Centralized crypto exchanges are slowly losing ground to their DeFi counterparts, according to an in-depth data analysis conducted by Decrypt.

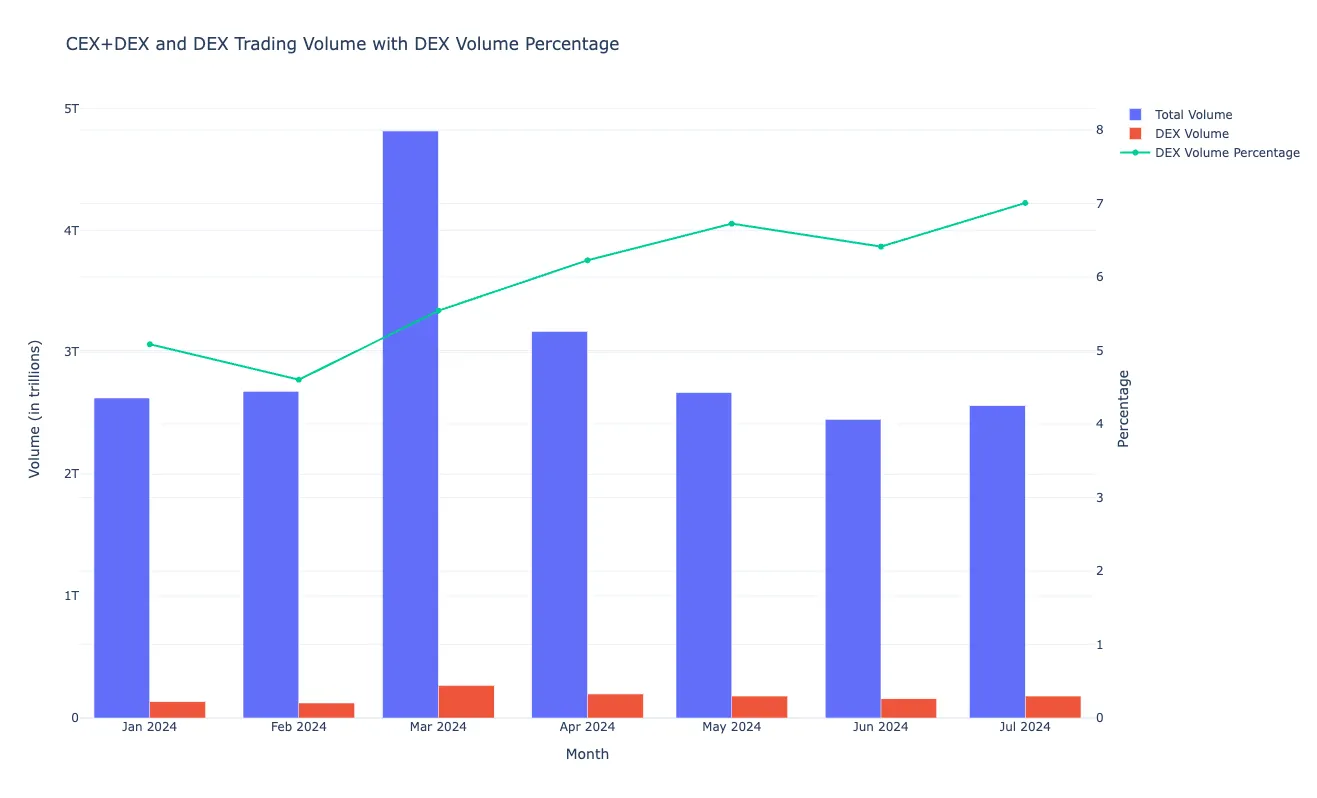

DeFiLlama decentralized exchange (DEX) volume data and CoinGecko total cryptocurrency trading volume data shows that the percentage of crypto trading volume that happens on DEXs compared to total trading volume went from 4.6% in February to over 7% this month. This is an increase of the DEX-fueled trading volume portion of over 52%.

Messari senior research analyst Kunal Goel told Decrypt that multiple factors are fueling the DEX market share growth. He cited “the growth of meme coins and long-tail assets” as one reason, explaining that they tend to be listed on DEXs first and don't appear on centralized exchanges until much later—if they last that long.

“Onchain UX has improved with low fee, high throughput on Solana and Ethereum L2s” he added, highlighting the progress making decentralized finance (DeFi) solutions increasingly easy to use.

DeFiLlama data further shows that in the past 24 hours, DEX volume accounted for 22% of all trading volume. The crypto price aggregator notes that this percentage is meant to represent the dominance of decentralized exchanges over aggregated decentralized exchanges and centralized exchanges.

So far in 2024, DEX volume has seen a slow and steady increase.

It went from $133.5 billion in January to $179.5 billion this month, showing an increase of roughly 34%. This year’s high was reported in March, when both CEX and DEX volume saw a major uptick to $4.8 trillion and $266.89 billion respectively.

Goel noted that at the time “Bitcoin hit fresh all-time highs in March and trading activity is typically positively correlated with price and sentiment.” Looking into the future, he expects centralized exchanges to move on-chain and disrupt their own business model before others can. He added that “Base and BNB Chain are the prominent examples.”

And there's reason to believe that an increasing amount of volume will be funneled through decentralized, not centralized, exchanges, Joseph Schiarizzi, CEO of stablecoin protocol Open Dollar, told Decrypt.

"My spicy take is that over time it becomes easier to launch stablecoins, easier to launch forks of DeFi tokens/protocols, etc.," he said. "Every day there are exponentially more tokens creating a longer and longer tail of assets. CEX's cant keep up now and they will only lag behind more and more."

TradingView also shows a DeFi market cap dominance chart, in percentage. Currently at 3.86%, it has fallen from 4.47% on Jan, 1 and reported a 2024 high of 4.81% on Feb. 25. Goel noted that this is unexpected since “DEX volumes are a key driver for DEX value so it is a little contradictory.”

The other factor to consider is the cost projects pay to get listed on exchanges, said Schiarizzi.

"The other side is it costs $50-100k or more for CEX listing fees, but uniswap or camelot or other DEX's are basically free to list tokens on using an L2 like arbitrum," he said.

In traditional finance, companies pay a fee to the exchange to have their securities—like shares, bonds, or other financial instuments—listed and traded. That's been carried over to centralized crypto exchanges, but not their DeFi counterparts.

DeFi is a catchall term for a group of financial tools built on a blockchain—this includes DEXs, exchanges operating mostly on-chain. The primary purpose of DeFi is to allow anyone with internet access to lend, borrow and bank without going through middlemen.

Similarly, the primary purpose of DEXs is to allow anyone with internet access to trade or even provide liquidity in exchange for an interest. DeFi and DEXs are one of the major areas of focus of dapp (decentralized application) development, which have seen considerable adoption this year.

Editor's note: This story was updated to add comments from Open Dollar CEO Joseph Schiarizzi.

Edited by Stacy Elliott.