Visa is cutting off its partnership with collapsed crypto exchange FTX, the payments giant confirmed on Sunday.

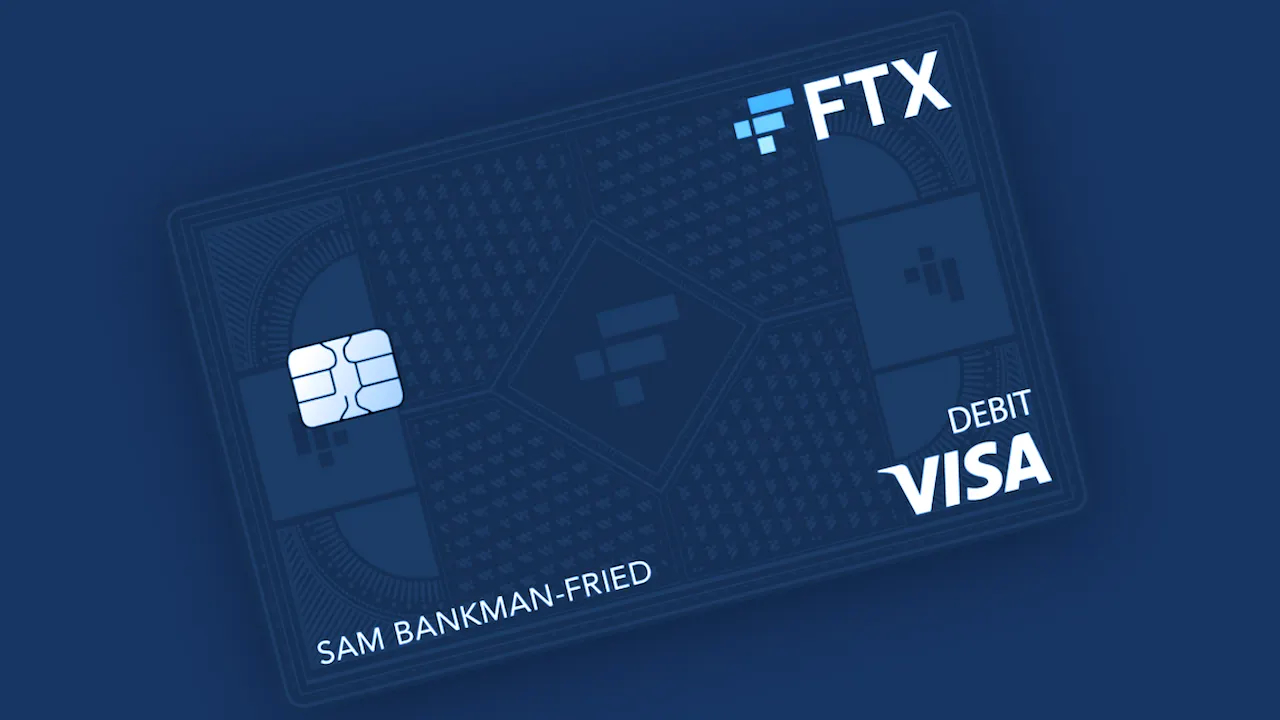

The end of the much-touted collaboration, which was expanded last month, spells the end for FTX-branded Visa debit cards, which the company said would be wound down.

“The situation with FTX is unfortunate and we are monitoring developments closely," a Visa spokesperson told Reuters. "We have terminated our global agreements with FTX and their US debit card program is being wound down by their issuer." Visa did not immediately respond to Decrypt's request for comment.

The cards were previously available to FTX account holders in the U.S. and were set to be rolled out to 40 new countries as part of a “long-term global partnership” announced by the two companies in early October.

At the time, Visa’s head of crypto Cuy Sheffield said that by partnering with “leading crypto exchanges like FTX,” the payments provider would “bring more flexibility and ease-of-use to the way people use their crypto.”

Debit cards were directly linked to the owner’s FTX account, allowing users to convert their crypto balances to pay for goods and services.

Visa, Mastercard eye crypto industry

Visa is one of several traditional payments firms looking to get a foothold in the crypto world.

In October, it filed new trademark applications suggesting it was mulling a crypto wallet and a metaverse product.

Meanwhile, rival Mastercard last month tapped trading platform Paxos to help it provide a service that aims to make it easier for banks and other institutions to offer crypto trading. The company also counts several crypto companies as members of its fintech startup program.

Efforts to link up the two sectors have also come from the crypto side, with the likes of digital assets security platform Fireblocks saying last month it was launching a solution that will help payment service providers (PSPs) manage crypto transactions.