Abnormal on-chain and market stats

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$65,965.00

-1.39%$1,938.73

-1.23%$615.37

-0.26%$1.35

-1.78%$0.9999

-0.01%$82.87

-2.06%$0.280536

-0.59%$1.029

0.00%$0.092207

-2.02%$48.89

-1.87%$1.00

0.09%$0.272504

-2.40%$440.78

-3.36%$9.08

1.96%$31.74

3.78%$340.32

-0.10%$8.63

-2.13%$0.161126

-3.69%$0.999369

0.02%$0.153744

-2.25%$0.999663

-0.00%$0.00910906

-2.08%$1.00

0.02%$0.097104

-3.06%$53.16

-2.27%$8.95

-2.08%$215.45

-2.08%$0.881841

-2.60%$0.00000551

-4.61%$0.074612

-1.92%$0.107882

-3.76%$5,338.13

0.52%$1.20

-6.51%$1.50

2.41%$5,435.87

0.94%$1.52

-8.48%$3.73

-2.75%$0.637164

0.43%$1.00

0.00%$1.12

0.00%$1.00

0.01%$0.997085

0.10%$0.705368

-1.41%$112.42

0.57%$175.66

-3.68%$75.47

-1.84%$0.166638

-2.33%$0.066623

-1.50%$2.14

-0.69%$1.00

0.05%$1.13

-2.82%$0.00000343

-6.06%$0.00000151

-3.18%$0.999283

-0.00%$8.44

-2.38%$2.36

-3.37%$0.251374

-3.97%$11.00

0.00%$6.90

-0.91%$0.00187396

-0.53%$0.103786

-3.96%$0.38221

-3.47%$7.55

-2.84%$0.056883

-1.56%$0.01708003

-3.44%$1.70

-4.89%$62.22

-2.51%$1.79

-3.29%$0.102532

-1.20%$0.844401

-0.65%$1.001

0.01%$1.23

-0.37%$3.40

-0.91%$0.02936901

-2.14%$0.0092681

-1.76%$0.085348

-2.17%$114.44

0.00%$1.028

0.00%$1.00

0.03%$0.956003

-4.31%$1.12

-0.43%$0.919341

-4.49%$1.33

-5.57%$0.03232093

3.04%$0.03230833

-2.70%$0.00708605

-2.37%$0.08035

0.90%$0.09801

-1.07%$0.578685

-3.52%$0.163651

1.70%$1.096

0.00%$0.997567

0.02%$1.00

-0.03%$29.97

-1.38%$0.00000578

-3.32%$0.01286016

-0.15%$0.999111

0.02%$1.089

0.07%$0.252852

-2.86%$0.999865

-0.04%$1.18

-0.11%$0.067558

-0.46%$0.250143

-3.00%$0.687433

-2.22%$1.29

-1.43%$174.56

-1.37%$0.00664684

-4.95%$0.04740328

-1.08%$31.71

-3.22%$0.370289

-2.79%$1.00

-0.00%$1.81

-2.96%$0.494633

-1.43%$1.78

-2.59%$0.9997

-0.00%$0.239619

-4.84%$0.079648

-1.70%$1.36

-1.45%$0.03290572

-3.72%$0.149809

-4.46%$1.018

-0.01%$0.00000034

0.45%$125.42

-0.55%$0.00000033

-0.35%$3.35

-1.89%$0.053818

-2.74%$0.339382

-2.21%$0.872824

-6.20%$15.15

-4.22%$2.98

-3.61%$0.315148

2.11%$0.01511821

-3.21%$0.994803

-0.18%$0.065533

-2.67%$14.33

10.79%$0.314306

-3.01%$17.51

-0.85%$0.0476033

-2.72%$0.991918

-0.78%$0.02540502

-3.10%$0.00540422

-3.66%$0.229482

1.11%$6.01

6.97%$0.00002696

-2.84%$0.120169

-0.90%$1.56

1.57%$0.297527

-2.30%$0.07201

-7.41%$0.04656364

-4.71%$0.00242933

-0.45%$0.00250385

-4.02%$1.26

-3.60%$0.000043

-5.88%$0.12552

0.57%$0.02089734

-0.45%$0.99979

-0.06%$1.82

-0.19%$5.90

-3.72%$0.992625

-5.51%$0.999925

-0.00%$0.03985123

-4.04%$0.081605

-2.68%$0.096941

-3.89%$0.984022

0.00%$0.999884

-0.04%$1.076

0.00%$1.25

-4.83%$0.000001

0.32%$22.79

0.00%$1.25

-2.10%$0.49016

-0.97%$0.097479

-1.20%$0.002004

-3.73%$1.00

0.00%$0.189316

8.18%$5,004.45

-0.01%$0.257195

-13.01%$0.187848

-2.97%$0.051705

-0.75%$0.184429

-2.27%$0.187606

-3.04%$0.078416

-3.33%$0.094645

-1.76%$2.58

-3.87%$1.00

0.00%$1.00

-0.05%$0.00465283

-3.45%$0.01842576

-3.52%$17.49

-3.12%$0.07517

-4.27%$2.08

1.60%$2.11

-4.00%$1.80

-0.12%$0.02013063

-1.30%$0.00345679

-3.10%$0.05205

-2.08%$48.01

0.07%$0.996071

-0.24%$1.27

0.45%$0.584811

-4.35%$1.70

-3.21%$0.155404

-13.59%$3.31

