While Bitcoin’s price has recovered since its March lows, topping out near $28,900, the crisis that caused the initial dip still poses concerns for the market.

The closure of Silvergate’s SEN and Signature’s Signet network in early March has exposed the crypto market to low liquidity risks.

“Liquidity is king,” an adage in trading circles, is an apt way to describe its importance. It describes a market's ability to facilitate conversion between an asset to fiat currency.

Poor liquidity around an asset leads to market inefficiencies where traders lose money due to events like thin order books, slippage, and larger spreads. It can also cause serious volatility and deter sophisticated investors from placing trades.

Kaiko’s head of research Clara Medalie told Decrypt that the current situation is “pretty dangerous” and could manifest in massive price volatility in both directions.

"A drop in liquidity certainly helps traders to the upside, but there is always eventually a downside,” said Medalie. “The moment buy pressure subsides, anything can happen to price."

Crypto’s liquidity crisis

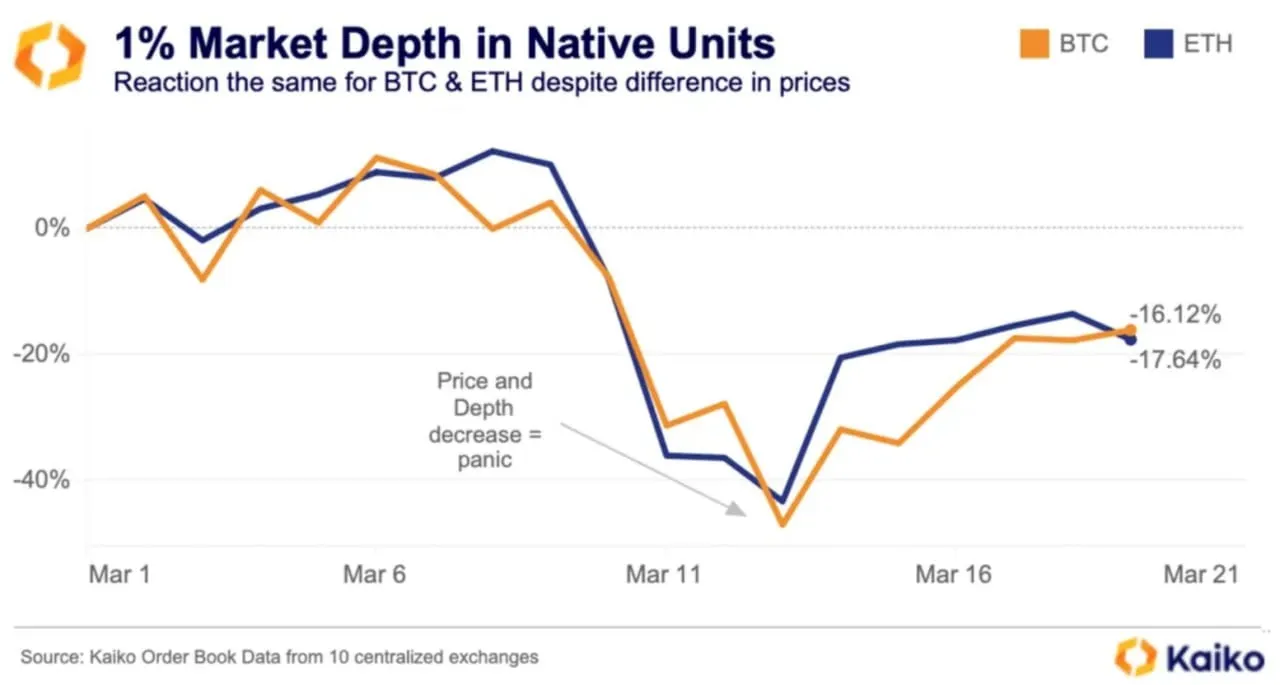

The liquidity crisis first manifested with a $200 million drop in 1% market depth after Silvergate’s SEN network was closed, as identified in Kaiko’s latest research note.

The 1% market depth is calculated by summing the bids and asks within 1% of the mid-price for the top 10 cryptocurrencies. If the market depth is sufficient and order books are crowded around the market price, it reduces the volatility in the market.

