Ethereum’s Shanghai upgrade is just around the corner and that means users are starting to place their bets.

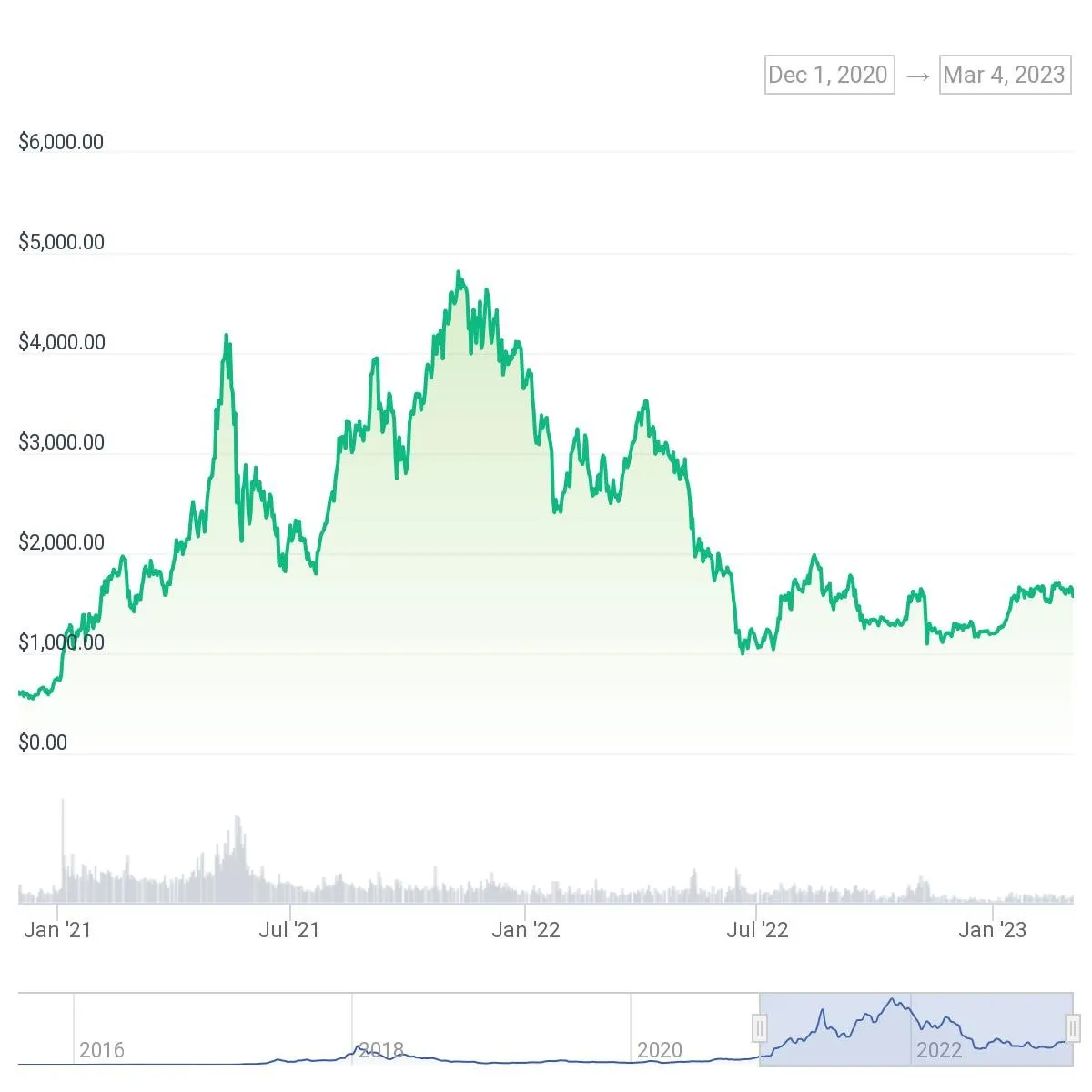

All of the attention on this specific upgrade revolves around one thing: withdrawing staked Ethereum. Since staking launched back in December 2020, the network just embarking on its journey to a proof-of-stake consensus algorithm, those who locked up their funds haven’t been able to withdraw those funds.

That’s expected to change in April. But is it bearish or bullish?

Some have argued that folks are going to quickly withdraw their ETH and dump to realize some gains.

Those gains won’t be much though. If you’d locked in your holdings on December 1, 2020, the price of ETH was $612. Selling at current prices means you’d still nab a whopping 156% win.

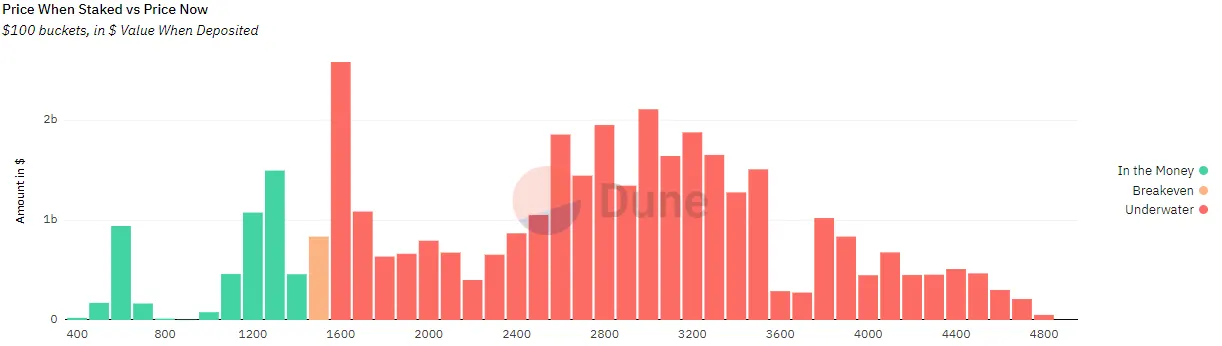

Those are certainly respectable gains, but for a pretty slim majority of users.

In fact, in dollar terms, since staking began, just 16% of stakers are in the money, per Dune. Were the upgrade to be executed today, the vast majority of users would be hit with some pretty serious losses.

It’s impossible to know what people will do when faced with potentially double-digit losses. Still, there are about $6.25 billion staked that’s in the money; it’s likely some of them sell.

That’s the bear argument.

The bull argument is this: after nearly three years, during which the devs finally delivered the highly-anticipated merge event, people are going to double down. The risk profile of staking drops tremendously once people can see that, yes, if they put their money into this black box they can earn a yield and can take the money out of that black box whenever they like.

Some DeFi projects are also making this bet too, rolling out a unique levered mechanism.

Aave’s latest upgrade does precisely this. Here’s how it works: Deposit your Ethereum into liquid staking protocol Lido Finance to receive staked ETH (stETH); use that stETH to borrow more Ethereum on Aave; restake the Ethereum on Lido; and repeat the cycle depending on how degenerate you are.

Spark Lend, a not-yet-launched product from a handful of MakerDAO engineers, will also offer a similar tool.

This is obviously hugely risky and if Ethereum hits any volatility, consider yourself liquidated.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay before it goes on the site. Subscribe here.