$68,612.00

-0.43%$1,987.61

-2.06%$634.58

-0.80%$1.37

-2.38%$0.999996

-0.00%$85.40

-2.22%$0.280786

-0.56%$1.034

-0.08%$0.089798

-5.99%$49.63

-1.15%$0.267077

-4.89%$1.00

0.00%$443.13

-0.76%$9.18

1.62%$32.25

-0.60%$342.07

-1.38%$8.85

-1.94%$0.158911

0.25%$0.99959

0.04%$0.152513

-3.60%$0.999792

0.03%$0.00919138

0.54%$54.91

0.47%$1.00

0.02%$0.097277

-2.82%$9.25

0.07%$219.77

0.02%$0.914037

-2.44%$0.0000055

-2.66%$0.075705

-0.44%$1.24

1.09%$0.104477

-4.13%$5,105.17

-3.39%$1.54

-0.07%$5,151.23

-3.43%$3.88

-0.93%$1.35

-9.81%$0.69194

7.54%$1.00

0.00%$1.12

0.05%$1.39

4.62%$0.999957

-0.01%$182.83

-2.46%$0.997384

0.03%$0.699373

0.54%$110.12

-11.33%$0.070774

0.11%$0.169793

0.28%$76.04

-1.48%$0.999875

-0.00%$2.12

-1.33%$0.00000346

-3.98%$0.00000158

-0.61%$2.43

-0.07%$8.54

-3.28%$0.9993

-0.00%$0.25596

-2.31%$11.01

0.03%$0.395445

-4.76%$0.0019209

-4.12%$6.95

-0.71%$0.101498

-0.55%$1.94

1.50%$7.73

0.06%$0.060854

1.64%$1.12

-0.07%$0.11168

-2.30%$62.87

-1.49%$1.81

-2.30%$0.01581707

-4.66%$0.864746

-0.35%$0.999955

0.00%$0.03030732

0.13%$1.22

-0.70%$3.42

-2.04%$1.011

3.93%$0.00923735

-1.66%$0.087002

-2.07%$1.003

0.62%$114.46

0.02%$1.028

0.06%$1.001

0.04%$1.35

-2.20%$0.03544503

6.82%$0.18027

1.00%$0.00719589

-2.44%$0.103375

-0.39%$0.079577

-0.31%$0.02948389

-8.61%$0.99991

-0.01%$1.096

0.01%$1.00

0.38%$1.00

-0.02%$0.00000598

-2.21%$29.43

-3.64%$0.01280132

0.46%$0.999825

-0.12%$0.746145

-4.76%$0.25865

-0.34%$1.088

-0.11%$1.16

-0.66%$0.999913

0.02%$0.067216

-3.13%$1.35

-0.47%$0.00700939

-3.28%$0.04858543

0.87%$33.89

-2.42%$0.379373

0.40%$0.226649

-3.61%$0.411849

-24.88%$165.30

-3.38%$0.51936

1.57%$0.03686897

5.58%$0.255598

0.44%$1.86

-0.37%$0.999414

-0.04%$18.62

32.35%$0.999869

-0.00%$0.082309

-2.04%$130.31

-2.04%$0.149548

-1.87%$1.32

-4.66%$1.02

0.04%$0.00000033

-0.43%$0.00000033

-3.19%$0.345239

-1.20%$0.054001

-2.32%$3.24

-1.63%$0.065249

-1.71%$0.329301

-2.88%$3.06

-2.44%$0.01581466

-0.23%$15.01

-2.22%$0.843226

-2.33%$0.331041

-1.24%$0.997746

-0.16%$0.392089

-5.59%$0.066196

-2.71%$0.02623273

