Following in the footsteps of two major partnerships, namely Bakkt and Komgo SA, a new company has decided to step into the crypto game. The 72-year-old firm Fidelity Investments–which has 13,000 clients and $7.2 trillion under administration–has announced the launch of Fidelity Digital Assets. Investors will be able to store their crypto assets in Fidelity’s cold-storage vaults. I mean, what’s the point of having Bitcoin if you can’t trust it with a third party?

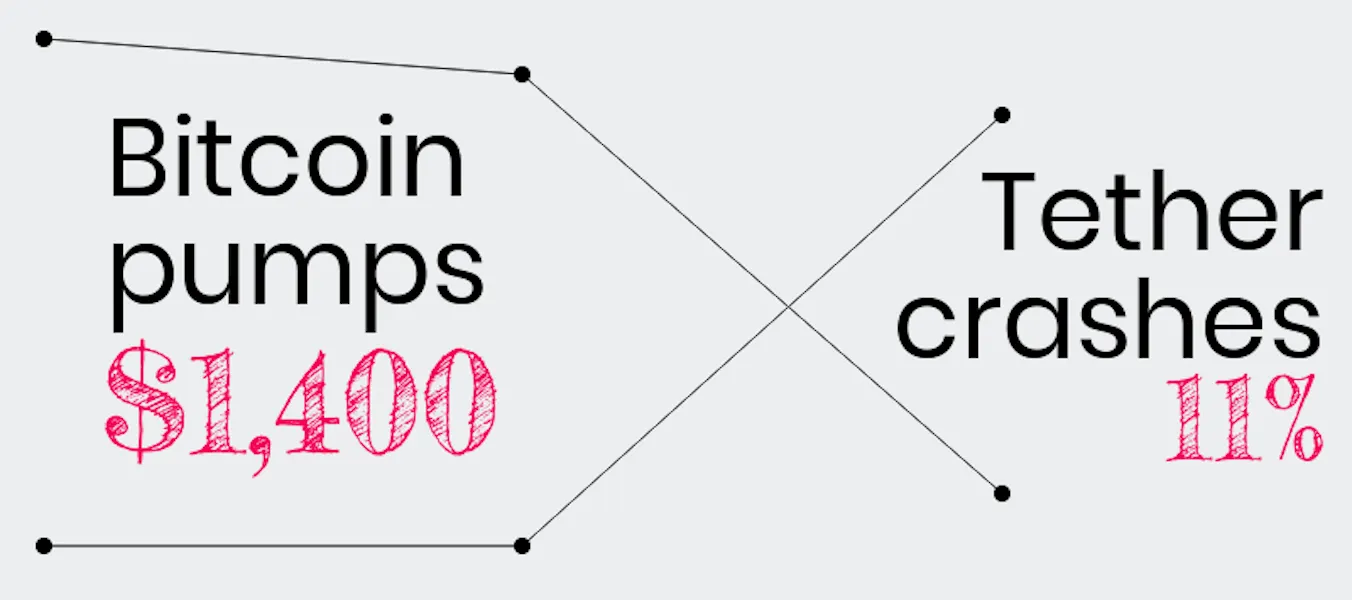

Until Monday, Bitcoin had been trading so flat some analysts had started calling it a stablecoin. Then, in an ironic twist, the most-used stablecoin, Tether, rocked the market by losing its peg to the US dollar and falling 11% to be worth $0.89. This had an opposite effect on Bitcoin’s price, causing it to pump $600 on most exchanges and $1,400 on those that traded against Tether. As traders jumped ship to other stablecoins, this knocked them off their pegs, too. Gemini, owned by the Winklevii causing Gemini Dollar to reach $1.19, making it an expensive dollar.

While Bitcoin was doing its thing, it was another rallying week for decentralized exchange protocol 0x which landed on not just Coinbase Pro, but Coinbase itself. It shot up a whopping 47% following the news. The coin has a had a rocky 2018 and is down 68% from its all-time high but up 118% from its lowest point earlier in the year. The key takeaway is that Coinbase has opened the door to adding ERC-20 tokens, which has been its intention for a while. However, number three ranked cryptocurrency by market cap, XRP, is left wanting to ascend to Coinbase heaven.