FTX’s complete collapse in the span of two weeks has been nothing short of astonishing.

Even Enron’s liquidator, who’s been appointed as the CEO of the crypto exchange during the bankruptcy proceedings, called the extent of the mismanagement “unprecedented.”

And while John J. Ray III continues to sift through the smoldering remnants of Sam Bankman-Fried’s empire—mincing no words along the way—DeFi continues to hum along, attracting supply with premium interest rates, servicing non-custodial trades, and liquidating under-collateralized loans all at the speed of Ethereum.

Digging into the numbers show just how impressively distanced platforms like Aave and Uniswap have been from FTX.

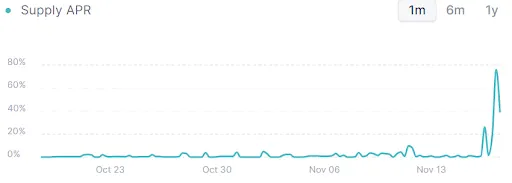

On Aave, for example, a unique spike in activity occurred this past week. For roughly an hour, you could’ve earned more than 73% interest on your GUSD, Gemini’s dollar-pegged stablecoin. The reason? Simple human panic.

Gemini announced on Wednesday that withdrawals from its Earn product would be delayed. These delays were due to Gemini Earn’s lending provider, Genesis, halting withdrawals, citing ongoing FTX contagion.

Back over on Aave, users pulled their GUSD holdings and began borrowing the asset en masse, with some speculating that borrowers were looking to short the stablecoin.

Just as these two events happened (withdrawals and borrowing), lending rates skyrocketed in order to attract more liquidity back on to the platform. Remember: Pretty much all of these decentralized lending platforms operate according to supply and demand. As supply rises, interest rates drop; as supply dwindles (or borrowing rises), rates will rise.

Basically, users were being offered a real-time reward for holding an asset that the market had temporarily defined as risky.

In a chart, here’s what that looked like. Lending rates remain quite high still.

Ultimately, in the worst (rather unlikely) case scenario, GUSD could collapse and Aave could vote to close this particular market. In any case, it won’t be the project’s founder Stani Kulechov who decides how that happens, but its DAO.

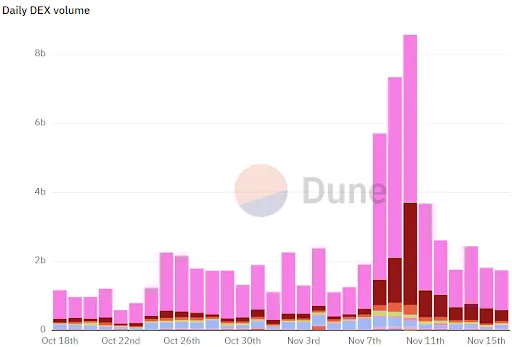

Meanwhile amid all the FTX madness, Uniswap—DeFi’s most popular decentralized exchange—overtook powerhouses Coinbase for daily trading volume on Ethereum pairs.

Another side effect of the FTX chaos has been that users have pulled money from crypto exchanges and turned to non-custodial options to trade funds. Thus as the largest, most liquid decentralized exchange on the market, Uniswap nabbed a huge amount of volume.

And Uniswap isn’t the only winner here either. Liquidity providers, or folks who had deposited funds into different pools that let traders swap tokens, also raked it in as volumes rose.

The Wrapped Ethereum (WETH) and USDC pool on Uniswap, for example, generated $3.8 million fees in the last week. That money is split proportionally among LPs based on how much they deposited. And LPs can be anyone; professional market makers, your grandmother, or a DAO can all participate.

Gas fees on Ethereum spiked somewhat during this debacle, too; but paying a touch more to avoid moving through an exchange registered in the Bahamas certainly seems like money well spent.

And finally, sales soared for other non-custodial products like hardware wallets from Trezor and Ledger. Ledger CEO Pascal Gauthier told Decrypt, "Last week saw Ledger's highest sales week in history. Sunday was our single highest day of sales ever. Until Monday, when we beat our all-time high again.”

Thus, on the one hand, the crypto industry is still reeling from one of the biggest scandals in perhaps all of financial history.

On the other, transparent alternatives to the traditional centralized arrangement are proving why decentralized finance is so important. And these alternatives work really well.

Whether regulators will see things this way is another question.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay before it goes on the site. Subscribe here.