A risky affair

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$64,131.00

-1.08%$1,859.03

-0.38%$1.35

-0.56%$585.42

-2.14%$0.999928

0.01%$78.96

0.23%$0.283427

0.77%$1.034

0.25%$0.092009

-1.52%$48.11

-0.74%$0.999997

0.01%$483.15

-3.61%$0.259588

-1.81%$8.47

6.46%$27.17

2.15%$0.999133

0.03%$0.160199

-1.10%$325.55

4.67%$8.21

-1.32%$0.150322

-1.38%$0.999725

0.05%$0.00940013

0.21%$0.999963

0.01%$0.095316

0.02%$243.53

1.46%$51.32

-1.07%$8.32

-1.35%$0.00000592

-2.12%$0.863508

-2.46%$1.30

-3.04%$0.11049

-0.06%$0.073976

-1.30%$5,129.08

-1.51%$1.42

1.41%$5,161.09

-1.66%$3.35

-0.73%$1.24

-2.90%$1.00

0.00%$0.59064

2.39%$0.997595

0.03%$114.33

-0.71%$0.699351

-0.49%$0.00000395

-1.38%$0.99996

0.01%$167.92

-2.09%$1.12

0.00%$0.999854

0.00%$74.03

-0.94%$2.20

-1.88%$0.065996

4.71%$0.00000164

-0.69%$0.162106

1.53%$0.999892

0.09%$8.34

-0.23%$0.970552

-1.60%$0.247584

-0.94%$0.113682

6.48%$11.00

0.03%$2.12

1.84%$6.84

-0.07%$8.30

0.60%$0.376277

0.68%$0.00170954

-6.26%$2.00

-6.17%$0.057056

-2.42%$62.53

-0.32%$0.01601461

-8.59%$1.00

0.04%$0.819064

-1.46%$0.8133

11.04%$0.098467

0.16%$1.23

-0.10%$0.02921276

-2.72%$3.36

0.91%$0.00913633

0.26%$114.40

0.01%$0.08403

-0.05%$1.00

0.03%$1.027

0.01%$1.36

-1.96%$1.11

-0.70%$0.883313

-1.09%$0.03340432

-0.81%$0.824249

1.20%$1.73

8.24%$0.00712258

-3.09%$0.080142

-0.29%$1.095

0.01%$0.996524

-0.04%$0.092577

-1.53%$0.999899

0.00%$0.02903209

1.97%$0.00000576

-2.33%$0.999387

0.07%$0.01253818

-3.14%$28.35

7.76%$1.088

0.14%$0.14504

-1.07%$0.999914

0.05%$0.255473

9.62%$1.18

-0.13%$0.065907

-1.45%$0.238429

0.73%$32.58

0.43%$0.0461325

1.16%$0.00644288

1.42%$0.61635

3.45%$1.20

-1.77%$165.92

-1.28%$0.36769

-0.62%$1.00

0.15%$0.502551

11.40%$1.026

0.13%$1.43

2.64%$0.152916

-1.18%$0.03346913

-1.65%$0.078228

-0.86%$1.021

0.05%$0.99983

0.02%$0.224106

0.77%$0.00000033

-0.57%$0.00000033

-1.54%$120.02

0.69%$0.01643611

-0.77%$3.14

-6.50%$0.053151

-0.78%$15.47

2.06%$3.16

0.23%$1.51

-0.98%$0.325376

