In brief

- Investing in cryptocurrencies share many similarities (but also differences) from investing in any other type of asset.

- There are a wide range of cryptocurrencies that perform a number of different functions for the networks they are part of.

- When investing in cryptocurrencies you should think about your appetite for risk, and the length of your investment horizon.

If you’re new to crypto, the idea of trying to invest in currencies like Bitcoin and Ethereum can seem daunting.

But fear not, we’re here to help you understand how to invest. In this series, in association with AAX, the world’s first digital asset exchange powered by the London Stock Exchange, we’ll take you from the basics all the way to the boardroom.

We’ll show you the investment landscape, the different types of investments and what are the risks and rewards of choosing different tools to invest in.

But before that, let’s start with the basics.

Investing in cryptocurrency

At it’s very simplest, buying cryptocurrency is like buying other types of asset: you find a broker or exchange, agree a price, and that asset is sent to storage. The hope being the value of that asset rises over time and you then sell that asset at the higher price.

With cryptocurrency it’s no different. But if you’ve come from the fiat world, where you may have invested in things like ISAs and pensions, the performance of these assets is very different.

For example, if you have a savings account, with interest rates so low in most Western countries, the performance of those savings would be a few percentage points per year.

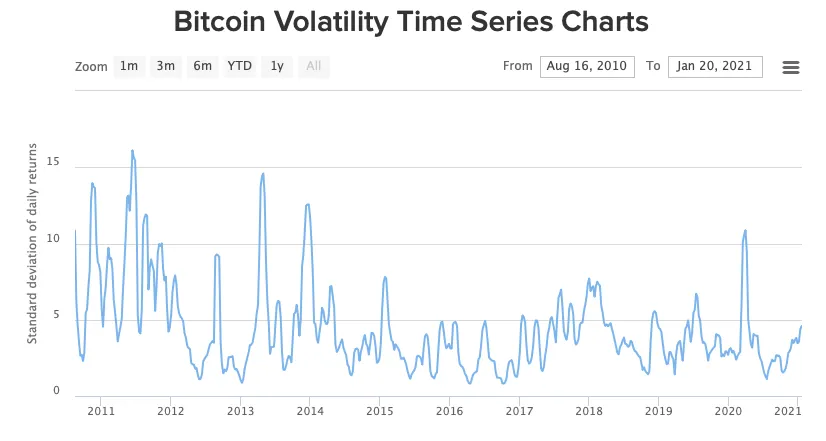

If you invested in Bitcoin meanwhile, depending on when you invested you could be way up, or down. In the past year, volatility has been as high as 10%, and as low as 1.5%

For comparison, the volatility of gold averages around 1.2%, while other major currencies average between 0.5% and 1.0%.

So investing in cryptocurrency should be seen as part of a balanced portfolio that contains a mix of assets with different risk profiles.

If you’re interested in why is Bitcoin so volatile, we’ve got an article on that, here.

Now that we’ve cleared that up, let’s dig into the different types of cryptocurrency.

The different types of cryptocurrency

If you look at the biggest cryptocurrencies by market capitalization - the total value of the tokens currently in circulation multiplied by the current price - you’ll see a whole host of different projects that use tokens for different things.

So you’ll see Bitcoin, which is a cryptocurrency that can be used as a store of value, a medium of exchange, or a unit of account. This idea has long been debated, and we cover that debate, here.

Because Bitcoin is open-source, there are hundreds of currencies that use the same code Bitcoin is built on. Popular examples include Bitcoin Cash, Litecoin and Bitcoin SV. But they are not the same as Bitcoin. They have different tokens, different communities, and different features that the communities attached to them may have added on .

Another popular type of cryptocurrency - especially for investors - are stablecoins. These are currencies pegged to the value of something else, typically the US Dollar. Examples of these include Tether and USD Coin.

The reason why they’re popular with investors is they’re often seen as a stable on ramp into cryptocurrency, and often developed and deployed by companies regulated by financial authorities. What you buy for a dollar, stays at that price (generally speaking).

Additionally you have your utility tokens, these are essentially tiny slices of a product. One of the most famous is Filecoin, it’s FiL token provides users a way of accessing its decentralized storage. There are hundreds of utility tokens built on Ethereum, too. The price of utility tokens tends to fluctuate in relation to how much that token is being used for its intended purpose.

There are security tokens, too, but because the definition of these tokens is not a legal distinction, but rather a technical one, we won’t go into too much detail.

There are a whole host of other definitions: privacy coins, meme coins, governance tokens, the list goes on. But at this stage, what’s important to note is that the value of these tokens, and in turn what influences that value comes from different sources.

Some tokens will see increases in value when exchanges decide to offer them as a trading pair with a more well known token, like Bitcoin. Other tokens rise - and fall - in value when the projects that run them announce or change features. Some will respond to headlines, and others might be being manipulated by organised groups using the network to inflate value so they can sell off the tokens at a profit.

One of the core ideas to think about when it comes to crypto is that the community is relatively small, as is the money contained within them, especially when you put cryptocurrency alongside other asset classes, which are collectively worth $256 trillion.

That means that when a piece of news, or a movement of cryptocurrency from one token to another takes place, the effects of those movements are often larger than you’d see in other asset classes. Think of it as a large pebble being dropped into a small pond. There will be ripples.

What you should think about when choosing what to invest in?

First and foremost, it’s important to understand your appetite for risk. While 2020 has seen Bitcoin’s volatility stabilise, it’s still well above what you’d see in other asset classes and stocks.

But the good news is that the levels of sophistication around investing in crypto have come on significantly in the last 12 months.

While many crypto investors choose to buy and hold a single cryptocurrency in a wallet, there are now institutional investment grade products and services that can shield you from direct exposure to an asset’s performance, hedge the performance of one cryptocurrency with another, and even allow you to earn interest for taking part in a network, something we’ll be exploring in part two of our investment guide.

Feeling comfortable? You’re ready to take your first step. Head on over to AAX where you can make your first purchase and start your journey into crypto using the FastBuy feature.

Disclaimer:

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

Brought to you by AAX

Learn More about partnering with Decrypt.