1/ Voyager and the UCC are in the process of finalizing Liquidation Procedures. As a reminder, the Liquidation Procedures must be filed before the Plan can go effective.

— Voyager Official Committee of Unsecured Creditors (@VoyagerUCC) May 4, 2023

$66,130.00

3.00%$1,932.26

4.79%$1.39

3.01%$600.10

0.23%$1.00

0.01%$82.34

5.92%$0.285196

1.19%$1.034

0.25%$0.094166

1.83%$49.43

3.00%$498.87

2.20%$0.999963

0.01%$0.268987

3.17%$8.52

7.71%$27.65

6.01%$333.75

8.00%$0.161674

-0.41%$0.999061

0.05%$8.58

4.03%$0.154452

1.99%$0.999979

0.11%$0.0095488

4.11%$0.098007

3.69%$249.01

4.75%$0.9998

-0.02%$52.76

2.51%$8.65

3.27%$0.00000608

1.51%$0.899601

2.41%$1.31

-3.13%$0.115

4.59%$0.075742

1.90%$5,168.24

0.25%$1.42

1.11%$5,199.70

0.16%$3.54

6.45%$1.29

1.73%$0.60107

4.32%$1.00

0.00%$119.02

4.05%$0.997649

0.05%$0.706962

2.10%$0.00000409

3.89%$173.69

1.91%$1.00

0.02%$75.82

2.06%$1.12

0.00%$0.999573

-0.04%$2.22

-0.14%$0.067085

7.31%$0.166085

1.92%$0.00000165

-0.33%$8.56

3.41%$0.999716

0.08%$1.006

2.49%$0.257167

4.01%$0.115977

9.64%$2.23

7.32%$11.00

0.03%$6.93

0.45%$8.57

4.09%$0.389544

4.95%$0.00177547

-2.14%$2.09

-0.77%$0.057476

-1.61%$64.37

3.67%$0.0161404

-7.28%$0.844556

2.47%$0.101721

3.31%$1.002

0.17%$0.804832

10.00%$3.48

5.01%$0.00934991

3.55%$1.23

-0.03%$0.02953167

-0.85%$0.085994

2.52%$114.40

0.01%$0.999945

0.11%$1.027

0.01%$1.39

1.35%$1.11

-0.08%$0.908998

1.78%$0.863301

5.68%$0.03344018

-0.57%$1.76

12.38%$0.00727947

-0.19%$0.080212

-0.01%$1.095

0.01%$1.001

0.19%$0.095242

2.49%$0.99999

0.02%$0.00000596

2.42%$0.02878449

0.67%$0.01296319

-0.46%$0.998435

-0.06%$0.270307

7.59%$0.149704

3.37%$27.74

3.08%$1.089

0.02%$0.999864

0.05%$1.18

0.02%$0.068169

1.91%$0.245125

4.25%$0.658098

11.02%$33.67

4.91%$0.00670186

6.05%$1.24

1.57%$0.04595124

1.95%$0.376607

1.37%$165.84

-1.55%$1.00

0.12%$0.50875

12.82%$1.47

7.82%$1.046

2.92%$0.157195

2.24%$0.03437954

0.31%$0.080743

3.37%$0.234849

5.80%$1.021

0.05%$0.99986

0.02%$0.00000033

-0.45%$0.00000033

0.60%$123.28

4.14%$3.23

-3.60%$16.11

7.36%$0.054461

2.86%$0.01651312

-0.23%$0.342176

16.37%$1.55

0.75%$3.16

0.67%$0.052452

3.70%$0.067572

2.01%$0.998947

0.11%$0.00575286

1.14%$0.02644611

1.72%$0.302004

10.55%$0.00002888

3.18%$17.79

4.11%$0.313929

5.26%$0.992959

0.15%$1.46

6.45%$1.63

0.48%$0.311096

4.50%$0.143338

7.69%$0.04991036

2.02%$0.121218

0.96%$0.219772

8.24%$0.072492

6.53%$0.00260491

3.25%$0.00248765

0.39%$0.334963

14.87%$6.25

3.70%$1.002

0.35%$0.04260403

5.22%$0.02057015

0.92%$1.00

0.00%$1.29

5.38%$0.988514

0.03%$1.075

0.01%$1.00

0.07%$0.080882

2.73%$0.513551

1.99%$5,657.07

7.92%$1.69

0.22%$0.00214513

7.12%$22.79

0.00%$0.100036

0.01%$1.24

4.70%$0.089857

2.80%$0.201791

0.91%$0.00000095

-0.34%$0.198338

6.89%$0.00003535

1.42%$1.00

0.00%$0.080931

5.37%$0.052574

1.53%$2.67

-0.27%$0.02045337

3.41%$0.184316

-1.21%$0.181864

17.01%$0.120697

4.83%$1.00

