Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$65,314.00

-2.44%$1,913.26

-2.70%$612.50

-0.94%$1.34

-2.83%$0.999856

-0.02%$81.98

-3.44%$0.280235

-0.60%$1.029

-1.71%$0.090795

-3.76%$48.13

-3.59%$0.999947

0.04%$0.269907

-3.84%$432.83

-5.61%$9.08

2.21%$31.57

4.19%$338.41

-0.47%$0.161423

-5.70%$8.56

-3.14%$0.999108

-0.02%$0.152279

-3.74%$0.999576

0.02%$0.00907499

-2.78%$0.9998

0.02%$0.095982

-4.68%$52.64

-3.95%$8.87

-3.08%$212.70

-2.99%$0.871348

-4.06%$0.00000546

-5.49%$0.073934

-3.08%$5,340.91

0.83%$0.106312

-5.29%$1.20

-6.83%$5,427.93

1.23%$1.48

1.21%$1.51

-7.17%$3.69

-3.73%$0.635285

0.16%$1.00

0.00%$1.12

0.00%$0.999935

-0.01%$0.996231

-0.05%$0.700285

-1.95%$110.97

-1.15%$173.75

-4.11%$75.01

-2.31%$0.165279

-4.05%$0.066136

-2.38%$2.14

-0.93%$1.00

0.02%$1.12

-2.98%$0.00000339

-7.32%$0.00000151

-3.25%$0.999105

-0.04%$8.33

-3.71%$2.35

-4.22%$0.248253

-5.26%$11.00

0.00%$6.87

-1.32%$0.00185043

-2.02%$0.102713

-4.90%$0.377982

-4.70%$7.48

-4.31%$0.0171627

-3.41%$0.056582

-2.57%$1.68

-5.77%$61.58

-3.55%$1.77

-4.47%$0.840678

-1.56%$0.999532

0.03%$0.10106

-3.72%$1.23

-0.49%$0.02927409

-2.64%$0.00919509

-2.50%$3.36

-1.96%$114.44

0.00%$0.084244

-3.94%$1.028

0.00%$0.999695

-0.06%$0.944555

-5.03%$0.90957

-5.20%$1.12

1.20%$1.32

-7.21%$0.03277338

5.23%$0.03220618

-2.90%$0.080088

1.37%$0.00701204

-4.00%$0.096279

-2.73%$1.096

0.00%$0.996447

0.02%$0.160784

0.20%$0.555164

