Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$63,095.00

-4.98%$1,821.60

-5.18%$1.33

-5.72%$586.09

-3.76%$0.999904

-0.01%$76.82

-4.57%$0.281308

-1.77%$1.031

1.50%$0.091217

-6.19%$47.47

-4.17%$0.999949

-0.00%$476.02

-11.64%$0.256972

-6.15%$8.06

-0.58%$26.43

-4.07%$0.998389

-0.08%$0.160213

-1.01%$325.37

2.28%$8.17

-4.34%$0.14917

-4.59%$0.999172

-0.03%$0.00963854

-0.27%$1.00

0.02%$0.09363

-3.98%$50.72

-4.12%$233.77

-6.03%$8.33

-4.56%$0.00000593

-4.62%$0.857265

-5.98%$1.33

-3.11%$0.074036

-2.16%$0.107941

-7.74%$5,136.11

-0.05%$1.40

0.94%$5,177.02

0.09%$3.32

-4.12%$1.24

-5.17%$1.00

0.00%$0.581071

-1.28%$0.997206

-0.02%$113.06

-4.96%$0.687654

-2.41%$0.999819

-0.01%$0.0000039

-6.22%$165.31

-5.23%$1.12

0.00%$0.999915

0.02%$73.32

-3.99%$2.20

-2.66%$0.00000164

-2.14%$0.161617

0.97%$0.063322

-0.08%$0.999277

0.01%$8.16

-4.08%$0.972743

-4.38%$0.244601

-5.61%$11.00

0.01%$2.07

-2.40%$6.66

-4.85%$0.10536

-3.99%$8.16

-2.83%$0.371056

-5.49%$0.00174613

-10.38%$2.04

-9.26%$0.01729164

-0.13%$0.057159

-5.89%$63.16

-2.02%$0.999106

-0.18%$0.812642

-3.90%$0.09644

-5.55%$1.23

-0.03%$0.02944863

-4.18%$3.28

-3.36%$0.0089534

-3.99%$0.083844

-3.60%$0.999743

-0.05%$114.39

0.02%$0.722866

0.19%$1.027

0.04%$1.11

2.18%$1.34

-5.34%$0.03355478

0.04%$0.874428

-4.01%$0.814944

-5.63%$0.0071716

-5.05%$0.080106

-0.38%$1.095

0.03%$0.996281

-0.02%$1.55

-5.71%$0.09192

-3.90%$0.02934071

0.79%$0.999851

0.01%$0.01300823

1.60%$0.00000579

-5.05%$0.998838

-0.04%$27.51

7.65%$1.087

-0.06%$0.9996

-0.02%$1.18

0.09%$0.142005

-4.85%$0.246977

-0.55%$0.065163

-5.09%$0.231997

-4.18%$0.04583399

1.83%$31.91

-4.44%$0.00634281

-4.40%$0.369232

-2.19%$165.74

0.01%$1.19

-6.19%$0.999302

0.02%$0.579258

-7.20%$1.005

-4.06%$0.03409265

-2.20%$1.40

-1.73%$0.152285

-4.13%$1.02

-0.07%$0.999752

-0.01%$0.077073

-4.74%$0.450061

-4.64%$0.00000033

-0.40%$0.218856

-4.94%$0.00000033

-2.49%$3.17

-9.48%$0.01638291

-2.12%$118.07

-1.61%$0.052409

-5.67%$3.13

-1.82%$1.47

-8.74%$14.86

-4.83%$0.992994

-0.54%$0.314134

1.74%$0.04985502

-3.41%$0.065669

-3.33%$0.005575

-7.18%$0.02562004

-4.12%$0.99255

0.27%$0.00002783

-4.95%$1.64

2.16%$16.94

-2.53%$0.296151

-4.42%$0.27499

-5.29%$1.36