0.12%$0.04878575

-3.16%$6.25

-21.06%$0.00554775

0.57%$0.00002842

-0.89%$0.994102

-0.06%$0.127294

0.42%$0.232575

-2.98%$17.17

-1.43%$0.306613

-1.38%$1.58

-1.30%$0.073669

-2.30%$0.113168

9.43%$0.04827299

-2.43%$1.087

9.02%$0.00256066

-3.41%$0.00004396

2.46%$0.00240679

-0.94%$1.26

-2.73%$1.86

-1.55%$6.00

-2.97%$0.085089

-1.56%$0.999092

0.05%$0.12458

0.76%$0.02059673

-4.02%$0.04038653

-2.84%$0.984022

0.00%$0.00000103

2.60%$1.00

0.02%$1.076

0.01%$1.28

-2.86%$1.24

-3.22%$22.75

-0.18%$0.490117

-0.47%$0.203607

0.52%$0.00204963

0.00%$0.195657

1.05%$0.193776

-0.66%$0.097987

-0.09%$1.00

0.00%$0.096903

-2.38%$0.05214

-1.74%$0.189463

-2.08%$4,906.95

-0.92%$0.182249

7.99%$2.57

-3.81%$1.00

0.00%$0.079245

-1.49%$0.074382

-6.51%$0.00462282

-2.71%$0.01873145

-1.84%$0.054916

-0.35%$2.18

-0.97%$0.02089807

-0.44%$1.00

0.01%$0.00355502

-1.22%$17.23

-4.18%$0.307076

-0.97%$1.80

-0.56%$3.53

2.40%$2.04

1.07%$0.16385

0.82%$1.78

-0.44%$48.01

0.01%$0.596788

-1.80%$0.994592

-0.04%$0.105477

-0.09%$0.04149061

1.10%$1.25

0.48%$0.02103816

-1.18%$1.002

0.46%$0.410973

0.71%$0.143308

1.13%$0.998392

-0.00%$0.00000707

-3.53%$0.311934

-1.32%$0.279527

0.58%$0.162978

-2.20%$0.295357

4.10%$0.077693

2.32%$1.013

-0.06%$0.094479

-1.21%$0.579492

-5.14%$0.621754

-1.18%$1,096.39

0.03%$0.130302

-4.10%$0.077551

-3.56%$4.25

-5.11%$0.221551

1.31%$0.130516

-0.10%$11.09

-1.22%$0.247207

-0.98%$0.275492

-2.12%$0.300775

0.02%$0.0212852

-2.87%$0.189618

1.80%$0.00143821

-0.89%$1.081

-0.06%$1.003

0.16%$0.00387442

-3.00%$0.381149

-0.86%$0.998566

-0.09%$2.31

-1.90%$1.028

5.71%$1.00

-0.00%$0.999033

-0.09%$1.064

0.03%$1.017

3.29%$0.291504

0.93%$0.110889

3.67%

Bitcoin fell 8% yesterday in its biggest single-day drop since FTX's collapse, leaving traders plenty cautious.

Early on Wednesday morning, the world's largest and oldest cryptocurrency sank as low as $60,951.91 before rebounding. At the time of writing, the Bitcoin price is $$63,154.69. That means it's 1.6% lower than it was this time yesterday, but 14% lower than it was this time last week, according to CoinGecko data.

