making crypto “more accessible, help it feel like money and place it in an environment that people will understand,” said Prince.

Next up for BlockFi this year will be the release of a Bitcoin rewards credit card, which Prince said clients will be able to fully manage from the mobile app. BlockFi recently hired a former American Express executive, Wittney Rachlin, to lead the card’s development and launch. The company also raised the interest on its Bitcoin savings account in March.