-2.76%$0.295958

-4.92%$0.04819435

-4.49%$0.116908

-6.74%$0.00247294

-0.63%$0.133455

-16.44%$0.00250277

-4.77%$0.998015

-0.30%$0.066267

-4.09%$0.197083

-8.39%$5.93

-5.80%$0.04082025

-4.27%$0.02037826

4.50%$1.00

0.02%$0.988343

-0.01%$1.075

0.03%$0.999656

0.02%$0.295251

3.43%$1.69

2.33%$0.078119

-4.41%$22.79

-0.31%$0.09989

-0.65%$0.491644

-2.11%$1.21

-3.69%$0.00207291

1.88%$0.00000095

0.01%$0.197397

-7.20%$1.19

-0.33%$5,065.03

-6.05%$0.00003474

-0.78%$1.00

0.00%$0.051654

-2.46%$2.63

-2.03%$0.085669

-2.49%$0.18782

-2.86%$0.183781

-4.42%$0.077737

-1.08%$1.00

0.00%$0.01906099

-3.98%$0.090355

-4.64%$0.00466861

-4.29%$0.115124

-3.91%$0.760318

-0.71%$0.999672

-0.13%$0.02311444

4.04%$17.25

-3.51%$0.0201469

2.48%$8.40

2.63%$1.79

-0.30%$0.00344681

-5.65%$2.02

-3.93%$47.99

0.00%$1.73

-5.25%$0.99561

-0.01%$1.26

-0.62%$0.02733531

49.40%$0.576136

-5.17%$3.32

16.00%$0.04928244

-5.13%$0.997751

-0.02%$1.92

-6.76%$0.150232

-0.22%$0.149646

-7.14%$0.998571

-0.23%$1.013

-0.09%$0.03907459

-3.34%$0.0000074

-3.99%$0.142187

-9.69%$3.20

-17.86%$0.3035

-1.44%$0.31318

-1.70%$0.383922

-3.04%$8.81

3.98%$11.88

-14.34%$0.6166

-5.03%$1,096.76

-0.03%$0.153234

-5.87%$0.12955

-3.19%$0.319656

-0.16%$0.073484

-2.96%$0.597179

5.07%$0.994656

-0.07%$0.077141

-4.75%$0.250174

-3.25%$0.124316

-3.26%$0.130789

0.01%$4.20

-4.96%$0.123041

-5.17%$0.00145213

-1.46%$0.086445

-4.48%$0.216719

0.73%$1.001

0.00%$0.272554

-5.72%$1.83

-5.75%$0.347405

-13.96%$1.007

-2.76%$0.241184

-5.26%$0.00387578

0.09%$0.999515

-0.07%$0.071827

-4.60%$1.47

11.78%$12.07

10.73%$0.02975373

21.02%$0.330584

-2.77%$1.062

-0.05%$1.00

0.04%$2.23

-1.54%

Bitcoin's upward trajectory continued on Monday, with the cryptocurrency surging past $41,700 hours after hitting $40,000 on Sunday afternoon.

Per data from CoinGecko, the price of Bitcoin currently stands at just over $41,600, up 5.6% on the day and over 11% on the week. Just one year ago, Bitcoin's price stood at just under $17,000, with the cryptocurrency surging by over 144% in the past year.

Bitcoin's rally has seen its price reach levels not seen since April 2022, helping to boost the market cap of all cryptocurrencies to $1.61 trillion, up 3.6% in the past 24 hours.