-7.04%$1.00

-0.03%$29.48

-2.48%$0.0128579

-0.18%$0.0000057

-4.42%$0.998882

0.00%$1.088

-0.13%$0.9999

0.00%$1.18

-0.04%$0.248915

-4.61%$0.0668

-1.38%$187.40

5.43%$0.247396

-5.62%$0.678773

-3.58%$1.28

-2.15%$0.04719591

-2.05%$0.00655133

-6.78%$31.28

-4.91%$0.365478

-4.30%$1.00

0.03%$1.78

-5.57%$0.487899

-2.79%$0.999618

-0.01%$1.73

-1.83%$0.236543

-4.61%$0.079123

-2.71%$1.35

-2.79%$0.03266043

-4.47%$1.018

-0.02%$0.148083

-5.29%$0.00000034

0.48%$124.38

-1.23%$0.00000033

-0.19%$3.35

-2.01%$0.053174

-3.79%$0.337401

-2.87%$0.857616

-7.91%$14.93

-5.66%$2.95

-4.60%$0.01512496

-3.28%$0.31145

0.27%$0.998588

0.22%$14.70

11.25%$0.064972

-3.85%$0.309251

-4.70%$0.991773

-0.76%$17.38

-1.77%$0.04716418

-3.63%$0.02512193

-4.33%$0.00534789

-4.95%$0.227625

0.25%$5.91

5.02%$0.00002674

-5.35%$1.57

1.92%$0.118975

-1.47%$0.294321

-3.70%$0.071356

-6.47%$0.00250979

-4.85%$0.00240796

-1.16%$0.04610549

-5.82%$0.00004246

-8.72%$1.24

-6.20%$0.124513

0.03%$0.998303

-0.26%$1.81

-0.58%$0.02070473

-1.30%$0.991729

-3.97%$5.83

-5.47%$0.999857

-0.01%$0.984022

0.00%$0.999523

-0.04%$0.03937563

-5.36%$0.08092

-3.57%$0.095564

-3.79%$1.076

0.00%$0.000001

0.25%$1.24

-5.95%$22.79

0.00%$1.24

-3.00%$0.477377

-3.82%$0.097513

-4.13%$0.00199649

-5.57%$1.00

0.00%$5,007.87

0.02%$0.187661

5.54%$0.051798

-0.77%$0.185604

-4.54%$0.078541

-3.98%$0.186302

-3.94%$0.182126

-3.52%$0.246652

-16.38%$0.093247

