1/ Bitcoin ETFs are being adopted by institutional investors faster than any other ETF in history. Don't believe the "it's just retail" story. The data prove otherwise.

A thread.

— Matt Hougan (@Matt_Hougan) August 21, 2024

$68,326.00

0.94%$1,978.36

0.44%$1.44

1.46%$625.63

-0.39%$0.999924

0.00%$85.59

1.40%$0.289161

1.22%$0.099024

-1.46%$1.045

1.37%$564.24

0.72%$50.91

0.52%$0.279997

-1.21%$0.99996

-0.03%$8.32

-4.35%$29.63

-1.38%$8.89

-0.15%$0.999325

-0.01%$0.160152

-3.16%$327.38

-1.59%$0.161877

0.26%$0.999108

-0.03%$0.00947312

-1.53%$259.50

0.29%$0.099884

0.15%$55.08

-0.02%$0.999996

0.02%$9.19

0.63%$0.0000064

0.38%$0.949837

-0.54%$0.121305

3.95%$1.34

-0.05%$0.077792

-0.91%$5,111.78

0.69%$5,149.50

0.87%$1.34

0.48%$3.62

4.94%$1.36

1.55%$0.635029

1.71%$1.00

0.00%$122.16

4.60%$0.720408

0.41%$0.00000417

-1.31%$182.72

2.91%$0.99686

-0.05%$79.03

-0.35%$2.34

0.08%$0.999764

-0.02%$1.12

0.00%$0.172686

-2.26%$0.999739

-0.02%$0.0000017

0.03%$0.064349

0.29%$9.11

5.19%$1.055

0.91%$0.998832

0.01%$0.267978

0.52%$0.00209976

0.23%$11.00

0.00%$2.20

0.80%$0.111054

5.30%$2.32

-0.87%$7.23

1.33%$8.52

0.97%$0.3888

0.33%$0.059515

-1.86%$66.53

-0.89%$0.01732696

-8.35%$0.898472

2.72%$0.108457

-1.69%$1.62

5.19%$0.999505

-0.01%$0.03114694

0.43%$3.47

-2.51%$0.00949575

0.75%$0.090181

-0.25%$1.23

-0.09%$1.47

-1.52%$1.00

0.04%$0.970185

1.79%$1.027

0.00%$114.37

0.00%$0.03534172

1.24%$1.11

-0.21%$0.888247

1.35%$0.00770937

-0.68%$0.080431

0.20%$0.098773

2.97%$1.095

0.00%$0.996144

-0.20%$0.00000631

-1.07%$0.999638

0.01%$0.02877816

-3.84%$0.157434

-1.90%$0.01299979

0.45%$0.999252

0.03%$0.999829

-0.02%$0.070824

-0.76%$0.474033

-1.41%$1.087

-0.01%$1.18

-0.07%$0.253867

-0.52%$1.33

2.39%$0.006875

0.02%$34.13

0.03%$24.70

2.48%$0.648684

0.00%$0.390304

-0.19%$170.21

4.43%$0.9988

-0.02%$1.095

-1.59%$1.53

3.79%$0.211693

-22.02%$0.04305948

-0.83%$3.79

11.42%$0.165971

-0.91%$0.03579094

0.22%$0.083906

0.92%$0.241718

-1.80%$1.72

4.82%$0.460262

-1.97%$0.999387

-0.02%$0.00000034

-0.37%$0.00000034

-0.56%$0.056386

-0.01%$1.02

0.01%$0.01699301

0.10%$16.23

0.70%$119.79

2.54%$3.20

2.03%$0.053787

0.47%$0.330203

5.67%$0.02826007

4.54%$0.32353

-0.48%$0.069099

-2.25%$0.162293

-0.38%$0.332882

0.56%$0.00003014

-1.51%$0.997077

0.02%$0.00585744

1.81%$1.51

4.24%$0.329949

0.27%$0.993826

0.17%$0.052934

2.10%$0.128829

0.88%$17.26

-0.96%$0.233452

2.88%$1.63

2.90%$0.00274904

0.07%$6.78

2.78%$0.072959

-3.20%$0.01994515

-1.14%$0.04516913

-1.51%$0.00246467

-1.17%$1.38

7.16%$0.999211

-0.06%$0.02098015

0.46%$0.085073

1.25%$0.222331

-0.98%$1.075

0.00%$1.00

0.00%$0.988304

0.00%$0.521633