The market depth for Bitcoin and Ethereum is still down 16.12% and 17.64%, respectively, from their monthly opening levels. Kaiko analyst Conor Ryder wrote that “we are currently at our lowest level of liquidity in BTC markets in 10 months, even lower than the aftermath of FTX.”

The liquidity crunch is also causing inefficiencies such as high slippage and larger spreads. Coinbase’s BTC-USD pair currently exhibits nearly three times higher slippage than at the start of March.

Slippage refers to the price at which an order is placed and the final price once that order is actually executed. In low liquidity environments, the difference between these two orders can be much larger than usual.

The most liquid pair in the crypto market, the BTC-USDT pair on Binance, also suffered a blow after the exchange ended its zero-free program.

As a result, the pair’s liquidity depleted by 70% as market makers moved to greener pastures.

These conditions have deterred market makers and sophisticated day traders from placing trades because of the additional costs incurred due to market inefficiencies, worsening the low-liquidity environment.

The need for fiat on-ramps

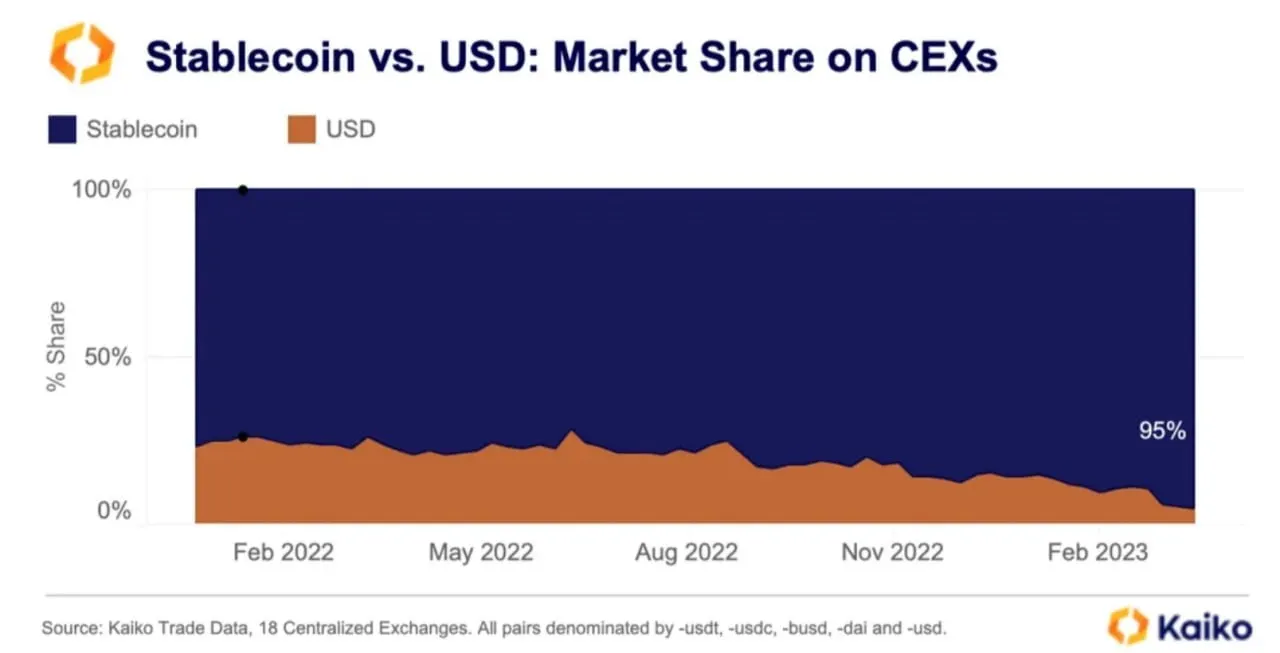

The market share of fiat dollars and stablecoins has also drastically shifted, with stablecoin volumes on centralized exchanges rising from a 77% share of volumes to 95% in just over a year.

The trend accelerated swiftly after the closure of crypto banking networks.

While shifting to stablecoin trading pairs does not create an issue for medium to small-scale investors, it can become a problem for more sophisticated traders.

Medalie explained that USD networks are essential to traders, who are required to settle their traders daily.

"Stablecoins are not ideal from a risk management perspective, especially to settle at the end of the day or week,” she said. “But if banks close and don't process transactions, then stablecoins are the next best alternative."