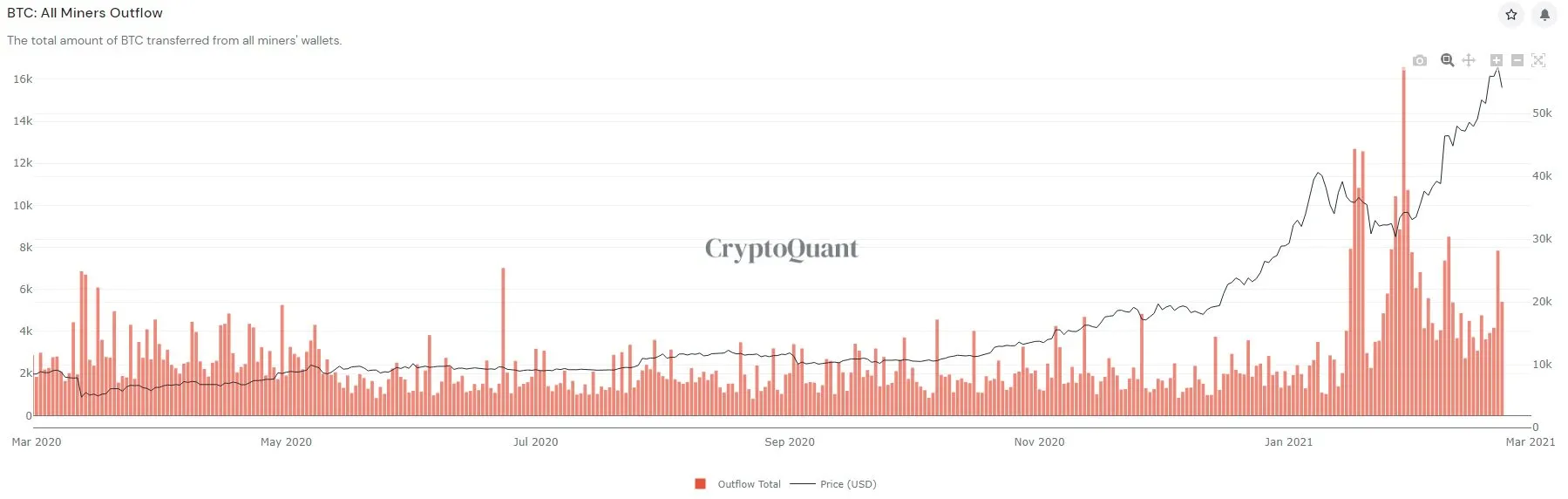

Bitcoin (BTC) miners have upped their sales of Bitcoin since the cryptocurrency started on its rally up to $58,000, according to crypto metrics platform CryptoQuant.

The data shows that miners, in general, have increased sales over the past two months, with some particularly large outflows causing big spikes.

Over the last month, there have been several massive outflows of BTC from miners’ wallets. In mid-January, there were two large outflows of 12,690 BTC ($444 million) and 12,570 BTC ($450 million). On January 29, miners transferred roughly 16,600 BTC (around $570 million at the time) out of their wallets.

Alex Zhao, CEO of Standard Hashrate Group, told Decrypt that Bitcoin miners—at least in Asia—began ramping up their sales as the current bull run picked up steam in January.

“The Asia mining community's consensus was that Bitcoin would reach a peak at around $20,000. Therefore, many miners sold a significant amount of Bitcoin inventory in the range between $17,000 and $19,000,” Zhao said.

“When Bitcoin's price broke through to ATH's in January, many miners continued to sell since they wanted to guarantee their profits,” he added.

An increase in the scale of Bitcoin sell-offs conducted by miners could arguably create downward pressure on the price of BTC. However, this depends on whether the Bitcoin is moved to an exchange to be sold on the open market or if it is sold to an investor who puts it into cold storage.

Yesterday, there was a big spike in outflows from Bitcoin miners, which hit 7,850 BTC ($450 million) on February 21. This came just hours before Bitcoin saw the largest drop in its history.