9.20%$0.050418

-1.32%$0.995533

-0.13%$0.065969

-0.87%$0.02568484

-1.60%$0.00556847

-2.66%$0.991965

0.07%$0.00002798

-0.95%$0.288924

4.83%$1.44

3.20%$17.13

0.00%$0.300072

-0.46%$1.63

0.12%$0.142634

5.11%$0.299472

-0.40%$0.117943

-2.81%$0.04825227

-0.16%$0.0024884

0.56%$0.209611

0.13%$0.00252184

-1.60%$0.069047

1.29%$0.320686

13.30%$0.999368

-0.06%$6.02

-1.27%$0.04182367

2.98%$1.00

0.00%$0.98856

0.47%$0.02012539

-2.09%$1.075

0.01%$0.999858

0.02%$0.00214825

6.05%$1.24

0.37%$1.69

0.29%$0.078536

-0.73%$5,527.47

5.18%$22.79

0.00%$0.498032

0.31%$0.09807

-2.74%$0.00000095

-0.40%$1.18

-1.22%$0.194509

-3.38%$0.00003486

-0.34%$1.00

0.00%$0.087661

-1.34%$0.191832

2.05%$0.080086

3.65%$0.051707

-0.08%$2.60

-2.05%$0.181273

-2.84%$1.00

0.00%$0.01927647

-3.28%$9.04

9.14%$0.00473464

-1.31%$0.116837

0.32%$0.089986

-1.72%$0.773051

1.26%$0.174095

10.84%$17.78

2.72%$1.00

0.08%$0.02314893

-5.95%$0.0035233

0.08%$2.08

0.14%$1.79

0.09%$0.01993606

-0.75%$48.00

0.03%$3.67

-3.61%$1.74

-2.25%$0.99583

0.32%$0.588576

1.61%$0.050451

-0.44%$3.37

14.69%$1.25

-1.17%$1.96

-0.85%$0.998515

0.05%$0.999721

0.09%$0.00000748

-1.20%$1.013

-0.01%$0.149468

1.87%$0.0393283

-1.53%$0.14678

-4.33%$0.02532296

34.23%$0.307561

-0.63%$0.671271

32.99%$0.647209

3.51%$0.305317

-3.76%$0.388711

0.32%$0.159514

1.75%$1,097.87

0.05%$8.61

-2.75%$0.074694

2.53%$0.600084

8.42%$0.317506

-0.59%$0.077853

-1.28%$4.28

-1.33%$0.125775

-5.94%$0.123082

-3.80%$0.250458

-3.86%$0.124942

-3.07%$0.359388

-6.10%$0.130329

-0.51%$0.087514

-1.62%$0.995467

0.05%$0.0014521

0.20%$11.13

-12.45%$0.277631

-0.35%$0.247718

1.07%$1.86

-0.55%$1.031

1.56%$0.215662

-2.83%$0.00391158

1.46%$1.001

0.00%$0.999951

0.04%$0.072725

-2.32%$0.191204

4.27%$1.44

4.69%$0.329266

-2.67%$1.063

-0.02%$2.25

2.07%$0.999992

0.02%

IMX, the token of NFT platform ImmutableX, saw a remarkable surge of 38.1% in just a few hours on Thursday morning—going from $0.55 to a peak of $0.76, according to CoinGecko data.

