Though Wall Street closed with a profit on Friday, the Dow Jones ended trading today with a fourth straight weekly red candle. Bitcoin, mirroring the stock market, also had a rough week after 15 days of recovery.

The US stock market’s main index, the Dow Jones, rose 1.34% after a rebound led by Big Tech companies, which allowed the market to recover part of this month's massive selloffs.

At the end of the trading session on the New York Stock Exchange, the Dow Jones rose 358.52 points to 27,173.96, driven by large listed companies such as Boeing (6.83%), Apple (3.75%), UnitedHealth (3.36%), and Microsoft (2.28%).

The S&P 500 closed with positive numbers, too. The index rebounded 1.6% on Friday to hit 3,298.46. Bitcoin performed similarly, remaining stable at $10,700 after its rebound on September 24th.

While scalpers and day traders can call it a day with positive returns, things look less favorable for those who hold longer-term positions.

The Dow and S&P 500 posted a weekly loss for a fourth straight week. The last time this happened was in August 2019 after a brief episode of financial panic. "Trade tariffs, retaliation, harsh rhetoric and recession warnings flashing from the bond market were issues that dominated the market this month," CNN reported at the time.

Bitcoin also followed the trend, at least for this week: The major cryptocurrency opened the week at $10,920 per token after two weeks of steady recovery from $10,200. However, its new position of $10,700 represents a 2% loss for the week.

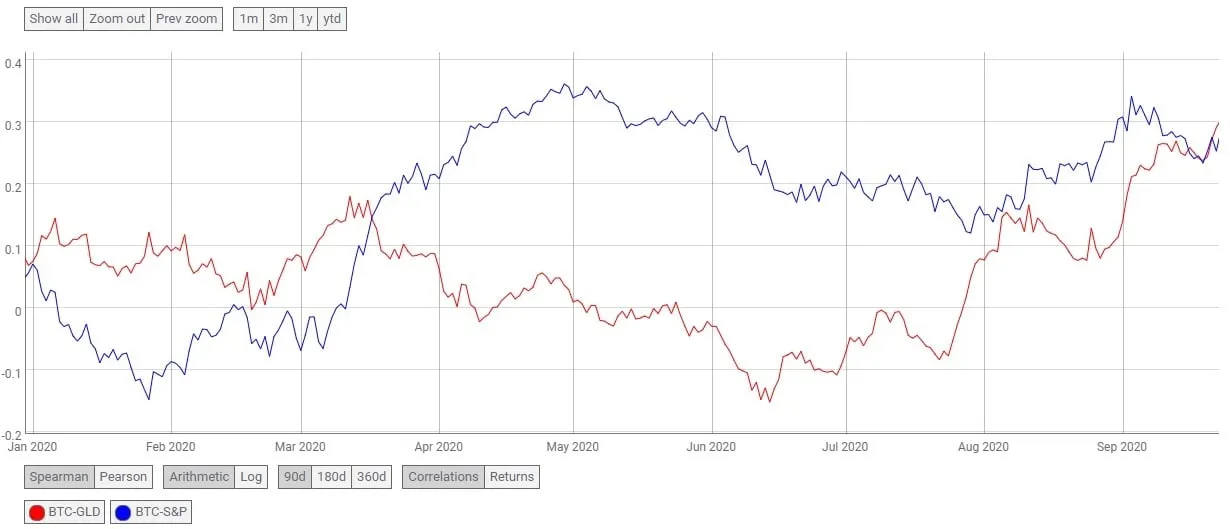

With that loss, Bitcoin’s price became a bit more correlated to the stock market. Though that correlation has dipped slightly in September, it is historically higher than it was toward the beginning of this year.

Interestingly, this week, for the first time since March 2020, the Bitcoin market began to look more like gold. Perhaps that's because some investors see Bitcoin as a store of value with stock prices dragging.