In brief

- Magic Eden’s Solana NFT market share is quickly falling as trading platforms that reject creator royalties are gaining popularity.

- Hadeswap, a decentralized exchange-like alternative to traditional NFT marketplaces, claims a better model for traders and creators alike.

The debate over NFT royalties is raging again, this time in the Solana NFT space—and marketplaces that eschew creator royalties are finding eager traders while capturing market share in a way that they haven’t yet in the larger Ethereum NFT community.

Magic Eden has been the leading NFT marketplace on Solana over the last year, quickly commanding 90% or more of the market en route to a $1.6 billion valuation in June. But its grasp on the Solana market has been rapidly eroding in recent weeks as new and evolving rivals alike successfully draw away NFT traders with the allure of zero-royalty transactions, which allow traders to eke out greater profits by allowing them to avoid paying upwards of 12% in fees on each trade.

And now the shifting tides of the Solana NFT market appear to have forced Magic Eden’s hand.

The company announced on Wednesday that it was “joining forces” with Coral Cube, a marketplace and aggregator that allows zero-royalty NFT sales. Magic Eden also teased that it will give users “the ability to determine what royalties on our platform will look like.”

Tiffany Huang, Magic Eden's Head of Marketing and Content, told Decrypt today that the startup will "protect" its brand by keeping creator royalties intact on Magic Eden. But it will also offer the option for traders to sell NFTs without paying royalties via Coral Cube—an apparent attempt to have it both ways in a quickly shifting market.

Solana shuffle

NFT creators, regardless of blockchain network, typically set royalties between 5% and 10% on their tokenized artwork, profile pictures, collectibles, and video game items, thus earning a percentage of the sale price of any future secondary market trades. Some NFT enthusiasts consider it a key part of the Web3 value equation, rewarding creators in perpetuity.

It’s built into the smart contract—or autonomous code that powers NFTs—but not in a way that’s immutable. In other words, they’re not consistently enforceable: marketplaces can effectively code around it and let people buy and sell NFTs without paying creator royalties. On large trades valued in the thousands or even hundreds of thousands of dollars, saving 10% in fees can make a significant difference, especially in a down market. The platforms that allow this have angered creators and businesses that depend on royalties for revenue, but they’re gaining traction on Solana among traders.

Upstart marketplace Yawww made the first move on Solana earlier this summer, launching a platform that didn’t honor NFT creator royalties, and then early Solana marketplace Solanart followed suit by shifting gears and making creator royalties optional for NFT sellers. The recently launched Hadeswap is now luring even more traders away from Magic Eden.

The impact has been swift and significant. According to data compiled by NFT marketplace Tiexo, Magic Eden’s Solana market share has dwindled in recent weeks. Looking at the charts, its share fell from 89% over the last six months to 79% over the last month—with bigger drops to 61% over the last week and 58% over the last 24 hours, as of this writing.

That’s a startling decline for a marketplace that has effectively ruled unopposed over the last year. Magic Eden saw barely any impact from the April entrance of top overall NFT marketplace OpenSea into the Solana space—OpenSea has claimed about 2% of trading volume over the past six months—but there’s a larger movement afoot this time around.

“When the bear market hit, margins were compressed and traders began to complain because the 10% royalties were eating hard into their 20% margins,” the pseudonymous SOL Legend, co-founder of MonkeDAO and managing partner of Frictionless Capital, told Decrypt.

“Magic Eden had such a dominant position that niche players had no choice but to pursue a 0% creator fee royalty strategy to take market share and move OTC volumes back into marketplaces,” he continued. “Once Yawww started the trend, there was no going back.”

It’s not just marketplaces embracing 0% royalties on Solana, either. ABC recently launched as a royalty-free project, and over the weekend, the creators of popular profile picture project DeGods and its successor y00ts cut the royalties on both collections to zero.

Our next experiment. pic.twitter.com/VmoDfXvcyu

— DeGods (@DeGodsNFT) October 9, 2022

The move came amid the ongoing debate about whether relying on NFT royalties is a viable business model for Web3 startups, especially when some marketplaces simply ignore them.

“We still believe that royalties are an incredible use case of NFTs,” the DeGods project tweeted. “We will continue to support creators that want to find solutions to enforce royalties. We believe this is the best decision for our business at this time. It’s about time we take a new approach.”

Hades rises

Just launched, Hadeswap isn’t like any other Solana NFT marketplace. Rather than use traditional NFT listings, Hadeswap relies on an automated market maker (AMM) format akin to decentralized exchanges, such as Uniswap, for trading cryptocurrencies. NFTs are sold into liquidity pools, which earn trading fees for pool creators—and royalties are currently disabled.

