There’s no stopping Ark Invest, the investment house led by Wall Street veteran Cathie Wood, from pursuing its long-time dip-buying strategy as the firm snapped up another 158,116 shares of Coinbase shares (COIN) on Thursday.

The purchase is worth almost $5.5 million based on COIN’s price of $34.78 at the closing bell.

According to Ark’s daily trade information newsletter reviewed by Decrypt, the entire purchase was allocated to the ARK Fintech Innovation ETF (ARKF), which invests in equity securities for companies in the fintech space.

The move comes shortly after shares of America's leading cryptocurrency exchange fell to a new all-time low of $31.86 per share on December 28 before rebounding almost 7% on Thursday.

This represents Ark’s largest purchase of COIN since December 14, when the firm bought a total of 296,578 Coinbase shares worth more than $11.9 million to its funds.

This was followed by two smaller purchases last week, with the firm grabbing 5,000 and 23,509 COIN on December 22 and December 23, respectively.

ARk Invest’s Coinbase bet

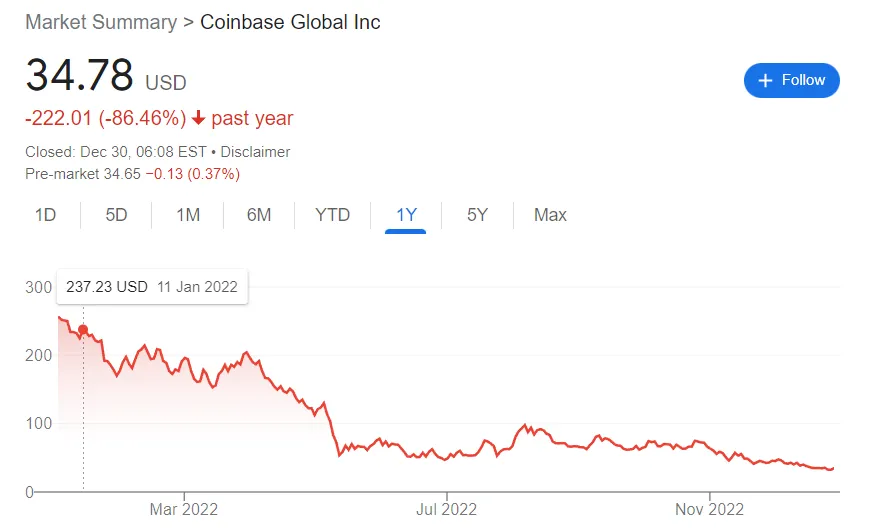

Despite COIN plummeting by more than 86% this year and the majority of other stocks taking a heavy beating in 2022, punishing Ark's funds' performance, Cathie Wood has defended the firm’s strategy, pointing to a five-year horizon for investments.

Earlier this week, Ark CEO shared her year-end message to investors, stating that “fear of the future is palpable these days, but crisis historically has created opportunities.”

Citing the latest Bank of America Fund Manager Survey, she pointed that "cash levels have not been this high since the 9/11 crisis in 2001.”

The note also included reference to a surging CBOE equity put-to-call ratio, which hit 2.4 on Wednesday, a new record for the metric even when compared to the early noughties tech crash and the 2008 financial crisis. When this metric is high, it indicates the market may be overly bearish; when low, it suggests a bubble is forming.

The Ark boss went on to say that the tech crash and financial crisis "were terrific opportunities" to invest.

“To the extent investors have reserves of cash to put to work, ARK believes that this time will be no different and that innovation strategies will be prime beneficiaries when equity markets recover,” wrote Wood.