Ethena Labs has just announced the launch of its governance token, $ENA, and the expansion of its yield-earning stablecoin, synthetic dollar token USDe. The upcoming debut has garnered considerable attention, including praise from Arthur Hayes, the former CEO of BitMEX, among other crypto enthusiasts. But it has a complex backstory.

Ethena says it will use this new token to be more decentralized, accessible and secure. The company also airdropped 5% of the total $ENA supply to all USDe and sUSDe holders as part of its Season 2 campaign, which is set to last five months.

But Ethena was ensnared in controversy when a February press release seemed to imply that they had raised millions from notable investors, who were later revealed to not have any involvement. In a now-deleted tweet, Ethena said the release was inaccurate, and the team later told Coindesk it was a “honest mistake.”

Meanwhile, the coin’s approach has also been deemed quite risky, especially as the crypto community still feels the repercussions of the collapse of the Terra ecosystem. Some experts claim the Ethena protocol itself has some flaws.

1/3 I’m calling out @CryptoHayes and @cobie who are invested in Ethena and have large followers to push Ethena to respond before TGE.

Ethena is critically flawed and WILL fail. There are solutions to fix it. I simply ask for a public commitment to a bounty that will be donated https://t.co/dboF6bFd2m

— TardFiWhale.eth (@TardFiWhale) March 25, 2024

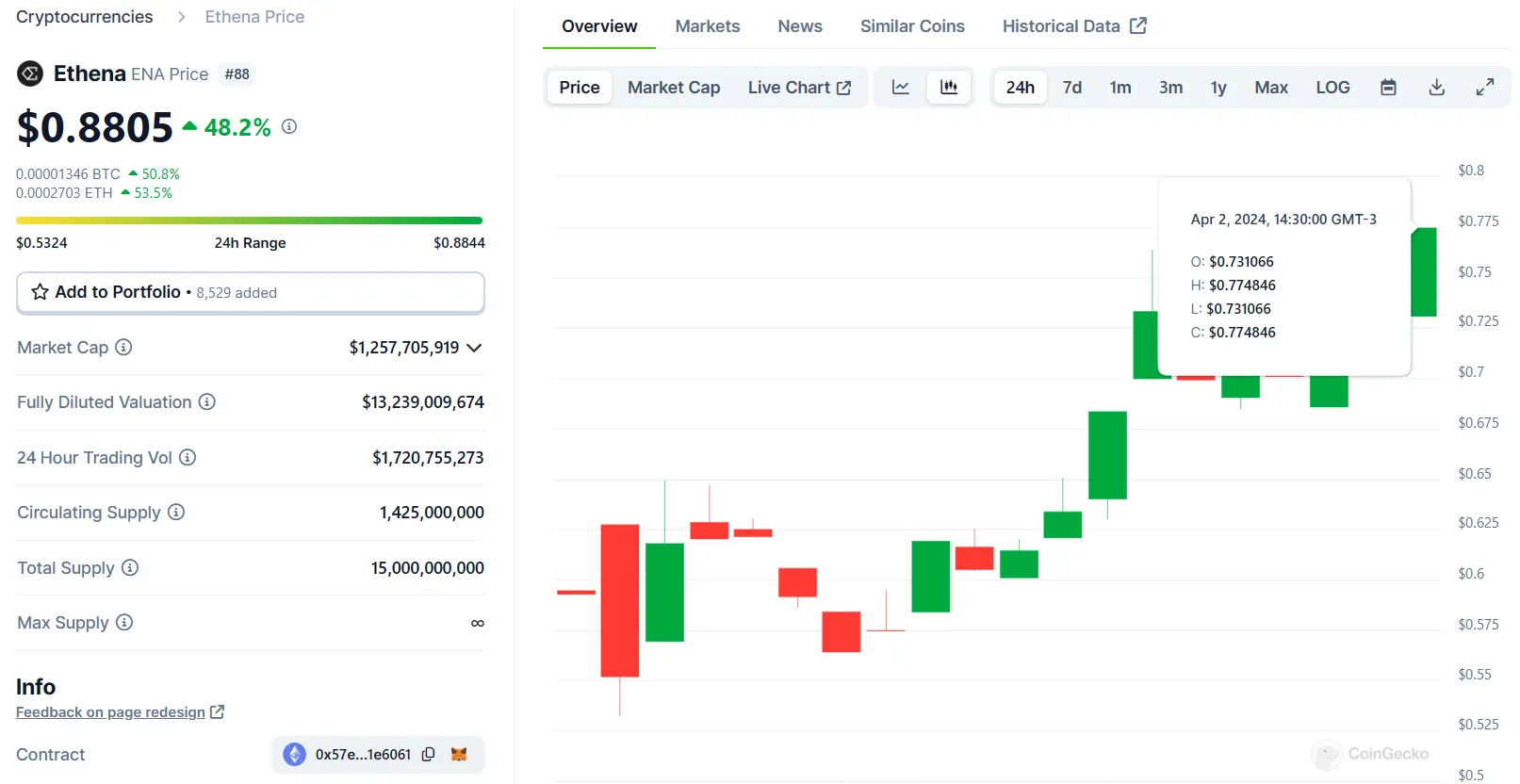

All that controversy was still not enough to cool down investor interest, however. Since its launch, the coin gathered enough market capitalization to claim a spot as the 80th most valuable cryptocurrency in the ecosystem with over $1.2 billion of total market capitalization according to Coingecko.

Before jumping aboard the ENA train, it’s a good idea to understand the intricacies of how it operates. The protocol's approach to minting, redeeming, and ensuring the stability of USDe is complex and makes the DYOR ethos hard for beginners. Hopefully, we can help.

Beyond the hype

ENA is the governance token of Ethena, the DeFi protocol behind the USDe stablecoin. Those holding $ENA have rights to decide the future of the protocol, just like shareholders decide the future of a company.

The protocol's foundation is built on the minting and redeeming of USDe—a process where users convert their cryptocurrency into USDe stablecoins, aiming to maintain a stable peg to the US dollar. This process is vital for ensuring that USDe can serve as a reliable medium of exchange in the volatile crypto market. Ethena leverages Ethereum and staked Ethereum (a version of Ethereum locked up to support the network's operation, earning rewards in return) as collateral, ensuring every USDe is backed by a tangible asset.But unlike Tether or Circle, these tangible assets are not real dollars stored in a bank account. Instead, they are cryptocurrencies locked in pools.