-3.66%$2.56

-4.86%$1.00

0.00%$0.998971

0.01%$0.00464548

-4.21%$0.01814932

-4.85%$2.08

1.59%$17.27

-4.56%$0.073924

-6.77%$1.80

-0.06%$0.02015971

-1.17%$2.08

-5.32%$0.051822

-2.38%$48.01

0.00%$0.00341199

-5.24%$0.995896

-0.26%$1.27

1.02%$0.157388

-11.29%$0.576199

-5.78%$1.67

-4.97%$3.28

-5.29%$0.1007

-6.37%$0.0207805

-4.52%$1.001

-0.23%$0.149675

-9.15%$0.03845428

-3.60%$0.9984

0.01%$0.315738

-2.61%$0.00000695

-3.12%$0.388774

-2.80%$0.136197

1.22%$1.014

-0.14%$0.587036

-4.83%$0.246128

2.98%$0.156549

-4.64%$0.131206

-2.94%$1,096.61

0.00%$0.283128

-4.58%$0.613309

-4.21%$0.074979

0.69%$0.255829

-2.33%$0.089661

-4.00%$4.27

-4.65%$0.076818

-4.71%$0.130549

0.07%$0.02164209

1.07%$0.302279

1.29%$1.001

0.00%$10.88

-2.71%$0.00388776

1.84%$0.240518

-2.63%$0.00140677

-2.32%$1.08

-0.05%$0.205953

-3.94%$1.46

-7.38%$0.257565

-5.02%$0.999643

-0.05%$0.999629

-0.04%$0.999188

0.06%$0.99944

-0.00%$1.002

0.15%$1.063

-0.06%$0.111722

1.58%$2.25

-3.72%$0.994359

-0.09%$0.173697

-5.64%

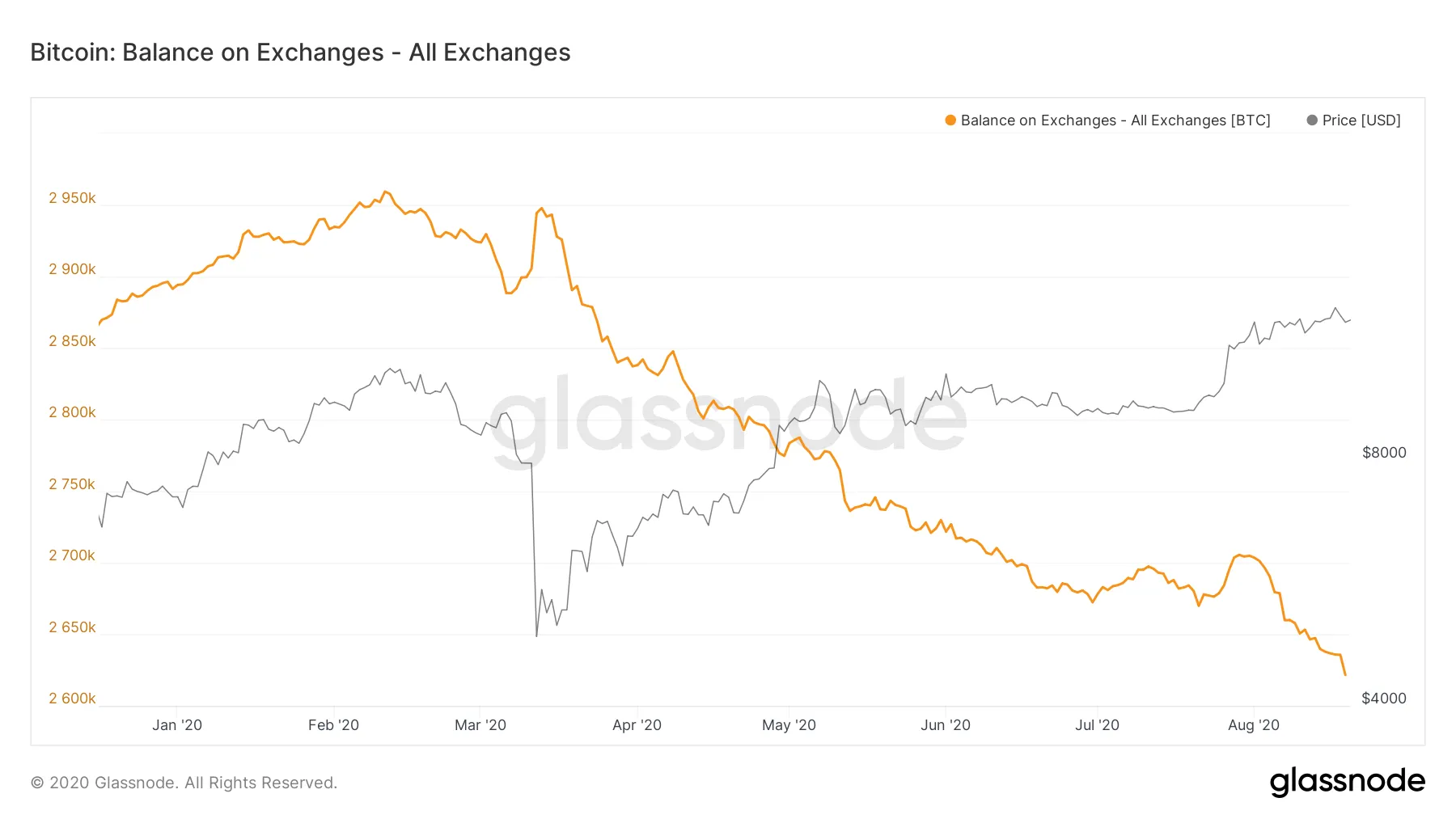

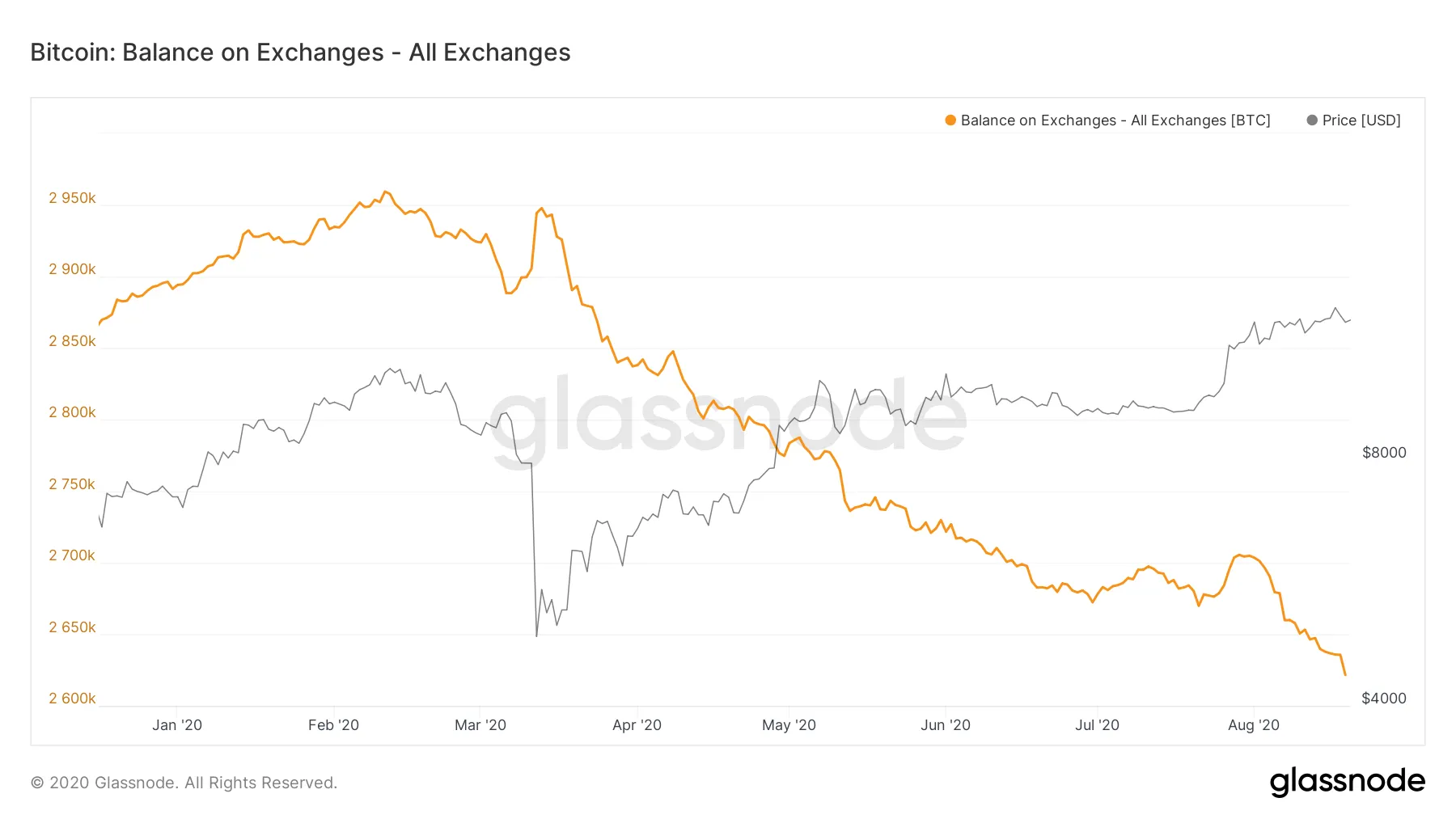

The amount of Bitcoin sitting in cryptocurrency exchange wallets has now fallen to its lowest value since November 2018, as pointed out by Unfolded.

As of yesterday, around 2.62 million BTC was currently held in exchange addresses, equivalent to just under 14.2% of the total circulating BTC supply. The number of Bitcoin held in exchange wallets has been on a downtrend since February 2020, after briefly reaching an all-time highest value of over 2.95 million.

Although the amount of BTC held on exchanges has dropped by more than 10% in the last six months, the dollar value of the amount remaining has dramatically increased over the same time period. Despite Bitcoin briefly dropping to an average value of $4,860 on March 12, it has since recovered to $11,758 as of yesterday.

Because Bitcoin has improved in value by more than 240% since March—even though exchanges now hold 10% less Bitcoin over the same time period—the absolute dollar value of Bitcoin held on exchange has still more than doubled since March.

The overall interest in Bitcoin trading has also reduced in recent months, as the average Bitcoin trading volume has fallen from a 2020 peak of over $60 billion per day in mid-March, down to just $22 billion today—a reduction of almost two thirds. This may indicate Bitcoin holders are now adopting a wait and watch approach as a result of the prevailing bull market, sitting on their funds instead of trading.

According to IntoTheBlock's wallet tracker, around 89% of Bitcoin holders are currently in profit—since they received their Bitcoin at an average value that is lower than its current value. Conversely, just six percent of holders are out of the money, which means they bought at an average value higher than it is today.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.