It’s similar in approach to Sudoswap’s SudoAMM, the Ethereum-based NFT trading platform that launched earlier this summer and helped fuel the previous debate over honoring creator royalties. In this case, Hadeswap was co-created by the pseudonymous HGE, the founder of OpenDAO and the creator of the ABC project.

The well-known NFT whale told Decrypt that Hadeswap—currently the second-largest Solana NFT trading platform by volume over the last 24 hours—improves liquidity for trading “floor” NFTs, or the cheapest NFTs listed from a project. It “allows more people/funds to enter and exit” a project, he said, and then trading fees are all currently paid out to pool creators.

The approach is catching on. Over the past week, Hadeswap has commanded about 11% of Solana trading volume, per Tiexo’s data, compared to 10% for Solanart, 7% for zero-royalty marketplace Coral Cube, and 5% for Yawww. Magic Eden still rules the roost at about 61%, but its share of the Solana market is slipping thanks to the collective rise of royalty-free rivals.

HGE pointed to an animated gif of Robin Hood as an explanation of the Hadeswap ethos—stealing fees from the rich (Magic Eden, in this analogy) and giving them back to the “poor,” or the Solana creators and collectors that use the platform. They’re “basically giving billion-dollar company [revenue] back to creators and holders,” HGE told Decrypt.

Give all fees back to the people https://t.co/E9Jhi629va pic.twitter.com/8iHHjwlIc6

— hadeswap (@hadeswap) October 11, 2022

Magic Eden is a divisive platform in the Solana space, and not just for its dominance. The marketplace has also been criticized for taking considerable VC investment, as well as using closed-source code and allegedly copying features developed by community builders. Magic Eden’s recent embrace of Ethereum has added fuel to the fire, too.

While Hadeswap currently skips out on royalties, HGE said that NFT creators can potentially earn more SOL by establishing their own liquidity pool and taking trading fees instead. It’s the same kind of approach as Sudoswap, and it requires project creators to take additional action and risk and effectively act as a broker in exchange for earning trading fees.

Eventually, when Hadeswap exits beta, the platform will also institute the optional ability for liquidity pool creators to add an NFT creator royalty to the equation. Hadeswap will also later add a 0.5% platform fee and pay that out exclusively to ABC NFT holders. “For now, creators make so much more royalties just by [providing] liquidity,” HGE claimed.

Magic Eden’s moves

Whether Magic Eden would shun royalties and try to recapture market share has been a hot topic among Solana NFT collectors in recent weeks. On Wednesday evening, the startup tweeted that it had “lots to say,” but quickly clarified, “The announcement is NOT that Magic Eden is dropping to zero royalties.”

Instead, Magic Eden said that it was "joining forces" with Coral Cube, the zero-royalty marketplace and aggregator, to “accelerate their path to become the biggest and best NFT aggregator across chains.” Magic Eden's Huang clarified to Decrypt today that the firm did not acquire Coral Cube, but instead is "partnering" with the marketplace. Terms of the deal were not shared by the time of this article's publication.

The future of Solana NFTs starts with you.

We and @coralcubenft will be giving traders the ability to determine what royalties on our platform will look like.

Vote with your trades.

More tomorrow.

— Magic Eden 🪄 (@MagicEden) October 13, 2022

The Coral Cube alliance may have been news to some, but many Solana insiders had expected it—one notable NFT collector called it the “worst-kept secret in the history of NFTs.”

“Now you know,” tweeted Hyperspace founding member Bryan Jun following the announcement, alongside an image that displayed the Coral Cube logo tagged with the label “Magic Eden (0 Creator Royalty).” Hyperspace, a competing Solana NFT aggregator and launchpad, began reporting Coral Cube sales as Magic Eden volume about a week ago.

On Wednesday night, Magic Eden teased, “The future of Solana NFTs starts with you. We and [Coral Cube] will be giving traders the ability to determine what royalties on our platform will look like. Vote with your trades.”

now you know pic.twitter.com/txSYwlbGfy

— bryan | hyperspace 👨🚀 (@thebryanjun) October 12, 2022

Magic Eden today clarified that approach to Decrypt ahead of further planned announcements. Huang said that the marketplace will maintain its current model, but is also partnering with Coral Cube as a way to offer zero-royalty trades without it happening on Magic Eden's own platform.

"Magic Eden has always been proud of being deeply creator-centric, which is why we we don't take this situation lightly and do not intend to go optional royalties on the Magic Eden brand," she said. "However, until royalties are enforceable, we also have to adapt to the market and balance both creators and traders."

Huang added that the move is meant to "protect the Magic Eden brand while serving traders" through its deal with Coral Cube, suggesting that there is likely some type of revenue-share agreement in place with the aggregator.

