Europe’s landmark crypto regulation could serve as a model for the U.S., a top American regulator has said.

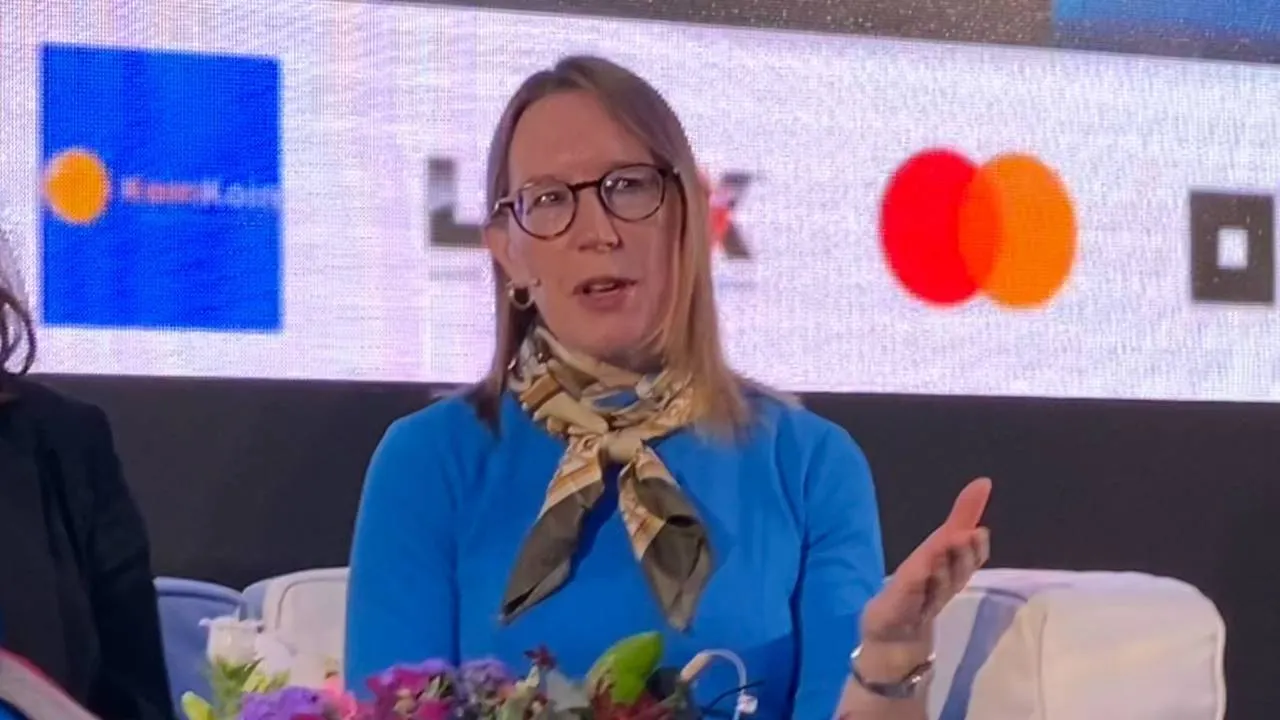

Hester Peirce, a commissioner at the Securities and Exchange Commission (SEC) who has previously been outspoken in her support for crypto, expressed her admiration for the speed at which the European Union put together its digital finance package.

Markets in Crypto Assets (MiCA) was passed by the European Parliament last month, putting in place a comprehensive framework for crypto regulation across the 27-country bloc.

“MiCA can serve as a model for us,” Peirce said at the Financial Times’s Crypto and Digital Assets Summit in London on Wednesday. She added that the UK’s efforts to build a crypto-friendly regulatory regime could also serve as inspiration to the U.S.

She said she was in favor of a system that informs customers of the risks, and figuring out a regulatory model “that allows for innovation, which I think is something that you all take very seriously here.”

“I think that's something that we can learn from and draw from, but whether or not that will take a little longer for us, I don't know,” she said.

She added that it was an “advantage” for the U.S. to be able to see how MiCA plays out.

EU politicians have previously spoken about their desire to share their experiences of crypto regulation with U.S. counterparts.

Financial Commissioner Mairead McGuinness last year even called for a global crypto agreement, led by the EU and the U.S.

EU could lure crypto firms away

The U.S. currently has multiple agencies, including Peirce’s employer the SEC, which claim some jurisdiction over crypto. Tensions between regulators and companies have escalated in recent

months, with the largest domestic player Coinbase taking the SEC to court to clarify its stance on crypto.

Peirce also predicted at the event that the rollout of MiCA could attract more businesses to Europe, due to the clearer regulatory environment.

“If we built a good regulatory regime, people would come,” she said. “I think you'll see that with MiCA.”

She added that U.S. regulators were currently “shooting ourselves in the foot” by not working with those in the field on regulation, arguing that there are inherent benefits to DeFi for the stability of the financial system as a whole.

“I would think that we would be delighted to see a more resilient financial system built on decentralized finance, rather than having everything concentrated in a few large centralized entities,” she said.