The market cap for cryptocurrencies across the board leapt by $12bn in a single hour overnight. Bitcoin grew by 5.79 percent, Ether by 5.28 percent, Ripple by 6.68 percent, and Litecoin by 6.75 percent. Traders speculated that the upsurge was due to a scheduled—albeit prolonged—halt in trading by crypto-derivatives exchange BitMex, which stopped users from selling their stock. Others cried foul, accusing BitMex of manipulating prices and putting off mainstream investors.

The mood appears set to worsen, with founding figures in sharp disagreement over what the future should look like. Ethereum co-founder Vitalik Buterin urged Bitcoin Cash users to “conclusively ostracize and reject” self-proclaimed Bitcoin brainchild Dr. Craig Wright—and his mining pool nChain—for advocating a contentious hard fork that would, supposedly, better reflect Satoshi's vision. (So much so the proposed fork is called Satoshi Vision.) Given Wright’s claims that he is Satoshi, he should know, right?

Or maybe not. Bitcoin ABC, which accommodates some two-thirds of Bitcoin Cash miners, is stubbornly pushing its own plans. ABC's update, due to be implemented after November’s scheduled hard fork, will supposedly quicken transaction speeds and increase efficiency. Proponents say this, not Wright’s solution, will help realise Satoshi’s vision. The struggle to divine the vision of a pseudonymous coder from 2008 wears on.

So Rogers vision of Satoshis vision is being split into Craig’s Vison of what Rogers Vision should have been? Did Craig and Roger have a vison then have a different visions of what each other saw ? @SatoshiLite @Excellion

— litetheworld [LTC] (@LitetheW) August 22, 2018

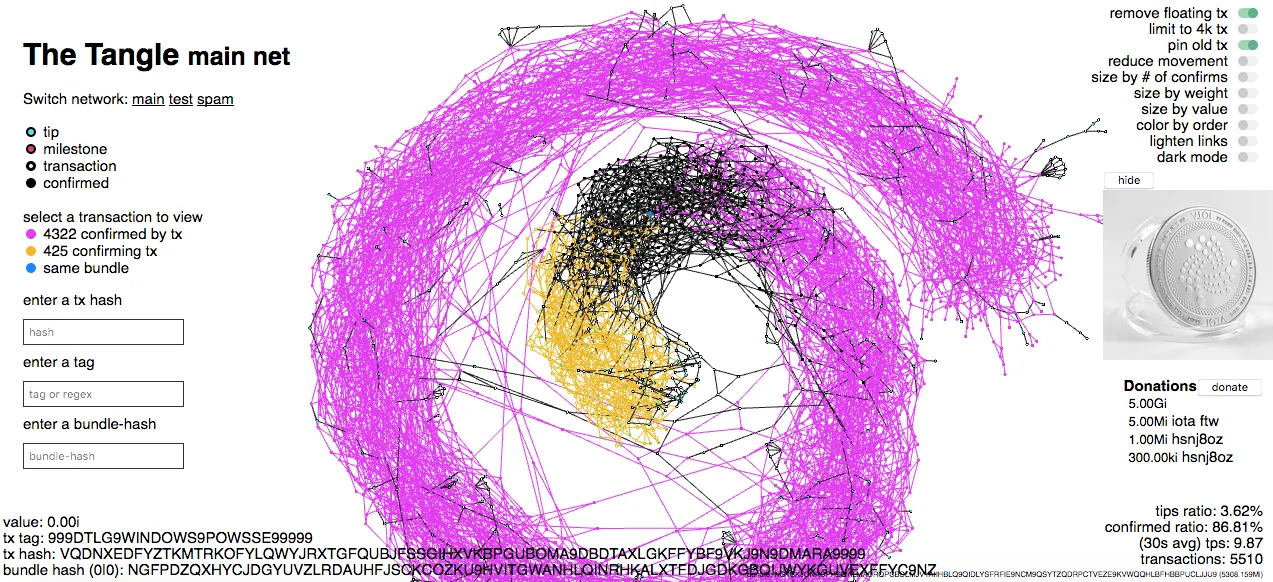

If Satoshi’s vision bores you, try this: Courtesy of Redditor vrom_von, here is a visualization of IOTA transactions rendered as cyberorganic strands, multiplying and twisting outward from themselves like the roots of a tree. Vrom_von says the visual demonstrates the 3rd wave currency’s formidable transaction speed: ”95% confirmed transactions after one min!” That’s 95 percent of roughly 1000 a second. Bitcoin manages three to four.

But reddit hype and technical spats go unheard up on Capitol Hill, where the word “blockchain” is uttered with a cautious reverence. On August 21, the U.S. Senate published filings from a special committee hearing over the technology’s possible effects on the energy sector. Princeton-based computer scientist Arvind Narayanan, a member of the committee, imagined a brave new world of energy consumers “selling excess rooftop solar power” with one another directly. Narayanan—and others—noted some potential drawbacks (see here for the whole 9 yards) but all concerned were hopeful.

Read Next: Daily Debrief, August 21, 2018