-4.59%$0.154543

-5.19%$0.02097014

-3.64%$0.101249

-4.91%$0.999499

-0.68%$0.03885324

-2.24%$0.998749

0.05%$0.315217

-3.28%$0.000007

-2.47%$0.25719

-8.01%$0.391241

-2.01%$0.136106

0.88%$1.014

-0.19%$0.594976

-3.43%$0.159262

-3.14%$0.132929

-2.43%$0.618772

-3.46%$0.284849

-3.99%$1,097.61

0.09%$0.074735

-0.37%$0.258503

-0.94%$0.090667

-2.50%$4.32

-3.23%$0.077824

-3.39%$0.02184684

2.92%$0.130388

-0.18%$0.301878

0.65%$11.03

-2.45%$1.001

0.00%$0.00389983

1.44%$0.00141434

-1.71%$0.239166

-3.88%$1.08

-0.07%$0.206234

-3.20%$0.261102

-3.18%$1.45

-8.06%$0.999836

0.00%$0.999858

0.00%$2.27

-2.37%$1.001

0.35%$0.175615

-3.69%$0.99959

0.01%$1.064

0.05%$0.999903

0.10%$0.11192

2.65%$0.994387

-0.10%

The crypto market's top gainer this morning was the token powering the 1inch Network, which saw a significant overnight gain of 19%.

The governance token of the decentralized exchange aggregator has been on a tear since July 14, with a weekly increase of 67%.

In comparison, the rest of the market stayed relatively quiet with minimal movements over the weekend as Bitcoin continues to trade in a narrow range between $30,150 and $30,500.

Ethereum (ETH) traded in a further smaller range between $1,920 and $1,945 since Friday.

The latest rally comes amid a hefty uptick in trading volume in South Korea, an anomaly witnessed during the price surge of both Bitcoin Cash (BCH) and Aptos (APT) in the last two weeks.

1inch was the second most traded coin on Upbit with a 24-hour volume of $360 million, which is more than 15 times the 30-day average trading volume of 1inch, per CoinGecko data.

The price surge since yesterday caused short liquidations worth $2.49 million in the perpetual swap markets, per Coinglass data.

Perpetual swap contracts are a type of derivative instrument or futures contract that enables leveraged betting on an asset price without an expiration date.

A short liquidation occurs when traders betting on the price of an asset to fall are forced to close their futures shorts positions due to an upward price movement.

Currently, Coinglass data shows that the open interest (OI) volume for 1inch perpetual swap contracts is at a 20-month high above $72 million, suggesting that the volatility will likely remain high.

Besides a massive surge in futures trading volumes, the token also recorded massive flows in and out of exchanges.

Celsius wallet tracker from Nansen shows that 1inch tokens worth $2.44 million were moved from the bankrupt crypto lender's wallets on July 14. The firm received permission from a U.S. court to sell their altcoins for Bitcoin and Ethereum, starting July 1.

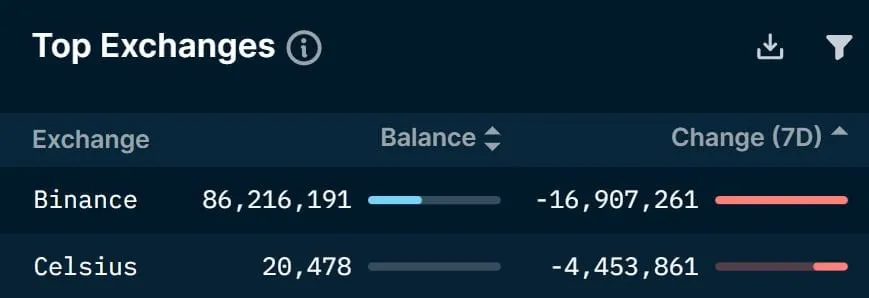

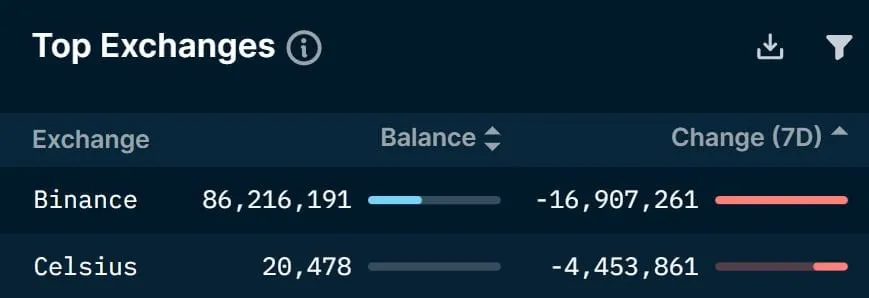

However, Nansen’s data shows that the selling pressure from Celsius was absorbed by a significant withdrawal of 16.90 million 1inch tokens worth $9.63 million in the last seven days from Binance.

The abnormal on-chain moves and a spike in trading volumes on Upbit suggest that the token’s price is influenced by large unknown entities, making it susceptible to volatility.

1inch token was last trading at $0.57, a three-month high for the token.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.