Considering the volatile nature of crypto, this system introduces several layers of risk—primarily around the protocol's reliance on the fluctuating value of Ethereum. The protocol's stability hinges on a strategy known as delta hedging—a method to reduce, or hedge, the amount of money an investment might lose due to changes in the market.

Ethena uses delta hedging to keep its USDe stablecoin's value regardless of Ethereum's price movements. If Ethereum's price goes up, the value of Ethena's Ethereum holdings increases, which is good. But to avoid risks if the price later drops, Ethena sets up special derivatives contracts that decrease in value when Ethereum's price rises—also known as short positions. This might seem like a loss, but if Ethereum's price were to drop further, these contracts should gain value, offsetting any decrease in the value of the Ethereum held.

According to Ethena, its delta hedging contracts represent approximately 15% of all ETH open interest.

Ethena regularly adjusts these contracts to match the current market, acting like an ever-adapting safety net to keep USDe stable.This can be pretty risky and complex to maintain over time, which is why a governance token is required in case of emergencies where sudden changes in strategy are required.

The Ethena framework

This is all part of what Ethena calls an Off-Exchange Settlement (OES) mechanism, a system that allows Ethena to manage its assets without having to keep them on an exchange, reducing the risk of hacking or exchange failure. The protocol's pricing is determined by an internal system that evaluates the value of collateral and hedges across various trading venues, ensuring that USDe's minting and redemption prices are always fair and reflective of the underlying assets' true market value.

Centralization and decentralization are often seen at opposite ends of the spectrum in the blockchain world, but Ethena plays with both: certain aspects of the protocol are managed by a central entity for efficiency and reliability, while others are distributed across the blockchain for transparency and security. This balancing act allows Ethena to tap into the strengths of both worlds—using centralized exchanges for liquidity and decentralized mechanisms for user governance.

Even so, the OES system makes the liquidity management process more complicated than usual. The timing of transfers between custodians and exchanges, the need to manage relationships with multiple OES providers, and the operational overhead of coordinating across different platforms all present challenges that Ethena must navigate.

Ethena plans to scale by diversifying its collateral types and expanding its presence across various blockchain ecosystems, but this also makes the protocol particularly difficult to understand.

If all this triggers the degen within you, you can buy and trade $ENA on Binance, Bybit, Kucoin, Gate.io and HTX. It’s also available on decentralized exchanges, and you can also farm it by staking tokens on Binance Launchpool and Bitget Launchpool.

Edited by Ryan Ozawa.