0.00%$0.092707

1.37%$0.00481548

1.28%$0.784326

2.64%$9.01

2.18%$18.10

5.35%$0.02364621

-0.28%$1.002

0.13%$0.00356462

2.56%$1.81

4.01%$2.06

-0.95%$1.80

0.17%$3.72

-3.04%$0.0199583

-0.12%$0.052343

4.61%$0.604759

5.80%$48.00

0.03%$2.03

4.31%$3.40

16.95%$0.995757

0.32%$0.158828

11.61%$1.26

-0.05%$0.00000773

2.91%$0.04030446

2.79%$0.150492

-0.29%$0.998176

0.01%$0.99847

-0.25%$1.014

0.14%$0.674612

37.94%$0.02488126

31.53%$0.305627

-0.63%$0.403021

5.00%$0.660731

6.15%$0.165336

6.80%$0.310549

-2.29%$1,097.76

0.02%$0.075226

2.88%$0.080583

3.21%$8.58

-2.37%$0.320726

0.07%$4.39

2.33%$0.604253

8.03%$0.372572

1.19%$0.255605

-0.15%$0.127901

-7.02%$0.090273

2.76%$0.127128

-1.18%$0.256209

5.26%$0.28602

3.11%$11.29

-9.32%$1.92

3.15%$0.124553

-0.80%$0.130975

0.23%$0.995242

0.05%$0.00146103

0.97%$0.219977

0.44%$0.00398528

4.59%$0.07583

3.20%$1.001

0.00%$1.002

-1.43%$0.197399

6.21%$0.999958

0.01%$1.44

-1.55%$2.27

-0.89%$1.065

0.26%$0.329563

-2.30%$1.00

0.06%

Crypto broker Voyager Digital will now liquidate its assets deals to sell them FTX US and, more recently, Binance US, have fallen through.

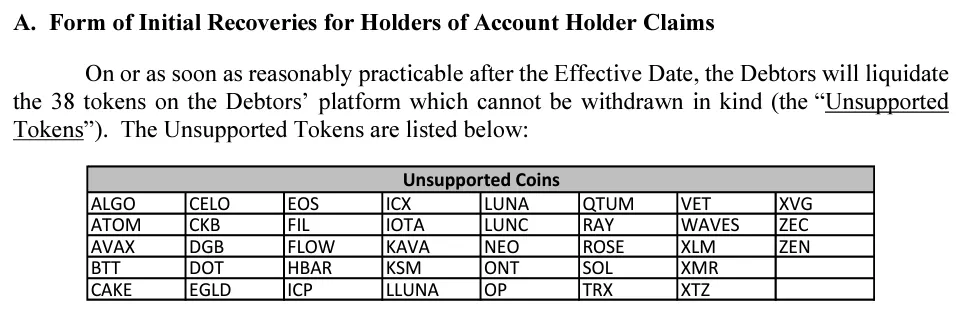

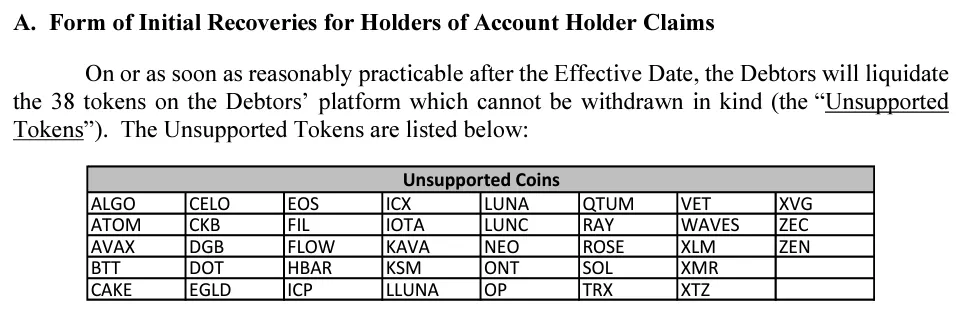

In a Friday filing, Voyager said that a number of digital assets on the platform that cannot be withdrawn will be liquidated and returned to customers. They include major cryptocurrencies like Algorand (ALGO), Celo (CELO), and Avalanche (AVAX).

A number of other major cryptocurrencies on the platform will not be liquidated but returned to customers in digital form, albeit at a recovery rate of about 36%, according to the court filing. These include major crypto assets Aave (AAVE), Ethereum (ETH), Bitcoin Cash (BCH) and 65 others.

Former customers will receive some form of reimbursement soon, the failed firm said on Twitter. “We are hopeful that initial distributions will begin within the next few weeks,” it wrote.

Binance US, the sister company of crypto exchange Binance that claims to be run independently, walked away from a $1.3 billion restructuring deal to buy Voyager assets last week. It cited a “hostile and uncertain regulatory climate in the United States.”

1/ Voyager and the UCC are in the process of finalizing Liquidation Procedures. As a reminder, the Liquidation Procedures must be filed before the Plan can go effective.

— Voyager Official Committee of Unsecured Creditors (@VoyagerUCC) May 4, 2023

Digital asset broker Voyager blew up last year after revealing it had massive exposure to failed crypto hedge fund Three Arrows Capital.

The firm has since been working out how to return assets to investors who used its services. Crypto exchange FTX was planning to buy Voyager’s distressed assets—but then itself went bankrupt in a highly-publicized and unexpected collapse which rocked the crypto ecosystem.

Its founder and ex-boss Sam Bankman-Fried has since been hit with 13 criminal charges and is awaiting trial.