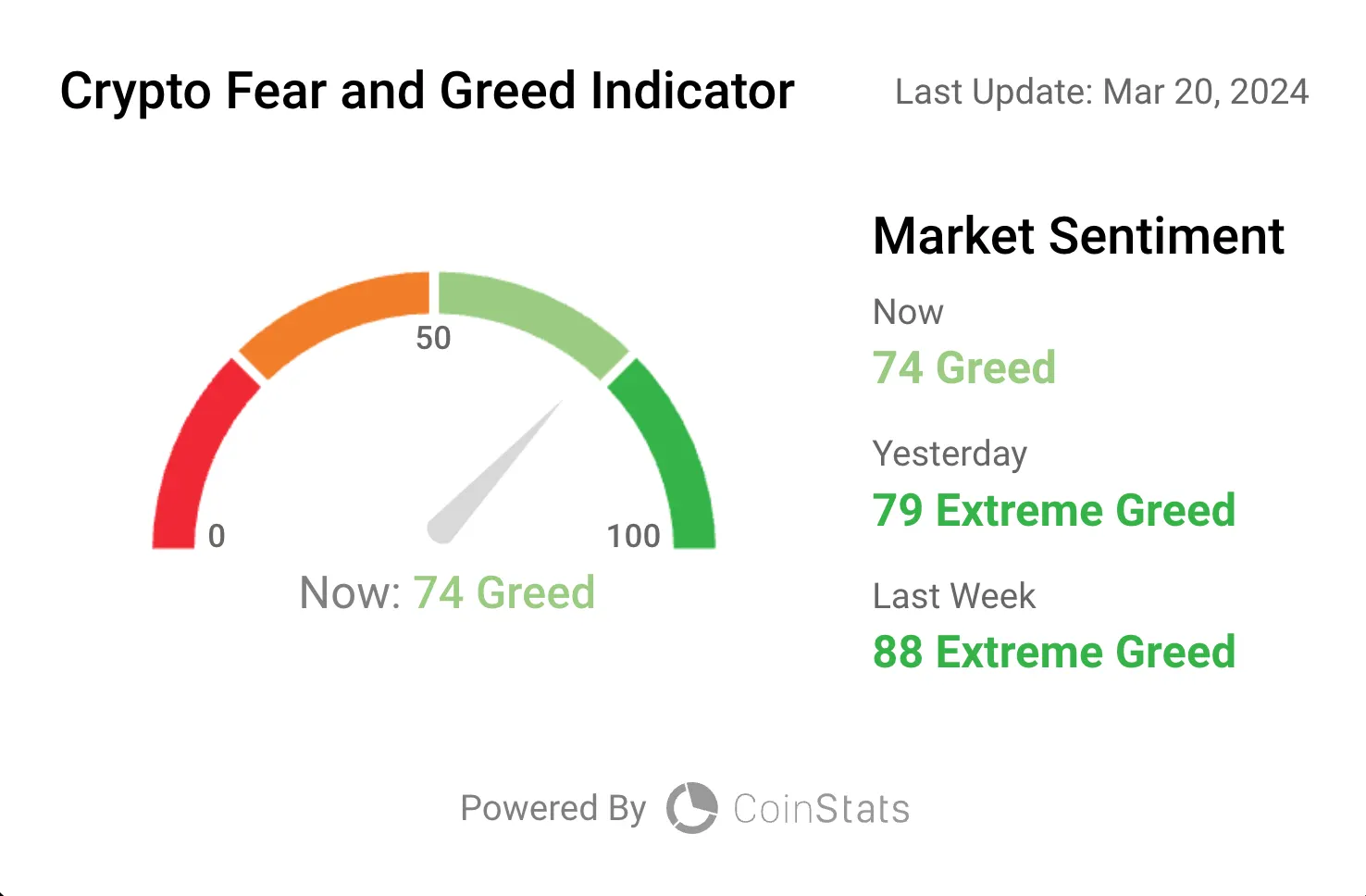

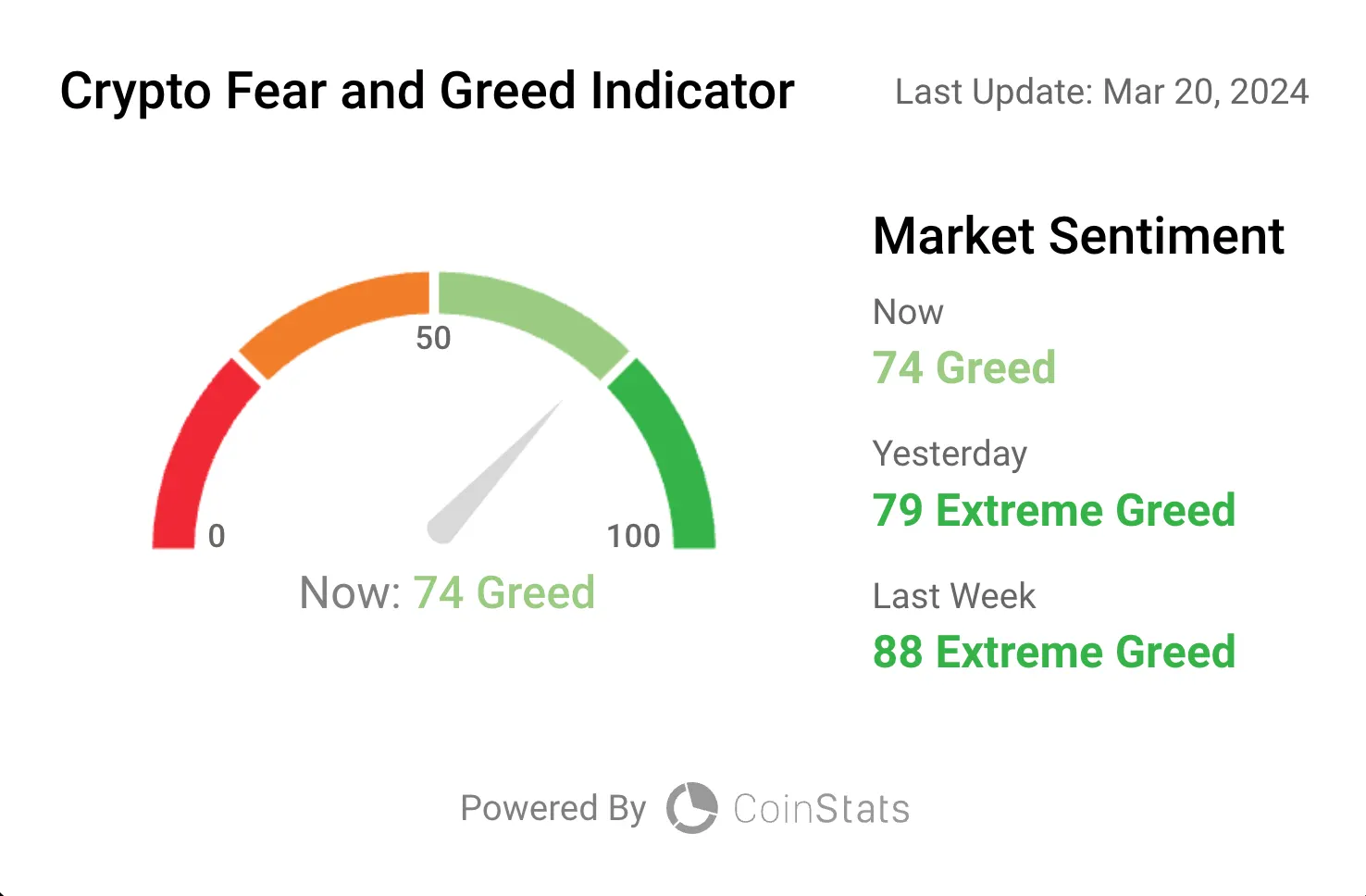

The recent volatility hasn't been enough to push the Crypto Fear and Greed Index back into fear, but the meter has ticked over from Extreme Greed to Greed.

The good and bad news is that there's another U.S. Federal Open Markets Committee press conference later today. During the conference Federal Reserve Chair Jerome Powell will announce whether interest rates will be adjusted and share the committee's outlook on the economy.

FOMC meetings can sometimes create volatility for crypto markets. Investors have been hoping since last year that the Fed would make good on its forecast to make three quarter-point cuts by the end of 2024 and bring the benchmark rate to 4.6%.