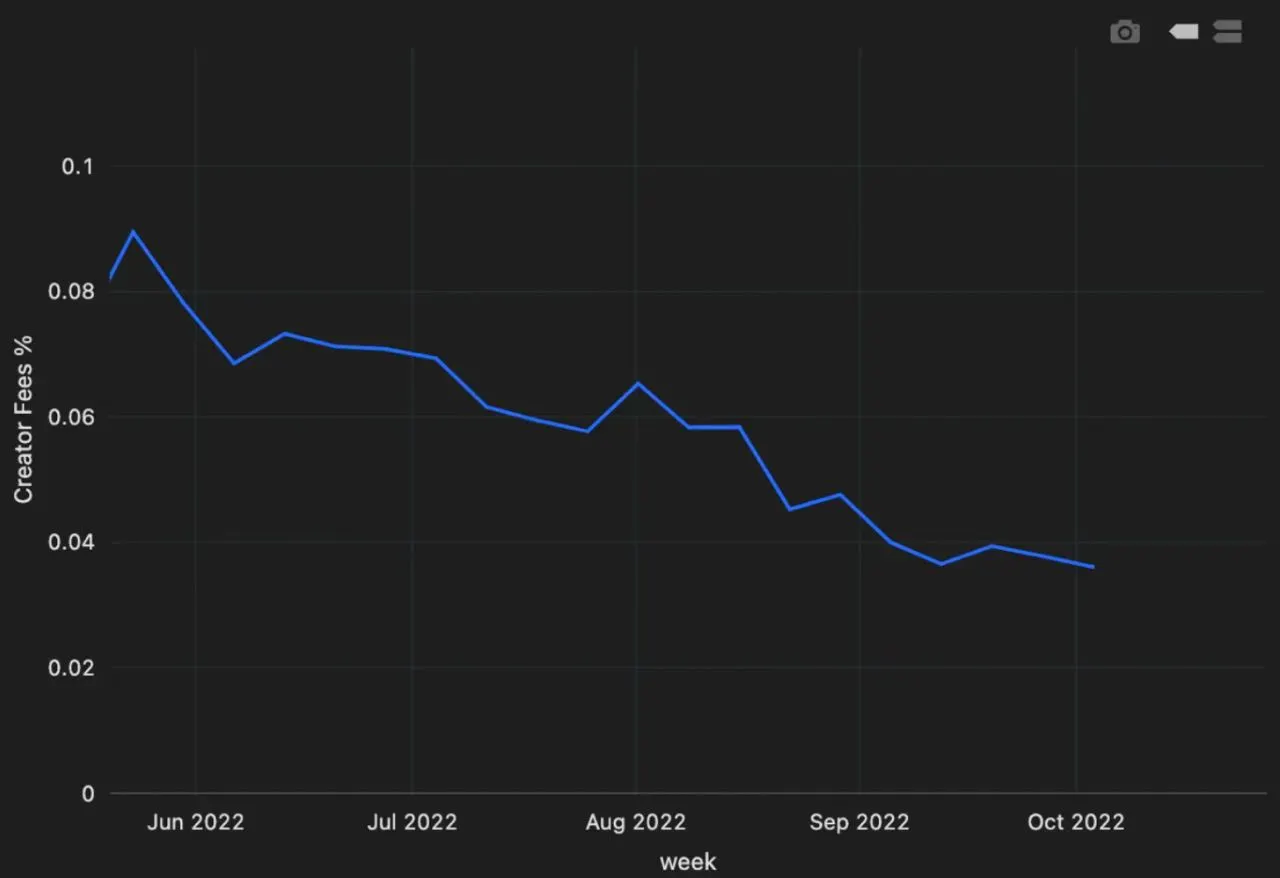

Huang also shared data from Magic Eden that indicates creator royalties on Solana have been trending downward for months. The graph, seen above, shows the amount of royalties that the top 50 Solana NFT creators receive as a percentage of secondary market trading volume, and it ticks down from about 9% in May to less than 4% now.

Magic Eden shared related data in a tweet last night, apparently as it tries to make its case for partnering with Coral Cube amid a volatile and quickly evolving Solana NFT market. The change may be due in part both to some marketplaces ignoring royalties or making them optional, as well as popular projects setting lower royalties (or none at all).

Answer: The median SOL project makes ~6% of their total revenues from royalties.

More research tomorrow.

A few more announcements today. pic.twitter.com/7v0JOJq44Z

— Magic Eden 🪄 (@MagicEden) October 13, 2022

Magic Eden had teased weeks ago that some kind of change to its approach was coming. In late September, as rival marketplaces started chipping away at its market share and Magic Eden took blowback for downtime, the company tweeted, “Is it time to disrupt our business model?”

However, Magic Eden had previously said in a July tweet reply that it wouldn’t touch royalties, writing, “Royalties are up to the creators of collections to decide. Not us.” Now, amid pressure from rivals and shifting sentiment around creator royalties, the company's stance appears to be far less concrete.