Real-world adoption of Bitcoin is, supposedly, already happening. Early this month, Coinbase touted a “new way to spend your crypto” in Europe and Australia: Crypto gift cards. With them, the bearer can buy stuff at online retailers including Nike, TicketMaster and Google Play. The program, which Coinbase hopes to extend to retailers and users everywhere, also allows one to buy “Uber credits” with crypto.

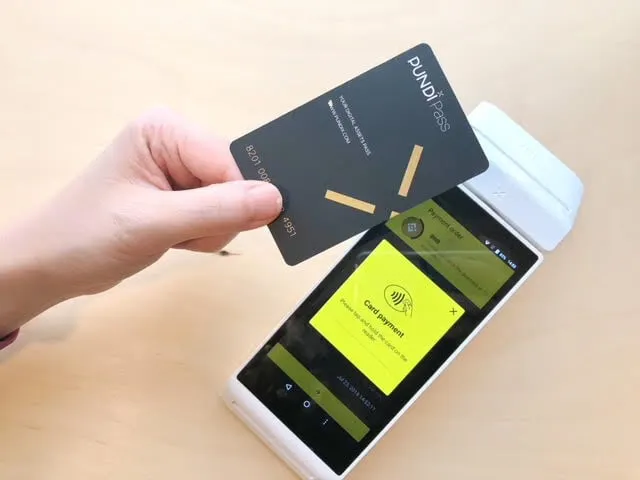

Meanwhile, in meatspace, Pundi X, whose end-to-end technology allows merchants to handle in-store crypto transactions, is rolling out 5,500 point-of-sale terminals to merchants across Europe, South America and Asia. The company plans to dispatch 20,000 more over the next three years.

Yet there’s something no one is telling you. None of these programs actually use Bitcoin or any other cryptocurrency, in its purest sense.

Instead, these payment methods rely on third parties or—horrors!—fiat money— the very things Bitcoin was designed to eschew.

Crypto purists know that even trusted third parties can freeze funds, reverse transactions and be controlled by governments. Likewise, where there’s a middleman in a transaction, there’s typically a vulnerability—and a hacker eyeing that juncture like a lion circling a tethered goat. And it almost goes without saying that middlemen typically add costs to the a transaction, on one or both sides of the ledger.

Bitcoin transactions in three seconds

When Pundi X processes a Bitcoin transaction, it happens within a few seconds. That ought to raise eyebrows since Bitcoin blocks can take ten minutes to produce. Vice President of Pundi X, Zeko Wan explains that the transaction is first settled on a private blockchain; it gets written to the public blockchain in batches, later.

That approach raises questions among the blockchain devout. Why? Because the owner of a private chain chooses who validates transactions, giving the validator control over payments. Which is a no-no.

"Centralized [private] chains are vulnerable to censorship and go against the ethos on which cryptocurrencies were built," says Simon Lange, founder of person-to-person Bitcoin exchange Liberalcoins. He says, that in theory, the private chain owner could undo and change previous transactions, by exercising his or her control over the network.

Likewise, if a third party controls the transactions, payments could be reviewed or audited by governments. Notes Lange: "A private chain is completely at the mercy of the operating company. If a government orders the company to shut down, all the data might be lost." Suddenly, Bitcoin is not held by the user, but in the reach of Uncle Sam's big, grubby hands.

That's what happens when Coinbase works with WeGift to make its gift card system work: The moment the gift card is bought, cryptocurrencies are no longer used, and the real-world transaction with the Uber car, or other business, is controlled by WeGift, a middleman.

You can glimpse the crypto future on an unassuming road in the suburb of Holešovice, Prague.

This is pretty much how the entire crypto-debit-card business behaves. BestBitcoinCard, a Bitcoin debit card comparison site, lists 14 crypto debit cards capable of spending Bitcoin. Each of those cards works by turning your crypto into fiat when loaded onto the card, essentially rendering it the same as any other gift card.

Similarly, Crypto.com offers six VISA crypto debit cards and proclaims it is the “future of money.” Yet on the company’s website, it states, “Cryptocurrency will be converted to fiat. All Visa transactions are currently limited to fiat only and are off-chain.” This is the digital equivalent of turning Bitcoin into cash and handing dollars over the counter.

The problems of cash

Satoshi referenced the financial crisis in the first Bitcoin block because it is an alternative to cash—it's not government issued, and it can't be printed at the whim of whoever is in power. Yet by storing fiat on a “crypto” debit card, it is subject to all the problems it was created to avoid.

Perhaps your typical crypto-bro, who made a killing in the 2017 run up, is more than happy to move his millions onto a debit card for easier liquidation. But for the purists and the poets and those longing for what Satoshi promised?

They (and anyone else) can glimpse that crypto future on an unassuming road in the suburb of Holešovice, Prague. Since 2014, an espresso bar there, Parallel Polis, has only accepted Bitcoin and Litecoin for customers to buy coffee. The bar even has a Bitcoin ATM so newbies can make their first purchase.

When someone buys a coffee, the crypto is transferred from their personal wallet to the company’s wallet. Not a single third party or financial institution is involved, nor could any entity alter the transaction. Notes the English version of the website: “To understand complex issues of Parallel Polis, it is important to refresh by the sip of strong coffee.”

Somewhere, Satoshi sips his strong coffee, refreshes and waits.

Read Next: Daily Debrief, September 17, 2018.