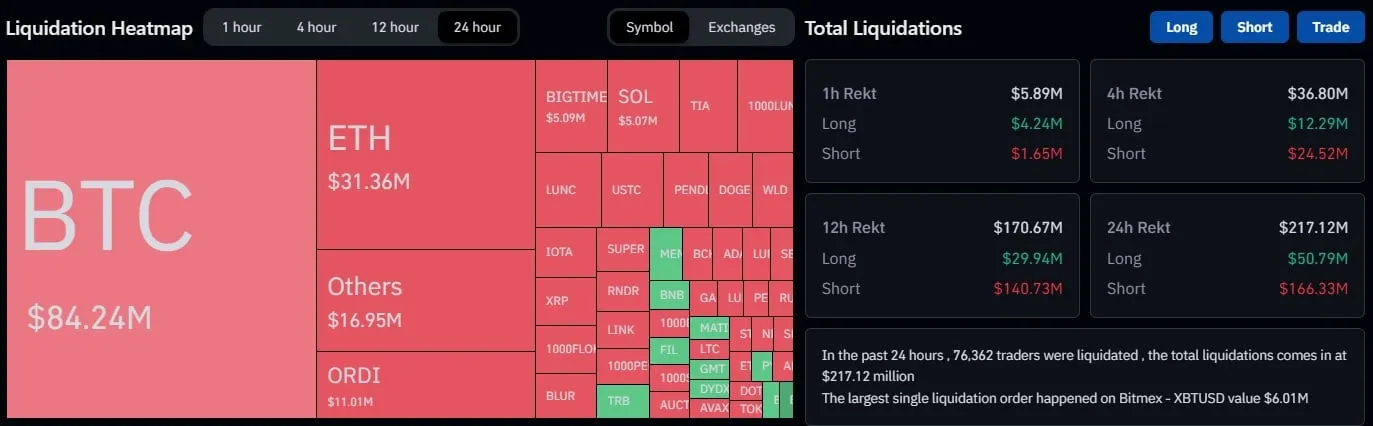

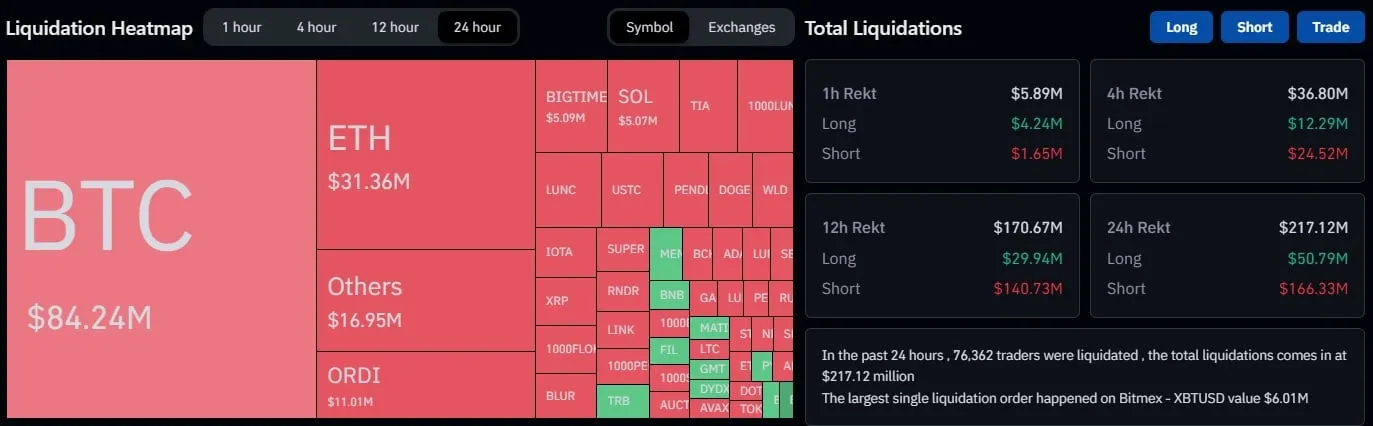

According to data from CoinGlass, Bitcoin's price surge has seen over $166 million in short derivatives positions liquidated in the last 24 hours.

Bitcoin's price movement over the weekend appears to be linked to renewed enthusiasm over the possible approval of a spot Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC).

In recent weeks, the regulator has met with applicants including Grayscale and BlackRock to discuss amendments to their applications, while analysts have zeroed in on three key dates in January when a window would open for the SEC to approve multiple applications simultaneously.

Bloomberg Intelligence analyists have put the odds of the SEC approving a Bitcoin ETF in January at 90%, prompting renewed optimism among everyone from Coinbase CEO Brian Armstrong to JP Morgan analysts.

Of course, the SEC could yet deny any or all of the pending applications; to date it has rejected every single spot Bitcoin ETF application to cross its desk.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.