-1.65%$0.999752

0.00%$5,682.04

-2.92%$0.00217045

1.57%$22.86

0.00%$0.096695

1.90%$0.00000097

0.65%$0.202443

2.49%$1.22

0.94%$0.00003644

-0.70%$4.52

4.06%$1.59

4.57%$2.76

0.02%$0.194401

0.32%$1.003

-1.53%$0.098499

0.70%$1.00

0.00%$0.052634

-1.50%$0.00507277

-0.48%$0.257481

17.36%$0.07959

0.73%$0.00390946

-0.04%$0.184694

-0.19%$0.182788

19.21%$0.121673

0.47%$1.00

0.00%$2.22

-1.47%$1.92

-3.67%$0.999834

-0.01%$0.649039

-0.16%$18.06

-1.04%$0.75762

-0.95%$0.02073493

26.87%$0.054103

1.20%$0.167183

-0.93%$2.12

1.17%$1.81

0.26%$0.04328448

-0.49%$47.98

-0.01%$0.02226953

-1.99%$0.00000799

0.53%$0.992248

-0.23%$1.27

0.28%$0.670174

15.22%$8.01

-1.49%$0.345501

3.38%$14.00

1.90%$0.998235

-0.05%$1.014

0.10%$1.001

0.14%$0.68943

4.09%$0.425186

12.20%$0.312228

0.07%$0.411184

-0.63%$0.167821

1.80%$0.272067

-1.93%$0.083266

2.20%$8.91

-1.06%$4.59

0.53%$0.304816

-2.87%$0.13234

4.32%$0.07537

1.39%$0.093393

0.47%$2.01

-0.77%$0.131354

0.17%$0.323103

-1.29%$1,097.13

0.01%$0.080189

-0.70%$0.261065

1.13%$0.0014994

-0.22%$0.995705

0.05%$0.00409877

0.14%$0.125067

6.25%$0.130831

0.04%$0.576784

-3.04%$1.001

1.31%$0.995734

0.00%$1.53

-8.37%$0.00229761

-0.02%$0.208264

0.01%$2.34

0.17%$5.95

48.38%$0.340479

-5.43%$0.192383

-2.02%$0.99973

-0.03%$0.999606

-0.01%$2.40

0.15%

U.S. spot Bitcoin ETFs pulled in $39.5 million Wednesday, on their fifth successive day of net inflows, in a week that saw market share for Grayscale's GBTC slip below 25%.

Demand for the Bitcoin ETFs has been resilient in the face of market uncertainty. At the time of writing, Bitcoin has climbed back above $61,000 after very briefly diving below $60,000 early this morning, according to CoinGecko data. Analysts have been saying the current rally will be short-lived.

Per data from Farside Investors, Bitcoin ETFs have collectively seen inflows of $236.6 million over the past five days, with their total net inflows since launch amounting to just under $17.6 billion.

But the dollar value doesn't tell the full story, Bloomberg analyst James Seyffart said on the Wolf of All Streets podcast Wednesday. "They have way more Bitcoin than they did last time they were up near this," he said, noting that Bitcoin ETFs are "nearing in on 1 million Bitcoin" after having "bought a ton" during its recent crash.

"Within a year, the U.S. ETFs will have more Bitcoin than Satoshi," Bloomberg's Eric Balchunas said, adding that, "by this time next year, BlackRock alone will have more than Satoshi, probably."

1/ Bitcoin ETFs are being adopted by institutional investors faster than any other ETF in history. Don't believe the "it's just retail" story. The data prove otherwise.

A thread.

