In brief

- Bitcoin remains trapped in bearish territory below the death cross with weak momentum despite reclaiming $90K.

- Meanwhile, GameFi tokens lead crypto gains, outpacing Bitcoin's sideways grind.

- Axie Infinity (AXS) surged 131% this week, and more than 250% in the last month.

While Bitcoin struggles to break out of a multi-month consolidation pattern, trading in the $90,000 zone with bearish charts intact, a different corner of crypto is absolutely ripping. GameFi tokens are posting double-digit gains this week, led by a stunning 131% weekly surge in Axie Infinity and a very solid bounce by The Sandbox.

The broader market backdrop is wild. Gold pierced $4,900 per ounce for the first time ever on Thursday, while silver broke past $99—both metals hitting all-time highs as investors rotate out of risk assets.

The S&P 500 is headed for its second consecutive weekly decline after President Donald Trump's Greenland rhetoric and proposed E.U. tariffs sparked a sell-off earlier this week. Goldman Sachs is now calling for gold to hit $5,400 by year-end as the "debasement trade" accelerates.

Bitcoin (BTC) price: Death cross deadlock

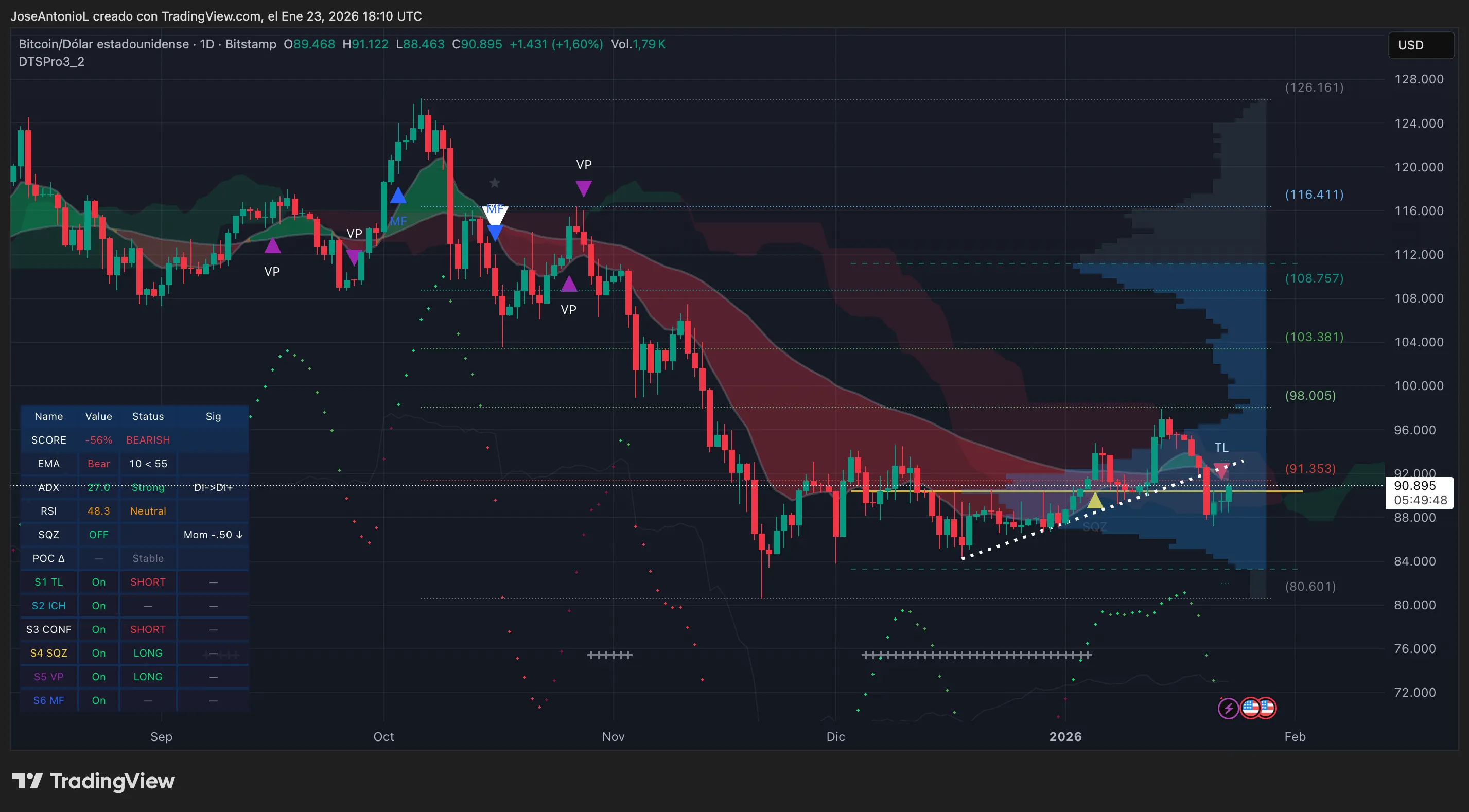

Bitcoin is up a modest 1.6% today, trading at $90,895 after bouncing from Wednesday's lows around $88,000. That sounds fine on the surface, but the technicals show weakness and indecision among bulls, especially those betting on long-term plays.

The most glaring issue is the bearish pattern that traders refer to as a “death cross,” which formed on Wednesday after invalidating a “golden cross” attempt that only lasted a few days. When the average price of Bitcoin over the last 50 days (also known as the 50-day EMA, or EMA50) sits below the 200-day average, that forms a death cross—a bearish configuration that typically signals downward pressure or at minimum extended sideways action. A golden cross is, well, the opposite of that.

For context, when a faster-moving average crosses below a slower one, it suggests that recent price action is weaker than the medium-term trend, and traders usually interpret this as a sign that momentum has shifted to the bears.

What makes this especially concerning is that Bitcoin is trading right around $90,895, which sits below both EMAs. The 50-day EMA is acting as immediate resistance near the Fibonacci level of $91,353. (These are natural supports and resistance zones that form organically in established trends.)

Bulls need to reclaim these moving averages decisively to flip the narrative—but so far, they haven't been able to hold above them for more than a few days at a time.

Meanwhile, Bitcoin’s Relative Strength Index, or RSI, sits at 48.3, smack in the middle of neutral territory. RSI measures buying and selling pressure on a scale of 0 to 100, with readings above 70 considered overbought and below 30 oversold. At 48.3, Bitcoin is showing neither strong buying momentum nor capitulation selling, but still suggests a slightly bearish mood among traders.

Axie Infinity (AXS) price: The GameFi moonshot

Now let's talk about the complete opposite of Bitcoin's deadlock: Axie Infinity, which trades as AXS, is absolutely ripping.

