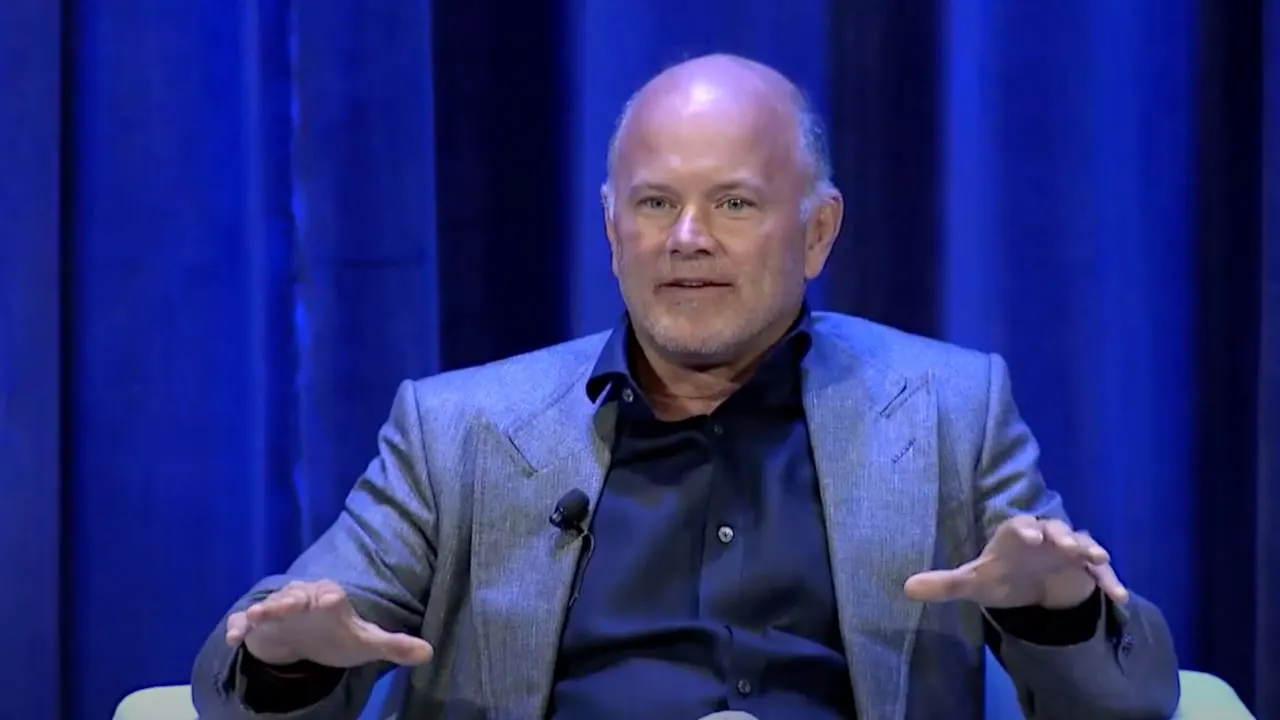

Galaxy Digital CEO Mike Novogratz says a spot Bitcoin ETF will likely get the green light in the next three months.

“We think a Bitcoin ETF will be approved this year in 2023,” said Novogratz during an interview with CNBC on Wednesday. “Talking to all the other people, it just feels like the dialogue with the SEC is all heading in the right direction.”

The billionaire founder of Galaxy Digital founder, whose investment firm is itself pining for a Bitcoin ETF approval alongside Invesco, argued that the Securities and Exchange Commission (SEC) is under a “tremendous amount of pressure” to approve the product–especially after its court loss to Grayscale.

Last Friday, the SEC let the deadline pass to appeal its court defeat, in which judges deemed the agency “arbitrary and capricious” for denying Grayscale’s applications for a spot Bitcoin ETF.

Since then, investor confidence in an upcoming ETF approval has been on the rise, as can be seen in Grayscale’s narrowing GBTC share discount–which now sits at a meager 13.5% according to YCharts.

Changing tides lift all Bitcoin ETF filings

Meanwhile, ETF applicants and analysts alike are noticing a more constructive change in tone from the agency.

“When you go to the comment period and what they’re asking about, [it] all seems much more specific than general,” Novogratz said.

In a separate interview with CNBC on Monday, Ark Invest CEO Cathie Wood also said she noticed a “change in the SEC’s behavior” regarding ARK’s joint ETF filing with 21Shares.

The agency asked questions about how Ark’s product would provide protections against various forms of market manipulation after delaying its approval, to which Ark responded last week.

“I do think hopes are rising that a number of Bitcoin ETFs will be approved,” she said.

On Tuesday, Fidelity provided an updated version of its spot Bitcoin ETF S-1 application, which featured more details to address SEC concerns.

Some include specifications around the fund’s custodial arrangements, mechanics around Bitcoin hard forks, notices about Bitcoin’s energy consumption, and other risk disclosures.

“There’s likely to be more amendments over the coming weeks and months,” said Bloomberg ETF analyst James Seyffart on Tuesday. “It’s an ongoing dialogue with feedback and responses etc. But will certainly be interesting to see what else the SEC may want in these documents.”

Edited by Liam Kelly.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.