OKX today published its third monthly Proof-of-Reserves (PoR) report showing $7.2 billion held by the exchange in Bitcoin (BTC), Ethereum (ETH), and the USDT stablecoin.

Citing data from the blockchain analytics firm CryptoQuant, which monitors PoR across the crypto industry, OKX said this is the "largest clean asset reserves among major exchanges."

As explained by OKX, asset reserves are considered “clean” when a third-party analysis—in this case the metric provided by CryptoQuant—determines the reserves do not include an exchange's native token and are made up exclusively of high-market cap “traditional” cryptocurrencies such as BTC, ETH, and USDT.

For example, CryptoQuant data shows that Deribit is the only other exchange to have 100% of clean assets reserves, although to a much lesser size of $1.4 billion.

Crypto.com is meanwhile 95.51% “clean,” followed by ByBit and Binance with 91.2% and 87.6%, respectively. Each of these exchanges, as shown in the chart below, hosts a percentage of their reserves in their native tokens.

PoR refers to a method of verifying that a trading platform or crypto firm does indeed have 1:1 backing across the digital assets it holds in custody on behalf of its customers.

The crypto community has been pressing for the exchanges to provide attestations of their holdings in the wake of the FTX collapse last November.

One way to execute an attestation is via a PoR protocol that uses a Merkle Tree proof to integrate large amounts of data into a single hash and verify the integrity of the data set. OKX was among the first to use this method to prove its stability as the exchange released two PoR reports by the end of December.

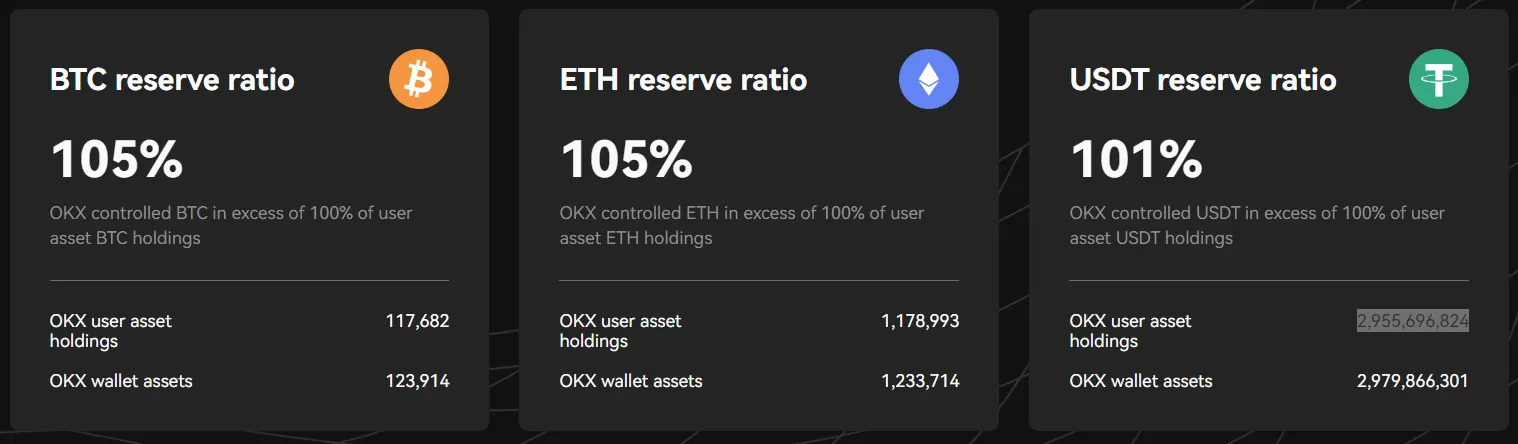

Breakdown of OKX’s assets

New features in today’s report include a detailed breakdown of the assets, showing OKX is overcollateralized with a reserve ratio of 105% for BTC, 105% for ETH, and 101% for USDT.

As of January 18, 2023, users held 117,682 BTC, 1,178,993 ETH, and 2,955,696,824 USDT.

OKX said it has published more than 23,000 addresses for its Merkle Tree PoR program while enabling users to self-verify the exchange’s reserves and liabilities with trustless tools on the OKX website.

The exchange’s additional holdings can be viewed on the OKX Nansen Dashboard.

Speaking at an event held in Hong Kong today, OKX’s director of financial markets Lennix Lai said the exchange “has never misappropriated user assets before and never will."

To provide more transparency and avoid scenarios similar to what happened at FTX, the crypto exchange is also planning to use zero-knowledge-proof technology.

Boasting a trading volume of over $1.8 billion in the past 24 hours, OKX is currently the third-largest cryptocurrency exchange in the world, according to CoinGecko.