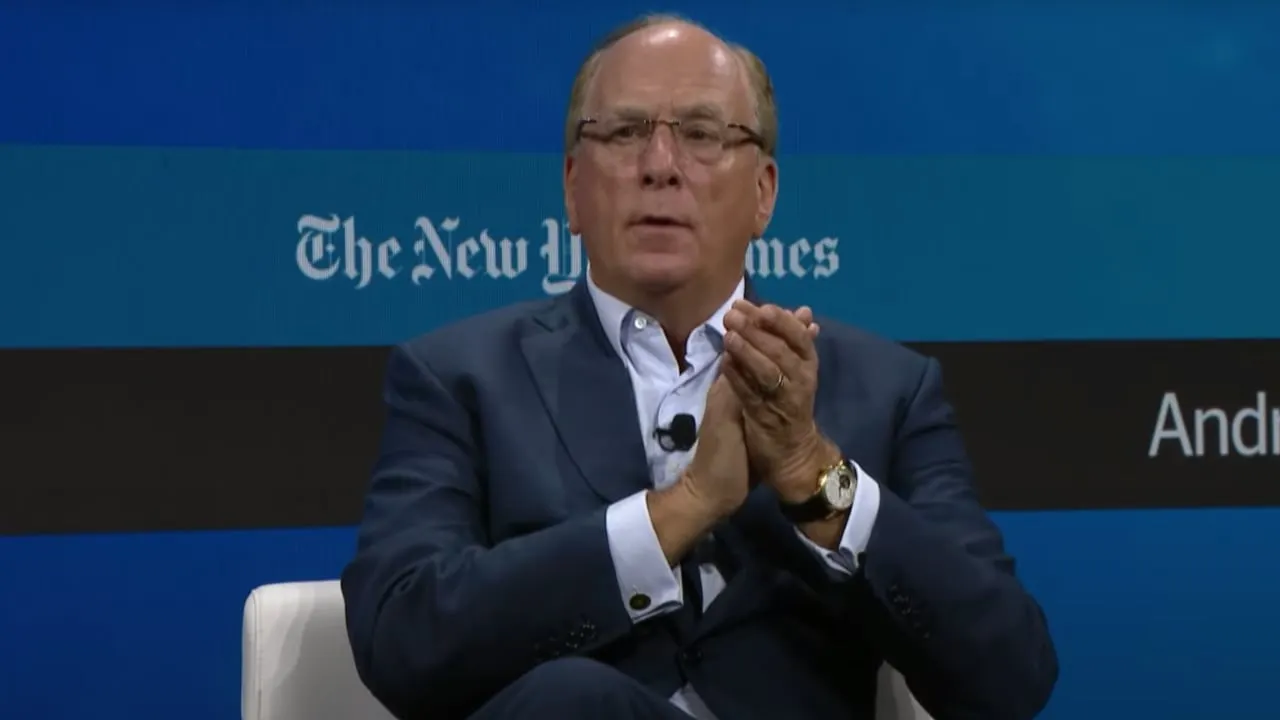

BlackRock CEO Larry Fink gave perhaps his most full-throated endorsement of Bitcoin yet on Monday, dubbing himself a “major believer” in the world’s top cryptocurrency—while simultaneously framing the asset as a choice investment for those with pessimistic outlooks on the world.

“It is a legitimate financial instrument,” Fink said during an appearance on CNBC Monday morning. “I believe it is an instrument you invest in when you’re more frightened, though.”

Fink’s comments come just two days after a shooter attempted and failed to assassinate former president Donald Trump at a campaign rally in Pennsylvania on Saturday. In the wake of the calamitous event—during which one rally attendee was killed and two others were critically wounded—Bitcoin spiked to its highest point in weeks.

“Political volatility is a catalyst for Bitcoin buying, and an assassination attempt on the leading Presidential candidate of the U.S. is an affront to democracy globally and reminds people of just how fragile the status quo is today,” Rich Rosenblum, co-founder of trading firm GSR, told Decrypt over the weekend.

While Fink did not reference the Trump shooting on Monday, he did explain that he sees Bitcoin chiefly as an attractive investment for those with a negative view of where the world is headed.

“If you want to hedge hope, Bitcoin is not an instrument for hope,” Fink said. “I look at it as a vehicle in which you’re expressing… [that] you’re more frightened of the world, you’re more frightened [for] your existence.”

The BlackRock CEO made clear that he personally views the world more optimistically. But his company—the largest investment firm in the world, with over $10.6 trillion in assets under management—has gone all-in on crypto in recent months, in some indication of how Fink thinks the rest of the world is thinking.

Last summer, BlackRock appeared to singlehandedly shake up the fledgling campaign for a spot Bitcoin ETF by filing an application to list the product with the U.S. Securities and Exchange Commission (SEC). Within months, spot Bitcoin ETFs were a reality on Wall Street, with BlackRock leading the charge.

Those moves played a major part in boosting BlackRock last quarter to its highest value of assets under management ever—an accomplishment that shattered Wall Street’s expectations.

BlackRock is further poised to soon become one of the first American issuers of spot Ethereum ETFs. The Wall Street giant also launched an Ethereum-based tokenized asset fund in March, which has so far been massively successful.

In a bizarre twist, the now-deceased individual identified as the Trump rally shooter by the FBI, Thomas Matthew Crooks, appeared in a BlackRock ad in 2022.

Edited by Andrew Hayward