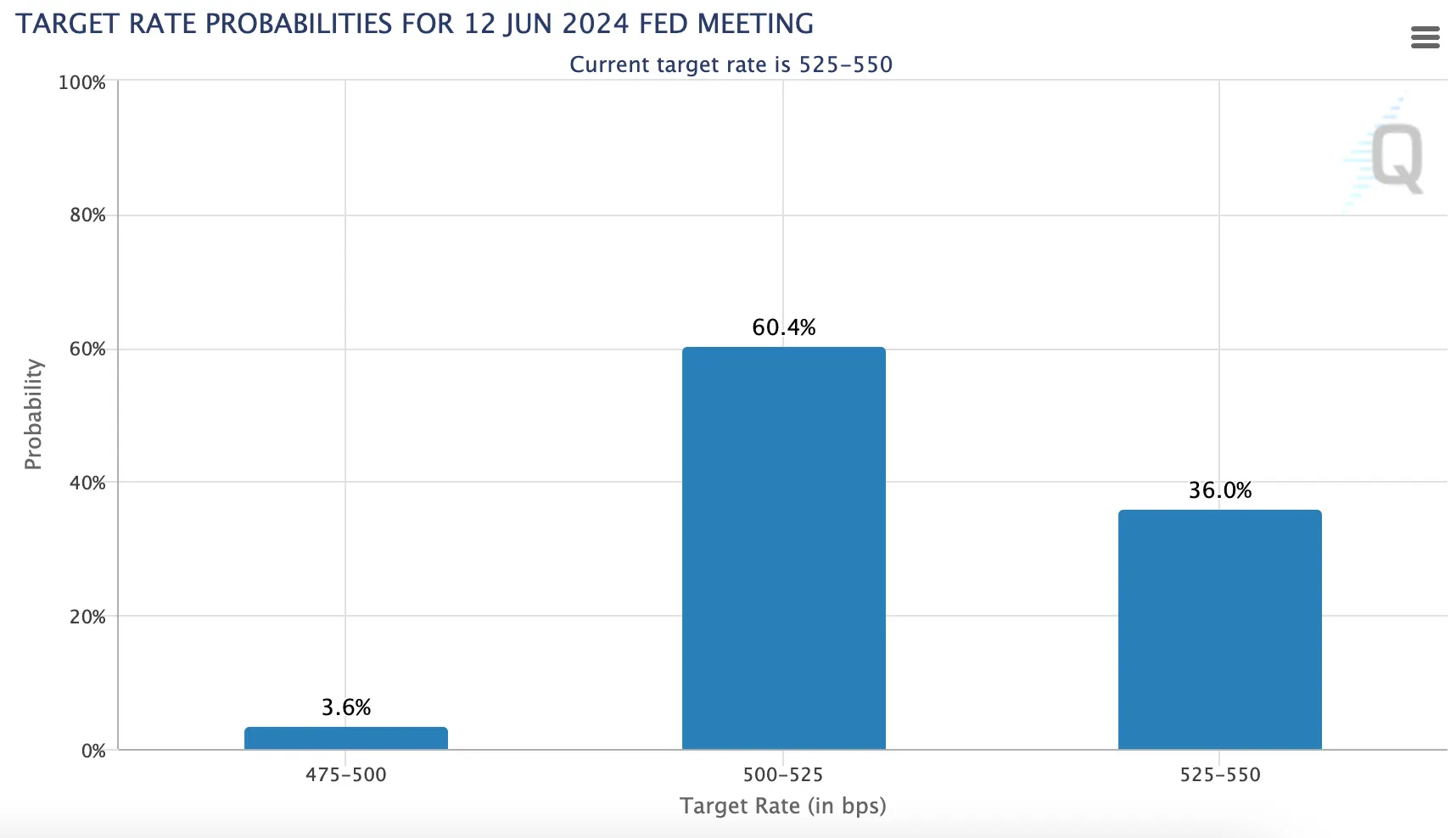

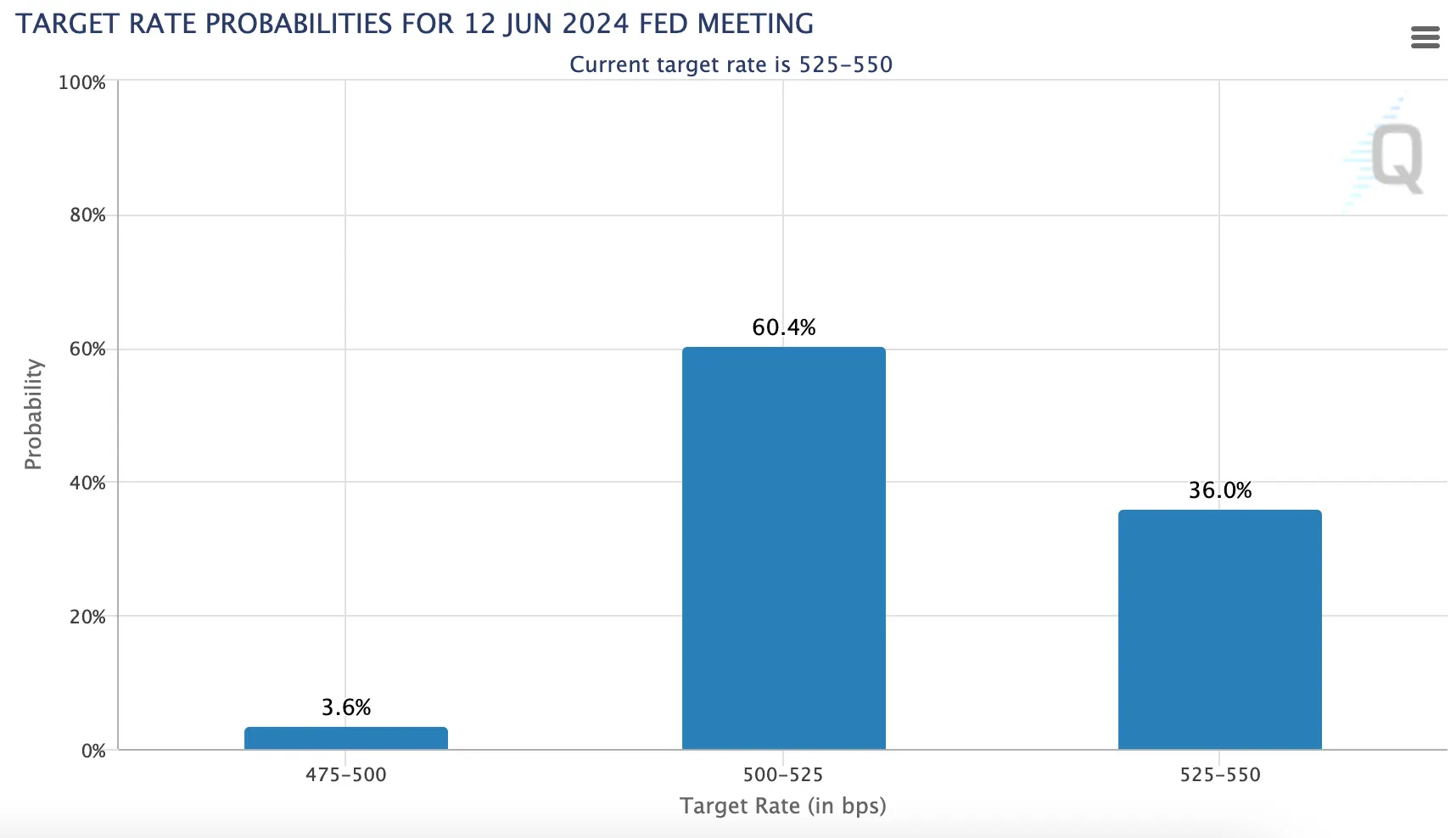

But an overwhelming majority—99% of investors—don't think the Fed will announce a cut today, according to the CME FedWatch tool. Ninety-four percent of investors think the current rate, 525-550 basis points, will remain the same again through the May meeting. But for June, 60% of investors think it's likely the FOMC will begin lowering federal interest rates.

That investors are certain rates will stay the same after this March meeting should mean that Powell saying so later today won't create lots of volatility. But it remains to be seen. Generally speaking, crypto investors see rates being lowered or at least left unchanged as a bullish sign.

That's because the Bitcoin (BTC) price has historically been correlated with risk equities and central bank policy. The more favorable credit conditions are in the economy, the more likely BTC is to pump. When interest rates are low, investors are more likely to take their dollars and put them into risk assets, such as stocks and crypto. When rates are high, investors flee back to dollars.