— Matt Hougan (@Matt_Hougan) August 21, 2024

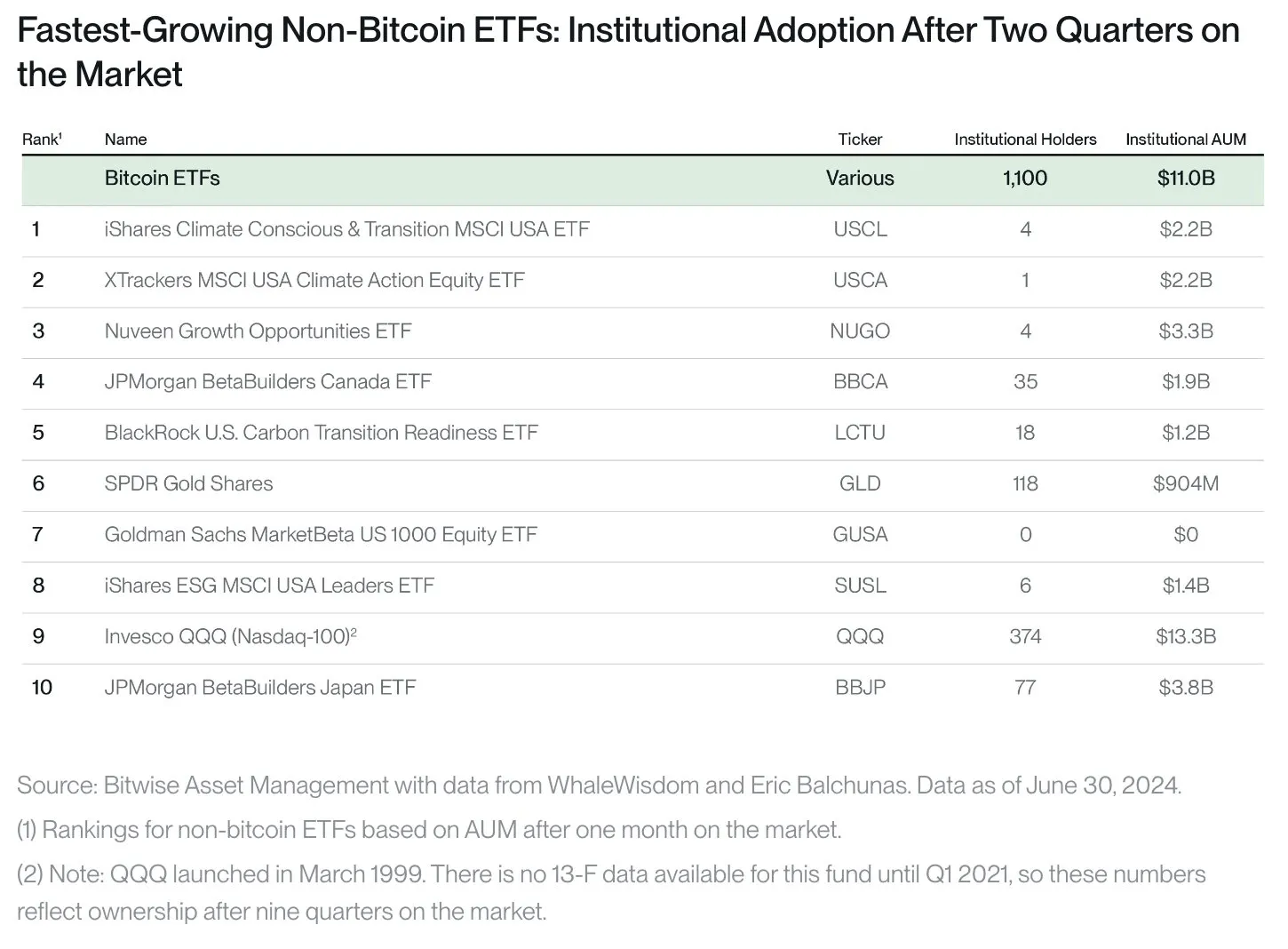

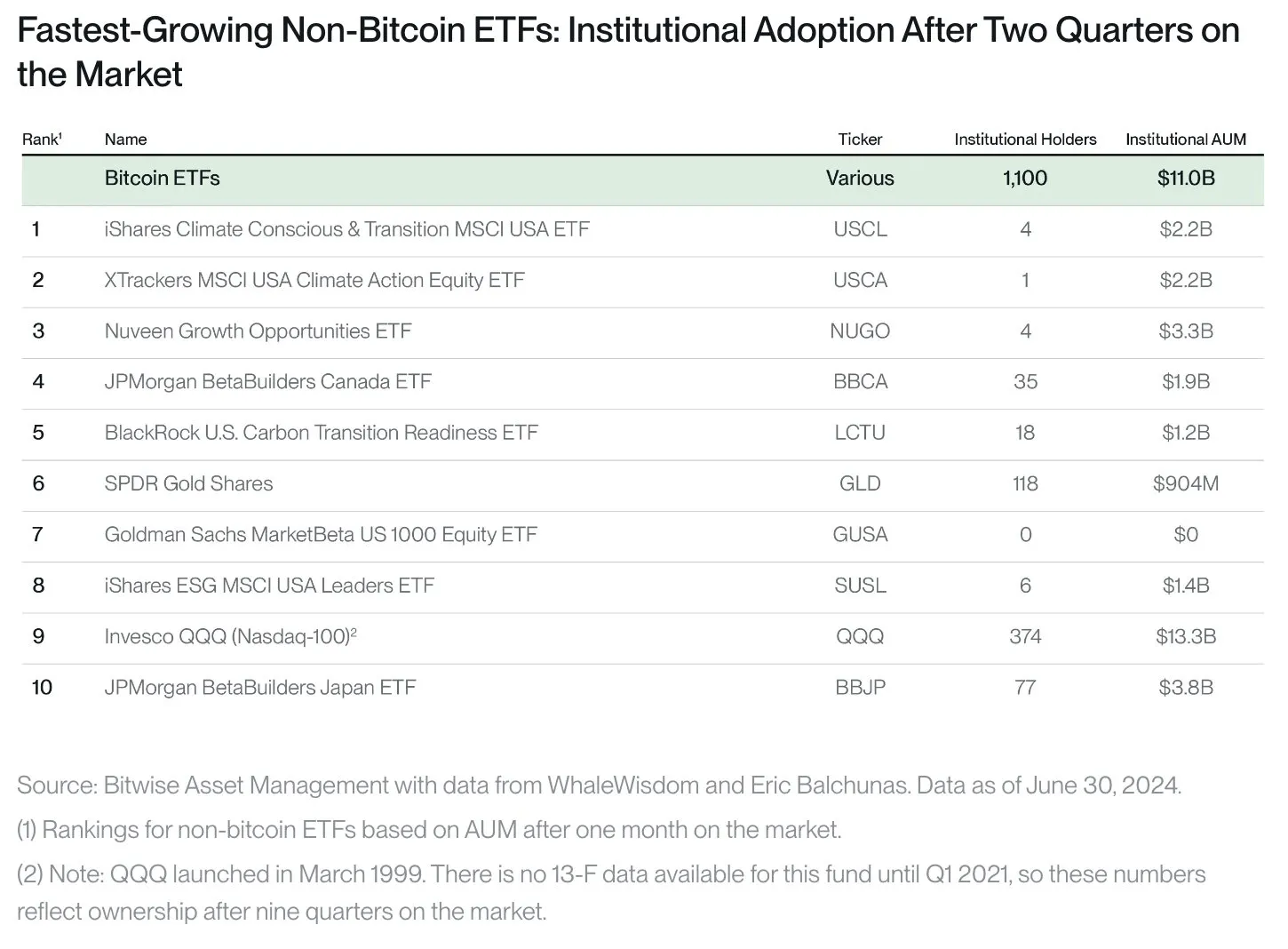

In a Twitter thread, Bitwise CIO Matt Hougan argued that Bitcoin ETFs are "by far the leaders in terms of institutional adoption" among other exchange-trade funds. Hougan compared them with the fastest-growing ETFs, ranked by assets under management (AUM) after one month on the market, during their first two quarters on the market.

With the caveat that Hougan compared all U.S. spot Bitcoin ETFs with individual ETFs, the data show that Bitcoin ETFs collectively have 1,100 institutional holders and $11 billion in institutional AUM. That compares to 374 institutional holders and $13.3 billion in institutional AUM for the Invesco QQQ (Nasdaq-100)—though Hougan points out that 13-F data for QQQ is unavailable until the first quarter of 2021, meaning that those figures reflect nine quarters on the market.

"The 'problem,'" said Hougan, is that retail adoption of Bitcoin ETFs is "so large it makes the institutional adoption seem small in comparison."

Edited by Stacy Elliott.