Last week a Maker DAO cluster launched a new lending market. Think Aave, because, well, it is actually using much of the same code.

And the term cluster here is intentional; the group of developers who built what is now called Spark Protocol were quite literally called the “Crimson Cluster.”

Now, they’re called Phoenix Labs, and they’re led by protocol engineer Sam MacPherson.

He told Decrypt that the key motor behind the idea was to provide “more advanced features” for DAI users that weren’t available on Maker previously. Basically, get DAI into more hands by providing more ways to use it.

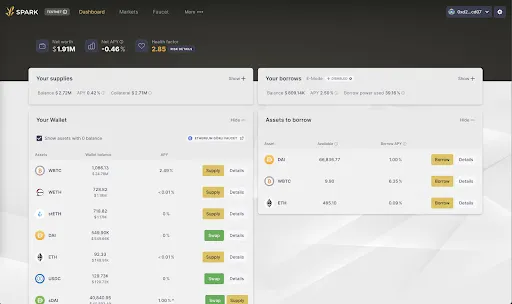

Spark Protocol isn’t the lending platform itself, but rather a frontend dashboard through which users can do a bunch of fun DeFi things, all in the name of supporting its decentralized stablecoin DAI.

The lending market is called Spark Lend, and it uses code from Aave’s latest v3 launch. For using the code, Spark Protocol will pay the AaveDAO 10% of all profits made within the DAI market. The Aave community voted in favor of the proposal and, voila, an open-source revenue-sharing agreement was established.

“Phoenix Labs is a big promoter of free and open-source software,” MacPherson said. “We wanted to establish the meta, if you will, giving back to developers who we view as developing public goods for the ecosystem.”

The critics in the back may be wondering why anyone would use a newly-launched lending platform instead of Aave. And doesn’t Aave already offer DAI too?

The reason users may turn to Spark Lend is because of a little reactivated feature within MakerDAO called the Dai Savings Rate or DSR.

Relaunched in December, the DSR is one of DeFI’s original fixed-rate offerings. And now that it’s implemented in a Maker-native lending platform, that flat 1% rate can be enjoyed by DAI lenders and borrowers alike.

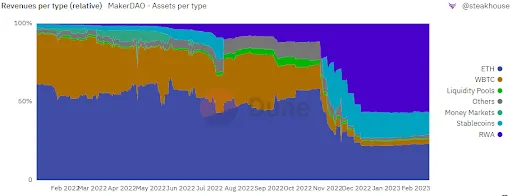

The DAO has been able to reactivate DSR because Maker, thanks to the Endgame Plan, is raking in the cash after it onboarded real-world assets to generate yield back in November. The below chart shows today more than 56% of the protocol’s current revenue comes from this group of assets.

But Spark Lend is just the tip of the iceberg, said MacPherson.

Spark Protocol is also teaming up with Element Finance and Sense Protocol to roll out a fixed-rate product at scale. It’s launching its very own liquid staking derivative (or LSD as the degens call it) called sEtherDAI, too.

It’s a ton of products, and crucially, it’s “owned by Maker governance, including IP and trademarks,” said MacPherson. “Phoenix Labs in our team has no control over any of this other than the development process.”

And, insofar as the project is owned by Maker governance, it's implementation is still subject to a vote from the community.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay before it goes on the site. Subscribe here.