Donald Trump's election victory and promised crypto-friendly policies could accelerate digital asset adoption in Latin America, where stablecoins and Bitcoin already serve as inflation shields and remittance channels for millions, experts say.

Regional exchanges are reporting a spike in crypto activity as the President-elect's pro-Bitcoin stance resonates in inflation-hit economies.

The president-elect's pledge to establish a national Bitcoin reserve and ease regulatory burdens arrives as Latin America emerges as a key growth market, processing over $85 billion in crypto transactions annually, according to Chainalysis data.

Regional players see Trump's win as a potential catalyst for increased institutional adoption and cross-border flows.

“Trump's second term in the White House could further boost the crypto market, giving room for further appreciation,” Sebastian Serrano, CEO of Argentina-based exchange Ripio, said in statements shared by Cointelegraph. “We are observing a decisive period for Bitcoin and the cryptocurrency market as a whole.”

The implications could be particularly significant for countries battling currency instability.

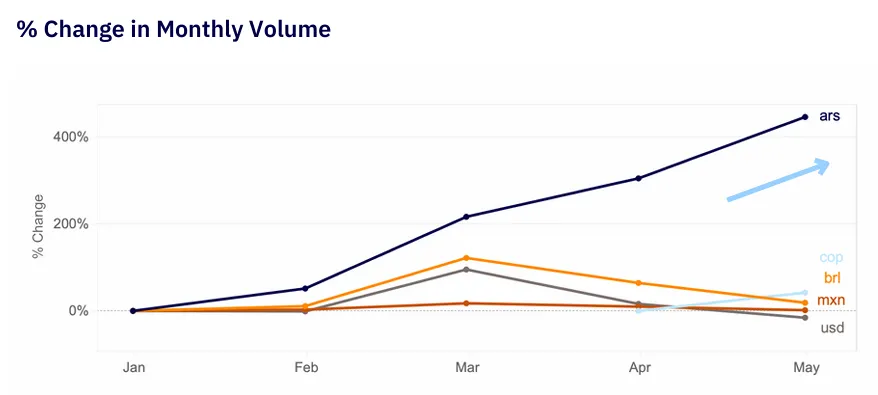

In Argentina, where the poverty rates spiked to over 53% under Milei’s libertarian administration, Bitcoin trading volumes surged 160% in October—and more than 400% in 2024— as users sought refuge from devaluation. Venezuela shows similar patterns, with over 92% of crypto activity flowing through centralized exchanges as citizens seek alternatives to the bolivar.

Regional crypto firms are already positioning themselves for potential growth. Lemon Cash, which recently expanded to Peru, reported processing over $20 million in local currency transactions in its first three months.

"Clear U.S. regulations could help us accelerate adoption across more LatAm markets," said Marcelo Cavazzoli, Lemon's CEO, in an interview with Decrypt en Español.

“Donald Trump's victory gave (crypto) an additional boost, as his campaign showed clear support for the sector,” Cavazzoli added, “Trump put forward policies to incentivize Bitcoin mining in the United States, aligning with the growing interest in the crypto market. This was especially reflected in Argentinean and Peruvian users, who began accumulating Bitcoin at the end of October.

Cavazzolli told Decrypt that Bitcoin trading volume hit a record on November 6 in Argentina, with Peru also seeing a 160% in trading activity vs the day prior.

Some regional players, however, caution that Trump’s campaign promises, while encouraging market sentiment, still need to address the fundamental changes facing LatAM’s crypto ecosystem and don’t solve the true needs of the crypto industry.

"The regulatory shift helps, but we still need to solve fundamental infrastructure challenges," noted Matías Reyes from TruBit exchange in an interview with Decrypt en Español. "Cross-border settlement and banking relationships are crucial for our region."

Latin America's unique combination of high crypto awareness, challenging monetary conditions, and significant remittance flows positions it to potentially benefit from Trump's crypto agenda. Regional exchanges report growing institutional interest as regulatory clarity improves.

"We're seeing increased inquiries from traditional financial players," said Hongyi Tang of TruBit. "U.S. policy shifts could accelerate this trend by providing clearer frameworks for banks and payment providers."

For a region where centralized exchanges handle over 60% of transaction volume—significantly above the global average of 48%—reduced regulatory friction could unlock new growth. Brazil, Argentina, and Mexico already rank among the top 20 countries globally for crypto adoption.

The prospect of a Bitcoin-friendly U.S. administration comes as Latin American countries grapple with their own regulatory frameworks. Argentina's CNV is finalizing rules for virtual asset service providers, while Brazil implemented comprehensive crypto legislation in 2023 and is expected to launch its blockchain-based CBDC next year.

"Regional regulators watch U.S. policy closely," explained Alfonso Martel Seward from Lemon Cash. "A more accommodating U.S. stance could influence local frameworks, especially around stablecoins and exchange operations."

As Trump prepares to take office, the US-Latin America crypto market—currently processing around $300 million in daily transfers—stands at a potential inflection point.

Whether Trump’s campaign promises translate into policies that benefit regional adoption, drifting away from what he did and said on his first mandate, remains to be seen, but local players are cautiously optimistic.

Edited by Sebastian Sinclair and Josh Quitter. Marco Lanz contributed to this story.