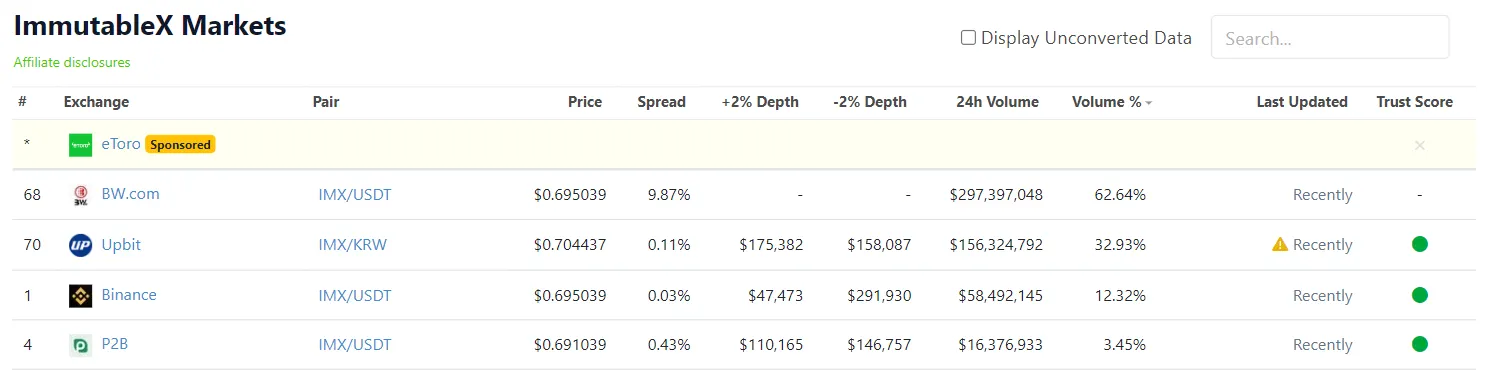

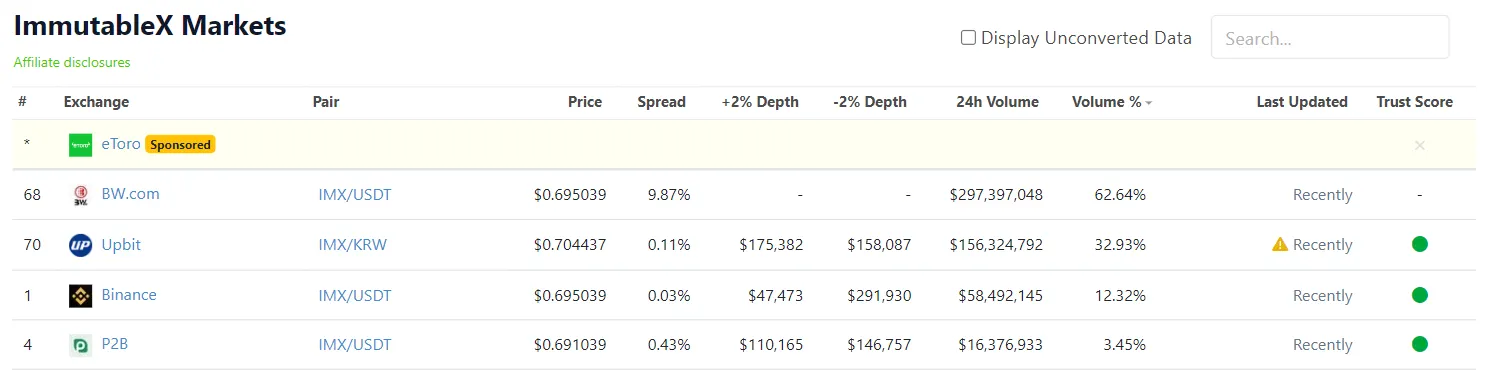

The price surge can be attributed to substantial volume spikes across South Korean exchanges in BW.com and Upbit, which traded $453.6 million in the last 24 hours.

This surge pushed the total daily trading volume to $664 million, which is more than six times the 30-day average trading volume for IMX, which typically hovers around $109 million.

The figure places IMX’s 24-hour trading volumes above many of the top 10 tokens by market cap, including BNB, Litecoin and Solana,.

The co-founder of crypto analytics firm Jarvis Labs Benjamin told Decrypt that large volumes from Upbit and other Korean exchanges are “resulting in a follow-up in spot and derivatives volumes on Binance and other exchanges like Bitget and OKX.”

He further cautioned that the price of IMX could witness “a cascading downside as soon as the pump in Korean exchanges are complete.”

Benjamin also mentioned that the open interest volumes for IMX “continues to go up,” potentially making it a risky short-term trade.

CoinGlass data shows that traders are aggressively placing short orders for IMX derivatives, indicated by a spike in negative funding rates on perpetual swaps.

The funding rate represents the interest paid by perpetual swap contract holders based on the relative demand for long positions versus short positions.

When the demand for short positions outweighs that of long positions, those holding short positions pay a premium, and vice versa.

Currently, the funding rate for IMX contracts is -0.25% for an eight hour interval equivalent to an annual interest of 275%. It motivates traders to go long to capture the premium and liquidate the short positions as the price surges higher—a phenomenon known as a short squeeze.

IMX token was last trading at $0.68, around 25% higher than yesterday.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.