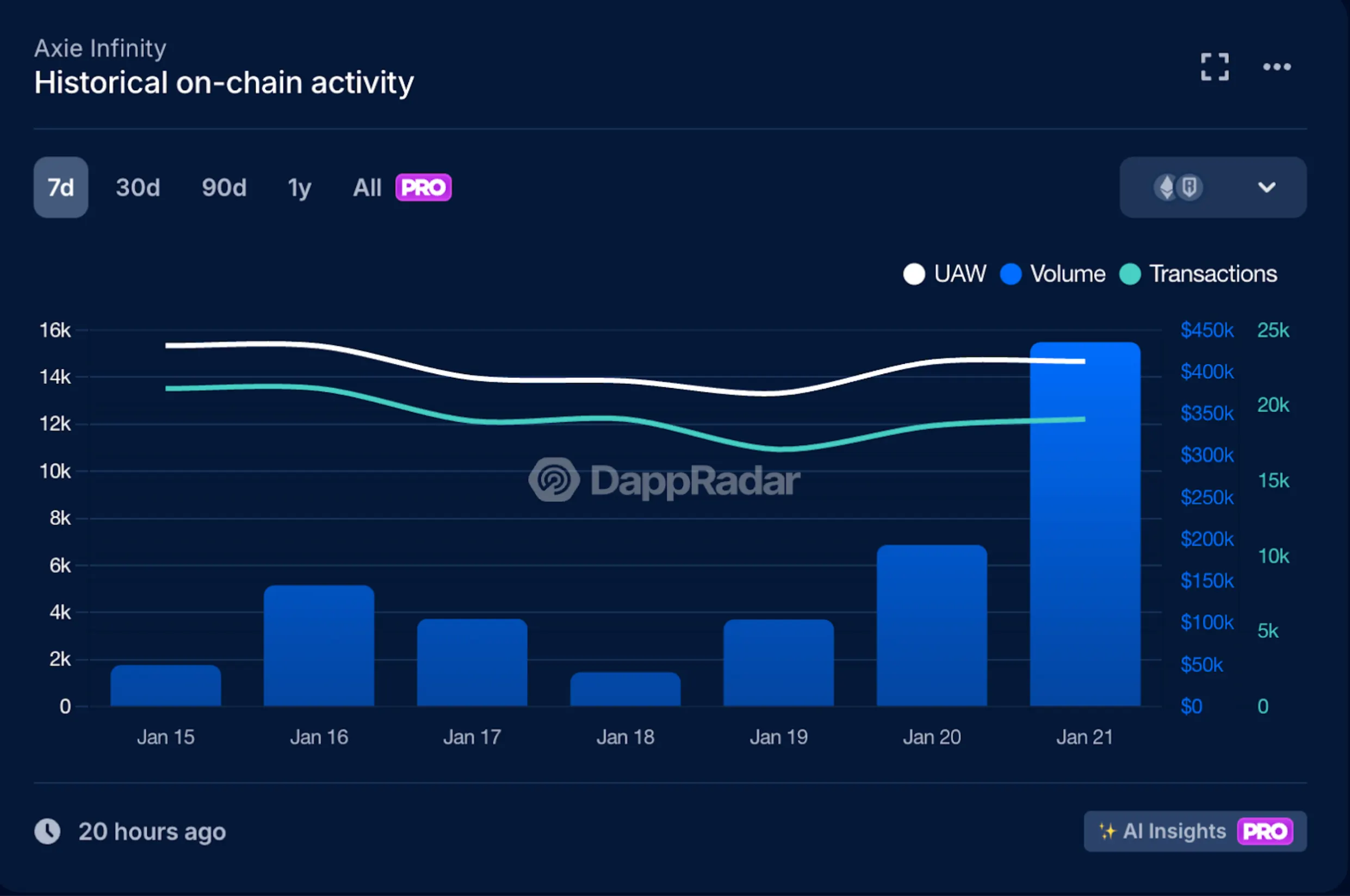

AXS, the reward token that powers the Axie Infinity game, is up 7.6% today alone, trading at $2.88, and has posted a mind-bending 131% gain over the past week and a 251% jump in the past month, all in the middle of a bear market. This is the kind of move that reminds people why they got into crypto: The token has gone from complete irrelevance to suddenly becoming one of the hottest crypto assets in the entire market this week.

It seems Axie Infinity is pumping hard lately due to a mix of factors: bullish news from the creators of the Axie Infinity game, Sky Mavis, and traders chasing those gains with price momentum that’s now reignited interest in the token.

Sky Mavis earlier this week launched Origins Season 16 with a new reward system built around bAXS, a non-transferable token backed 1:1 by AXS that reduces immediate sell pressure and discourages bot farming, signaling a more sustainable in-game economy.

The update triggered a surge in trading volume, a recovery in daily active users, and heavy whale accumulation, while broader GameFi tokens are rallying as capital rotates out of a stagnant Bitcoin market.

Of course, the hype around the Axie Infinity game died a long time ago, and the AXS token is still down almost 99% from its all-time high four years ago, at the peak of the crypto gaming fervor. So, anyone who bought AXS anywhere near the top probably couldn’t care less about the “pump” right now.

But for those who may have clairvoyantly bought Axie in the last month or so, the gains have been substantial.

The technical setup on the AXS charts here is the polar opposite of Bitcoin. AXS is showing extremely bullish signs across multiple indicators, suggesting this coordinated move may have some momentum behind it.

