Kids playing too much Fortnite? Maybe you should get them into high-stakes crypto trading instead. Or so says Pigzbe, the developer behind the new crypto wallet for children, aged six and over. Just what they need, right?

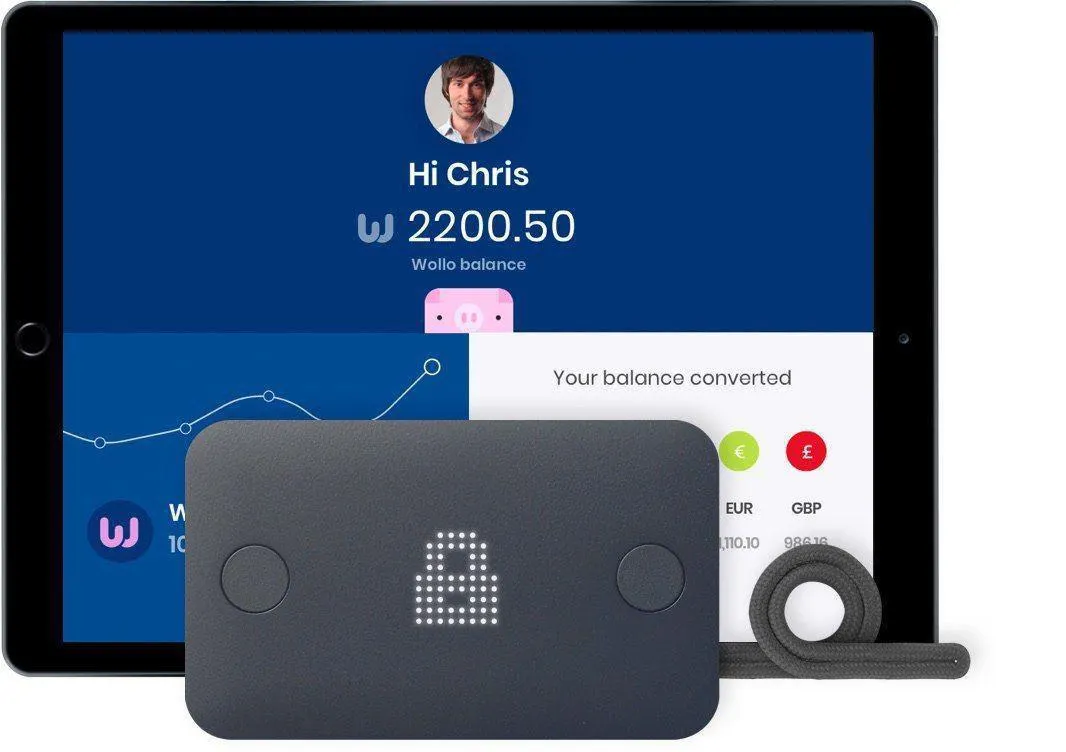

The company wants to help the world's two billion children brush up on peer-to-peer exchange trading, settlement risk, and price fluctuation in a “family friendly way.” Family friendly how exactly? Well, Pigzbe’s native wallet (pictured below) syncs with a regular iPad, giving children access to a game featuring a porcine Squircle that teaches them everything they need to know about the world of crypto finance.

The real learning experience, however, is toying with Pigzbe’s native crypto token “Wollo,” which sells for 12 cents a pop ($6.1 million of which have been sold in Pigzbe’s ICO so far). Pigzbe's hope for the token, says CEO and founder Filipo Yacob, is that it will provide families with an “exciting and non-threatening entry point into the world of cryptocurrencies." Parents buy tokens, deposit them into their children’s digital wallets, and, next thing you know, wee Billy is inexorably on course to becoming a Wollo hedge-fund manager.

But like any crypto asset, Wollo only acquires its value when converted to fiat on an exchange. To this end, Pigzbe currently has support from BitFinex, and is hopeful of partnerships with others. On top of that, Pigzbe has a “point-of-sale” card in the works, which—according to Yacob—will let kids transact in “real-world stores,” meaning your bright-eyed princess will have to comply with anti-money laundering laws if she wants to buy a My Little Pony bracelet with her digital cash.

Now, I don’t know about you, but when I was a young lad, I didn’t store more than $1.37 at a time in my regular piggy bank. So unless little Timmy is flogging illegal weapons to Saudi Arabia, who cares if his allowance is decentralized?

A “Piggy-banking paradigm shift.”

The hard sell here, it seems, is that crypto-adoption is inevitable, and your kids will be destitute if they don’t figure out how to margin trade before they’re seven. The purpose is to “future-proof financial education for the 21st Century,” says Natasha Nicolovski, a spokeswoman.

Yet perhaps Pigzbe is an omen that the “put it on a blockchain” craze has reached its upper limit. It seems disingenuous to frame the piggy bank, that innocent repository for candy money, as another insidious corporate monopoly ripe for disruption. But this Pigzbe does anyway, branding the classic piggy-bank model (buy a ceramic pig, put money in it, smash it when you want an ice cream) “outdated” and calling its product a shift in the “piggy-banking paradigm.”

This “shift,” explains John Galpin, Pigzbe's CMO, is needed because money, as we know it, has become an “abstract concept for children,” and that “teaching them with physical coins […] doesn't reflect the reality of the society they live in.”

Won’t somebody think of the children!?

As with all cryptocurrency, there may be security risks. What if, for instance, a Pigzbe version of Mt. Gox occurs, and 12 year olds the world over are fleeced out of their collective $24.94?

This wouldn’t matter, says Galpin. Ultimately, Pigzbe is a “financial literacy product, as opposed to a savings product.” Even a ruinous Wollo bear market, he says, wouldn’t affect the “learning.” So when the Wollo price plummets to zero and all those third graders have to remortgage their lemonade stands? That's when the real learning experience begins, kids.

Read Next: A Mombasa slum looks to digital currency to escape poverty