The bear of yesterday has been shunted back into storage and our friend, the bull, has been let loose once more. Just last night, bitcoin passed the $7,000 mark, and now looms tall holding 53 percent of the total crypto market cap. While a far cry from the heady days of 2017 where it held 95 percent of all crypto value, it's nice to see the bitcoin bull on the charge. Blockmanity described bitcoin as breaking through a point of “major resistance” and achieving “dominance" over the crypto-markets, as if the coin had just breached the ramparts of Constantinople. It came, it saw, it coinquered.

The news will please academic institutions. A recent report by crypto-exchange Coinbase found that 42 percent of the world's universities nowoffer fully-fledged “crypto-courses.” They may, however, be getting a bit carried away, as only 25 percent of students said they had any interest in taking such courses.

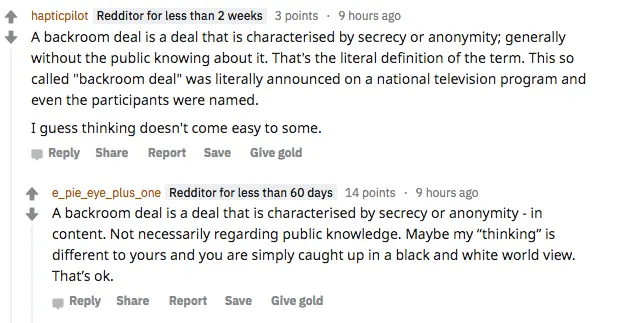

Off campus, petty feuds among bitcoin’s self-designated heirs drag on. Speaking on CNBC, Bitcoin Cash advocate Roger Ver let slip he was preparing for an “invitation only” meeting in Bangkok with several BCH mining giants. The heavyweights, he said, will aim to settle growing divisions within the network and avoid a cataclysmic “split.” A handful of hot-blooded redditors branded the talks “backroom dealings.” Others suggested those people didn’t know what “backroom dealing” actually meant.

The feud is over November’s coming Bitcoin Cash “hard fork,” a software update designed to incrementally increase the amount of data a block can store. This, advocates say, will quicken transaction speeds and accommodate “massive on-chain scaling,” as per, of course, “Satoshi’s Vision.” The update is backed by mining giant Bitcoin ABC, which accounts for some two-thirds of the BCH hash-rate.

Some, however, including Dr. Craig Wright, the founder of the mining conglomerate nChain (and biased news site-cum-mining pool CoinGeek), has taken the imminent forking as an opportunity for a history lesson. Such block-bloating, Wright claims, would be an affront to Satoshi’s vision, which, as reported in our August 22 Debrief, he would know all about.

Will they duke it out Queensbury style, or will they reach some sort of detente? Eli Afram, of Coingeek.com, thinks the intra-mining pool brawl could be productive. Per Afram:

Beyond the fighting chimps, governments and corporations continue their foray into blockchain technology for real-world purposes. Moscow City Hall, the Russian capital’s administrative body, has unveiled plans to build an Ethereum-based application for farmers. What business does an honest-to-God farmer have with blockchain? Farmers, it turns out, need to apply for commercial plots to sell their wares. Under the current system, however, there are only enough plots to accommodate three out of four of the region’s 20,000 farmers each market season, which spans from April 20 to November 25. Farmers, justifiably, get upset when they’re not picked, and cry corruption. What they need, then, is an immutable record of every application for farm land. The solution to this problem, as always, is “put it on a blockchain.”

Will Ethereum do a Bitcoin Cash and fork over the farmers?