Let's start with the Average Directional Index, or ADX, which reads 50—more than double Bitcoin's 27.0 and well into "very strong trend" territory. ADX measures trend strength, regardless of direction, on a scale from 0 to 100. Scores above 25 indicate a clear trend, and readings above 40 are considered extremely strong. At 50, AXS is showing powerful directional movement, and unlike Bitcoin, this trend is pointing straight up.

The exponential moving averages paint a bullish picture too. The token entered a golden cross last week. More importantly, price is trading above both moving averages, meaning bulls are firmly in control and the EMAs are providing support rather than resistance on any pullbacks.

But there are some potentially dangerous signals for latecomers. The Relative Strength Index is at 82.4, deep into overbought territory. RSI above 70 is generally considered overbought, meaning buying pressure has been so intense that a pause or pullback becomes more likely. At 82.4, AXS is flashing bright red warning signs that it's due for a breather.

Combine this with a 131% spike and it may take some guts to put in a long position right now expecting good results without a major correction.

Looking at the chart, AXS has broken out of a massive descending channel that had contained its price since early 2024. After months of lower highs and lower lows grinding Axie’s price down from $4+ to around $1.00, the breakout above $2.00 represents a major shift in market structure. The token is now marking higher highs and higher lows—the definition of an uptrend.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.