The total value deposited into various DeFi contracts on the Coinbase-incubated Base network reached a new all-time high of $301.2 million, rising 53% overnight, per DeFiLlama data.

This surge in deposits on the Ethereum layer-2 network can be attributed to the liquidity mining incentives on the newly deployed Aerodrome decentralized exchange.

Liquidity mining, also called yield farming, refers to the incentives a project doles out for users joining the platform. In this case, Areodrome is essentially paying users to simply make trades on the platform.

Aerodrome is a fork of Velodrome, itself a popular decentralized exchange on Optimism.

Aerodrome was also launched on August 29 by the same team and introduced liquidity mining for its native governance token, AERO.

The project designated 10% of Aerodrome’s initial token supply of 500 million tokens for liquidity mining. The team also airdropped 40% of the initial supply to Velodrome’s VELO token holders.

The AERO emissions began on August 30.

Shortly after, Aerodrom’s total liquidity surged from around $3 million to $144 million, per DeFiLama data, as users rushed to farm AERO tokens.

Base ecosystem still nascent

Base’s DeFi ecosystem is still in its early innings with meme coins dominating activity and lending protocols like Aave seeing scarce liquidity, currently hosting less than $1 million in total collateral, per DeFiLlama.

The Ethereum layer-2 witnessed significant usage due to social media app Friend.tech.

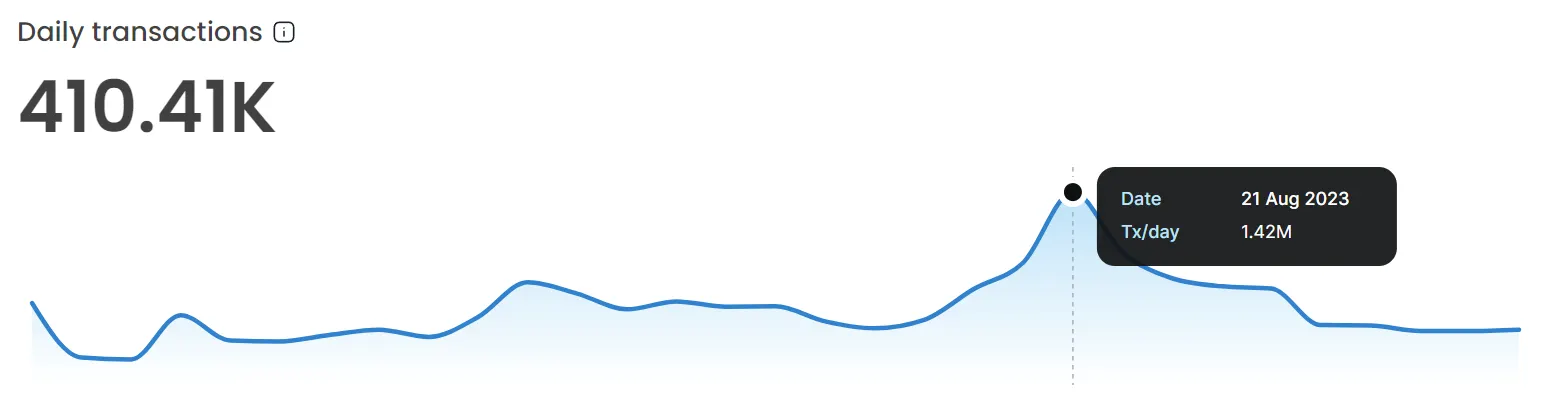

However, the daily transaction count on Base appears to have fizzled out, falling from a peak of 1.4 million on August 21 to just over 400,000 transactions yesterday, as activity on the social media app plummeted.

The total value bridged on the Base layer-2 jumped from $254.6 million to $311.7, recording a 22% increase overnight, according to L2Beat data.